Introduction

What Are Expense Tracking Apps?

The rise of the digital economy has made these tools more essential than ever. With the decline of cash and the rise of countless subscription services, it’s become incredibly difficult to manually track our spending. As reported by sources like Statista, millions of consumers are turning to FinTech apps to regain control and clarity over their finances.

Why Tracking Your Expenses is the First Step to Financial Freedom

It Provides a Foundation of Awareness

You cannot change what you do not measure. Tracking your expenses replaces assumptions with data. You might *think* you only spend a little on coffee, but the app will show you the reality. This awareness is the necessary first step to making conscious, intentional changes to your spending habits.

It Helps You Find and Plug “Money Leaks”

These apps are like a detective for your finances, uncovering the hidden costs that are draining your account.

- Forgotten Subscriptions: They identify all your recurring charges, helping you find that gym membership or streaming service you forgot you were paying for.

- Areas of Overspending: Clear charts and graphs make it easy to see which categories are consuming the biggest portion of your income.

It Empowers You to Create a Realistic Budget

You can’t create an effective budget based on guesswork. By tracking your spending for a month, you get a realistic baseline. This data allows you to create a budget that is based on your actual life, not an unrealistic ideal, which makes you far more likely to stick with it. For more on planning your financial future, check out this valuable resource.

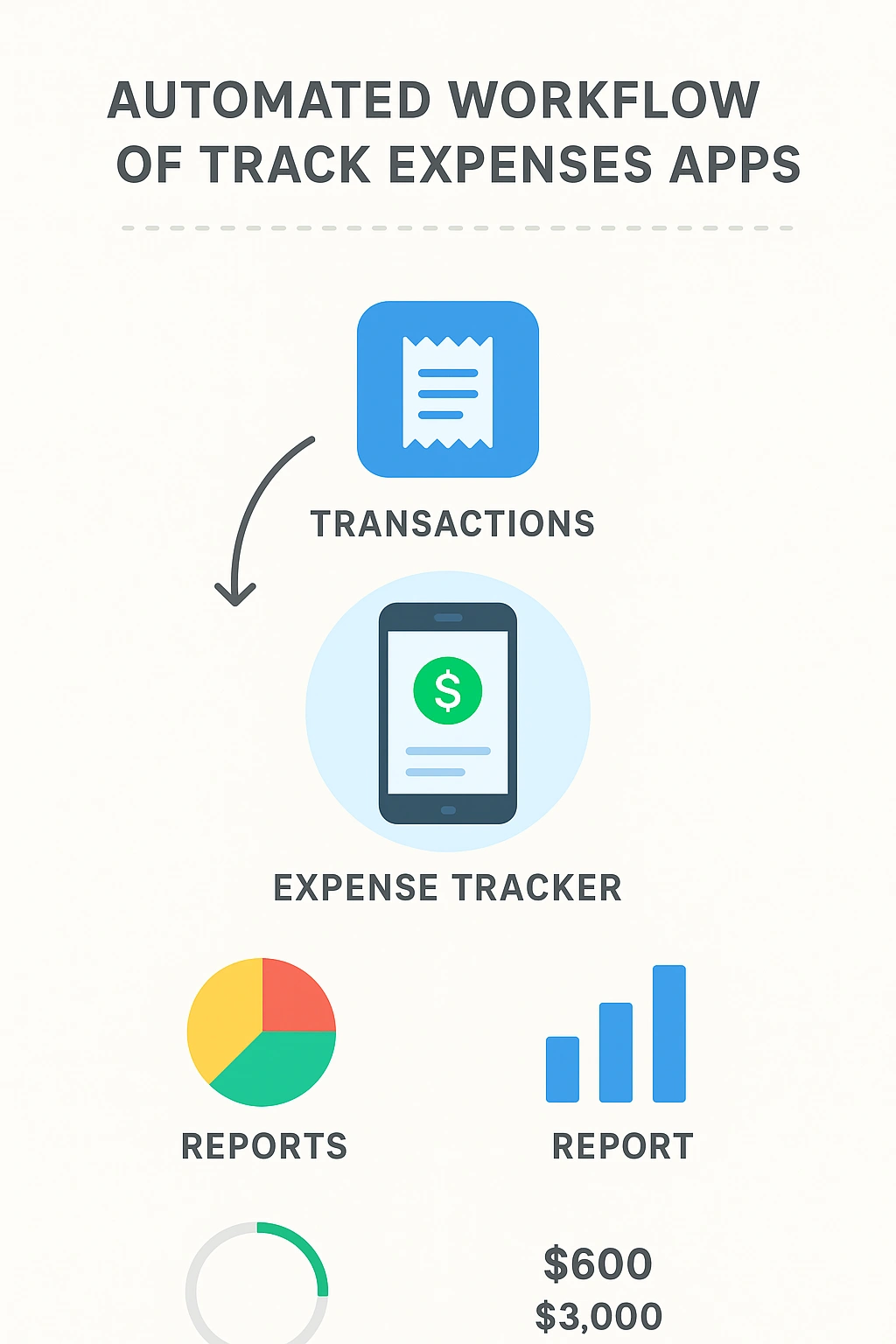

How It Works: The Automated Tracking Process

The magic of these apps lies in a simple, automated workflow that turns raw transaction data into powerful financial insights.

