Introduction

What is Wealth Management Retirement?

Why a Wealth Management Approach is a Game-Changer

Adopting a wealth management mindset provides a powerful set of benefits that go far beyond simple investment returns.

It Creates a Truly Coordinated Strategy

In a typical financial life, your investment advisor, your CPA, and your estate planning attorney may never speak to each other. Wealth management brings all these pieces together, ensuring that your investment decisions are aligned with your tax strategy and your long-term legacy goals.

It Focuses on Tax Efficiency

A core tenet of wealth management is minimizing your lifetime tax bill. This involves a range of sophisticated strategies.

- Asset Location: Placing different investments in the most tax-efficient accounts.

- Roth Conversions: Strategically converting pre-tax money to tax-free money.

- Tax-Efficient Withdrawals: Creating a plan to draw down your assets in retirement in a way that minimizes your annual tax bill.

It Provides a Plan for Your Entire Life, Not Just Your Portfolio

True wealth management goes beyond the numbers. It helps you answer the big questions: When can I afford to retire? How do I ensure my spouse is taken care of? How can I leave a legacy for my children? It’s a comprehensive approach to funding the life you want. For more on planning your future, check out this valuable resource.

The Core Pillars of Wealth Management

A comprehensive wealth management plan is built on three interconnected pillars.

Here’s a breakdown of the essential components:

| Pillar | What It Involves | The Goal |

|---|---|---|

| 1. Comprehensive Financial Planning | Creating a detailed roadmap that defines your goals, analyzes your cash flow, and models your retirement readiness. | To create a clear, actionable plan to achieve your life goals. |

| 2. Sophisticated Investment Management | Building and managing a globally diversified, low-cost, and tax-efficient investment portfolio. | To grow your wealth in a disciplined, risk-appropriate manner. |

| 3. Integrated Tax and Estate Planning | Coordinating with tax and legal professionals to minimize taxes and ensure your assets are passed on according to your wishes. | To preserve your wealth and create a lasting legacy. |

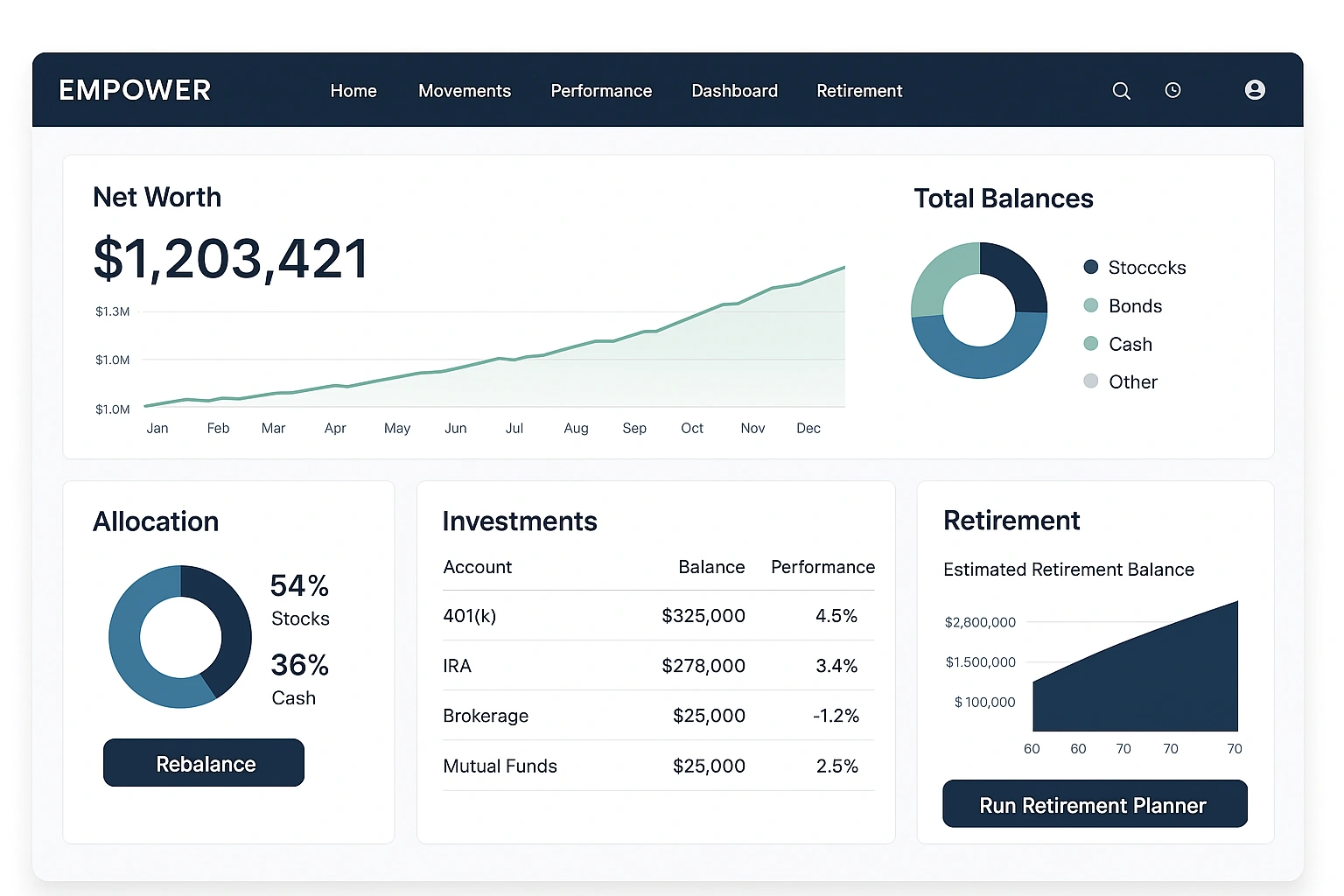

Real-Life Use Case: Empower’s Wealth Management Service

To evaluate a modern approach to **wealth management for retirement**, I analyzed the service offered by **Empower (formerly Personal Capital)**. They are a great example of a “hybrid” model that combines a powerful digital platform with a dedicated team of human financial advisors.