Here’s a breakdown of the core process:

| Step | Action | The Technology Behind It |

|---|---|---|

| 1. Secure Connection | You securely link your bank and credit card accounts to the app. | Trusted third-party services like Plaid that use bank-level encryption. |

| 2. Data Import | The app automatically imports your transaction data. | API integration with your financial institutions. |

| 3. AI Categorization | The app’s AI analyzes each transaction and assigns it to a category. | Machine learning algorithms that recognize merchant names and spending patterns. |

| 4. Visualization & Reporting | The app presents your categorized data in easy-to-understand charts and reports. | A user-friendly dashboard interface. |

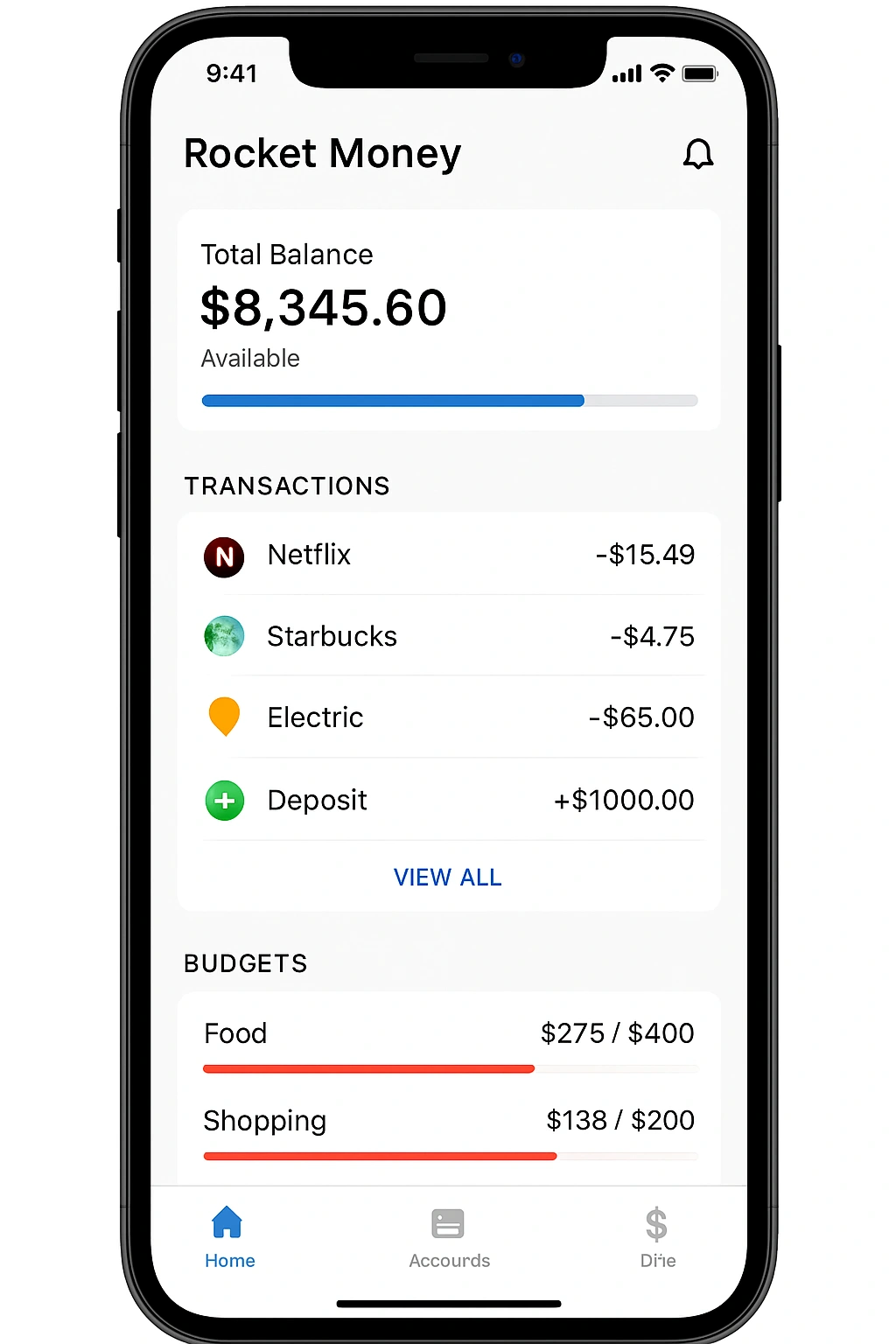

Real-Life Use Case: A Review of Rocket Money

To evaluate one of the most popular **track expenses apps**, I used **Rocket Money (formerly Truebill)**. This app is particularly well-known for its automated tracking and subscription management features.