The process starts with their free dashboard, where a user links all their accounts. This gives the advisory team a complete, real-time picture of the client’s financial life. From there, the human advisors create a personalized financial plan and a custom-tailored investment portfolio. They use a tax-efficient strategy that includes asset location and tax-loss harvesting. The client can track their progress on the dashboard and has unlimited access to their advisory team. This model combines the data-driven insights of technology with the personalized, human touch of a traditional advisor.

Here’s a breakdown of this hybrid model:

| Pros | Cons |

|---|---|

| ✅ Data-Driven and Holistic: The advice is based on a complete picture of your finances. | ❌ Higher Minimums: Typically requires a minimum investment of $100,000. |

| ✅ Lower Cost Than Traditional Advisors: The advisory fees are generally lower than a traditional, old-school firm. | ❌ Less Face-to-Face Interaction: Most of the communication is done via phone and video calls. |

| ✅ Combines the Best of Tech and Human Advice: You get a powerful digital dashboard and a dedicated human advisor. | ❌ It’s a Discretionary Service: You are handing over the day-to-day management of your portfolio to them. |

Comparing Approaches to Wealth Management

There are several ways to approach wealth management. Here’s how the main options compare.

| Approach | Description | Pros | Cons | Best For |

|---|---|---|---|---|

| Traditional Human Advisor | A dedicated financial advisor who provides a high-touch, personalized service. | Highly personalized, face-to-face relationship. | Typically the most expensive option (1-2% fee). | Those with very complex needs who value a personal relationship. |

| Hybrid Digital Advisor | Combines a powerful digital platform with a team of human advisors. | Data-driven, holistic, lower cost than a traditional advisor. | Requires a significant investment minimum. | Affluent investors who are comfortable with a tech-forward approach. |

| DIY with Wealth Management Tools | Using a platform like Empower’s free dashboard to track your own finances and implement your own strategy. | The lowest cost option, gives you complete control. | Requires a high degree of discipline, knowledge, and time. | Confident, knowledgeable DIY investors. |

Common Wealth Management Mistakes to Avoid

Whether you’re working with an advisor or going it alone, avoid these common mistakes.

- Focusing Only on Investments: True wealth management is about more than just your portfolio. It includes your tax, insurance, and estate plans.

- Ignoring Your Tax Strategy: Not having a tax-efficient withdrawal plan can cost you dearly in retirement.

- Not Having an Estate Plan: Without a will or trust, you have no control over how your assets will be distributed after you’re gone.

- Making Emotional Decisions: The worst financial decisions are almost always driven by fear or greed. A good wealth management plan is designed to be a rational guide through emotional markets.

- Paying High Fees: Whether it’s high-cost mutual funds or a high-fee advisor, costs are a major drag on your long-term returns. As financial experts cited by Google often advise, minimizing costs is a key component of successful investing.

Expert Tips for Success

Implement a smart **financial planning for wealth** strategy with these pro tips.

- Start with a Comprehensive Net Worth Statement: Use a tool to get a clear picture of where you stand today.

- Build a Tax-Diversified Portfolio: Have money in pre-tax, post-tax, and taxable accounts.

- Review Your Plan Annually: Sit down with your advisor (or yourself) once a year to make sure your plan is still on track.

- Create a “Statement of Financial Purpose”: Write down what your money is for. This will be your north star during difficult financial decisions.

“Wealth management is the process of turning a collection of financial accounts into a single, coordinated engine designed to power the life you want to live.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the difference between financial planning and wealth management?

A: Financial planning is often focused on specific goals, like creating a budget or a retirement savings plan. Wealth management is a more comprehensive, high-level service that typically includes financial planning, investment management, tax strategy, and estate planning. It’s a holistic approach to managing a person’s entire financial life.

Q: At what point do I need wealth management for retirement?

A: While anyone can benefit from the principles of wealth management, it becomes particularly crucial as your financial life becomes more complex. This is typically when you are in your peak earning years, have multiple investment accounts, and need to start thinking about tax efficiency and estate planning, usually about 10-15 years from your target retirement date.

Q: Can I do my own wealth management without an advisor?

A: Yes, it is possible for a diligent DIY investor to manage their own wealth using powerful financial planning software and a disciplined strategy. However, a professional wealth manager can provide a level of expertise, objectivity, and coordination—especially in complex areas like tax and estate law—that is difficult to replicate on your own.

Q: What is the most important part of financial planning for wealth?

A: The most important part is creating a single, unified strategy that aligns all aspects of your financial life—your savings, investments, insurance, and estate plan—with your long-term goals. It’s about ensuring that all the pieces of your financial puzzle are working together, not in isolation.

Q: How much do wealth management services typically cost?

A: Traditional wealth managers often charge a fee based on a percentage of the assets they manage, typically around 1% annually. Digital platforms and robo-advisors with access to human advisors offer similar services for a much lower fee, often in the range of 0.30% to 0.50%.

Conclusion