The setup was incredibly fast. After linking my main credit card and checking account, the app pulled in my recent transactions and categorized them with impressive accuracy. The “Recurring” tab was the most impactful feature. It immediately identified a subscription to a digital magazine that I had completely forgotten about. With a single tap, I was able to use Rocket Money’s concierge service to cancel it for me. The monthly spending report provided a clear, visual breakdown of my habits, showing me that I was spending significantly more on “Dining & Drinks” than I had realized.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Excellent Automated Tracking: The AI is very good at categorizing transactions and finding subscriptions. | ❌ Budgeting is a Premium Feature: The free version is for tracking; proactive budgeting requires a subscription. |

| ✅ Actionable Features: The subscription cancellation and bill negotiation services are very useful. | ❌ Bill Negotiation Takes a Cut: The bill negotiation service takes a percentage of the savings it finds for you. |

| ✅ User-Friendly Interface: The app is clean, modern, and easy to navigate. | ❌ Focus is on Spending, Not Net Worth: It’s less focused on tracking investments and overall net worth. |

Top Apps to Track Expenses Compared

Rocket Money is a fantastic tracker, but other apps offer different philosophies and features. Here’s how the best **personal finance tools** compare.

| App | Key Feature | Pros | Cons | Best For |

|---|---|---|---|---|

| Rocket Money | Automated spending and subscription tracking. | Excellent for finding and canceling unwanted subscriptions. | Full budgeting features require a paid plan. | Beginners who want to quickly understand their spending. |

| YNAB (You Need A Budget) | Proactive, zero-based budgeting method. | Excellent for gaining intentional control over your money. | Subscription-based, has a steep learning curve. | Hands-on budgeters who want to be very deliberate. |

| Empower Personal Dashboard | Holistic net worth and investment tracking. | Best free tool for a complete view of your finances. | Budgeting tools are less proactive than YNAB. | Users who want to track both spending and investments. |

| Monarch Money | Modern interface, collaborative tools for couples. | Great for couples, strong goal-setting features. | It is a premium, subscription-only tool. | Couples and families managing finances together. |

Common Mistakes to Avoid When Tracking Expenses

An app is just a tool. To be successful, you need to avoid these common behavioral mistakes.

- “Set It and Forget It”: The automation is great, but you still need to actively engage. Spend 15 minutes a week reviewing your spending to stay aware and in control.

- Not Customizing Categories: The default categories are a good start, but you should customize them to match your life. This will give you more meaningful insights.

- Ignoring Cash Transactions: The app can only track what it can see. If you use cash frequently, you need to have a system for manually entering those expenses.

- Tracking Without a Goal: Data is useless without a purpose. Use the insights from your tracking to set a specific, achievable goal, like “reduce dining out by $200 a month.”

- Feeling Guilty: The point of tracking is not to feel bad about your spending; it’s to gain awareness. As financial experts cited by Google often advise, a non-judgmental approach is key to building sustainable financial habits.

Expert Tips for Success

Use your **track expenses apps** like a pro with these best practices.

- Start with a “No-Budget” Month: For the first month, don’t try to change your spending. Just let the app track your natural habits to get an honest baseline.

- Have a Weekly “Money Date”: Set aside 15 minutes every Sunday to review your spending from the past week.

- Use the “Notes” Feature: For large or unusual purchases, use the app’s notes feature to add context. This will help you remember what it was for when you review your budget later.

- Automate Your Savings: Once you’ve identified an area to cut back, set up an automatic transfer for that amount to your savings account each month.

“Tracking your expenses is the financial equivalent of turning on the lights in a dark room. For the first time, you can clearly see what’s there, which is the necessary first step to tidying up.”

– A leading personal finance author

Frequently Asked Questions (FAQ)

Q: What is the best app to track my expenses?

A: The ‘best’ app depends on your goal. For simple, automated spending tracking and finding forgotten subscriptions, Rocket Money is excellent. For a more hands-on, proactive budgeting approach, YNAB is a powerful choice. For a free, holistic view of your entire financial picture, including investments, Empower Personal Dashboard is a top contender.

Q: Is it safe to connect my bank account to an expense tracking app?

A: Yes, reputable apps use bank-level security and trusted third-party services like Plaid to link to your accounts. This connection is typically ‘read-only,’ meaning the app can see your transaction data but cannot move or access your money. Always use a strong password and enable two-factor authentication for the app itself.

Q: How do these apps automatically track expenses?

A: These apps securely connect to your bank and credit card accounts. They automatically import your transaction data and then use AI to analyze the merchant name and other details to assign each transaction to a category, such as ‘Groceries’ or ‘Gas.’ This eliminates the need for manual data entry.

Q: Can an expense tracking app help me save money?

A: Absolutely. The first step to saving more is understanding where your money is currently going. By providing a clear, visual breakdown of your spending, these apps give you the awareness you need to identify areas where you can cut back and redirect that money towards your savings goals.

Q: What is the difference between tracking expenses and budgeting?

A: Tracking expenses is the process of recording and categorizing your past spending to see where your money went. Budgeting is the proactive process of creating a plan for your future spending. The best money management and budgeting apps help you do both: they use the data from your tracked expenses to help you create a realistic and effective budget.

Conclusion