Introduction

What Are Tax Mistakes Retirement?

Why Avoiding These Mistakes is Crucial

A smart tax strategy is one of the most powerful levers you can pull to improve your retirement outcome.

Maximize Your Spendable Income

This is the most direct benefit. Every dollar you save in taxes is a dollar you can use to live on. A lower tax bill means your nest egg will last longer, or you can afford a higher standard of living.

Gain Control Over Your Financial Future

A tax-efficient plan gives you more flexibility. By having your money in different “tax buckets,” you can strategically manage your withdrawals to stay in a lower tax bracket and react to unexpected life events without creating a massive tax bill.

Avoid Costly Penalties

Certain mistakes, like failing to take your Required Minimum Distributions (RMDs), come with severe penalties from the IRS. A good plan ensures you are always in compliance with the law. For more on planning your future, check out this valuable resource.

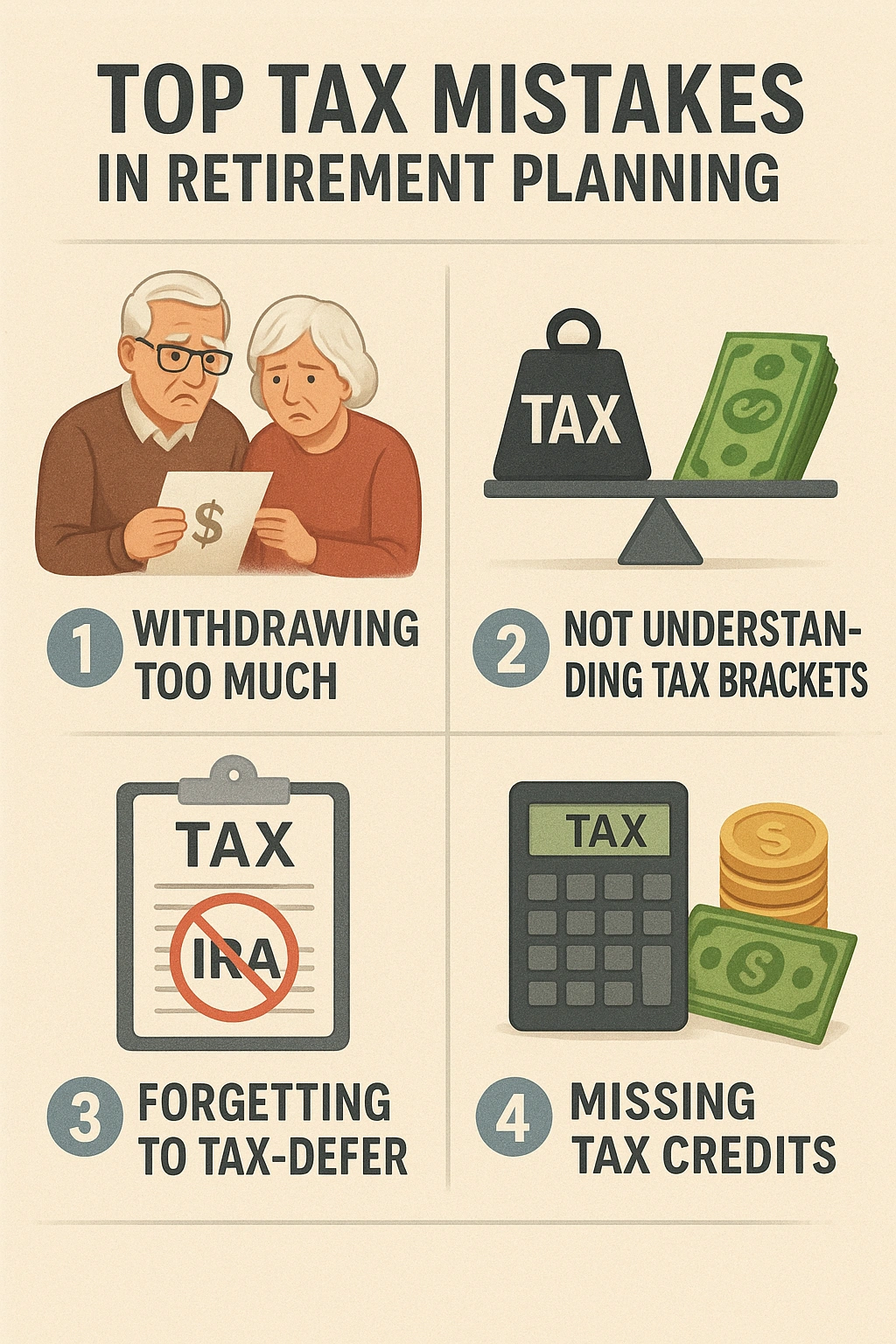

The Top 7 Tax Mistakes in Retirement Planning

Here are the seven most common and damaging mistakes that can derail your journey to a secure retirement.

Mistake #1: Having No Tax Diversification

This is the most common strategic error. Many people save exclusively in pre-tax accounts like a Traditional 401(k). This feels good during your working years because of the tax deduction, but it creates a “tax time bomb” in retirement, where 100% of your withdrawals will be taxed as ordinary income. A smart strategy involves having a mix of pre-tax (Traditional), post-tax (Roth), and taxable accounts.

Mistake #2: Mismanaging Required Minimum Distributions (RMDs)

Starting at age 73, the IRS requires you to take a minimum amount out of your pre-tax retirement accounts each year. The penalty for failing to take the correct amount is a steep 25% of the amount you should have withdrawn. This is one of the most punitive **pension tax errors**.

Mistake #3: Not Understanding How Social Security is Taxed

Many people are surprised to learn that their Social Security benefits can be taxable. Depending on your “combined income,” up to 85% of your benefits can be subject to federal income tax. A large withdrawal from your Traditional IRA can easily push you over the income threshold and cause a big chunk of your Social Security to become taxable.

Mistake #4: Cashing Out a 401(k) When Changing Jobs

This is a catastrophic mistake often made early in a career. Cashing out a 401(k) will trigger a 10% penalty plus ordinary income taxes on the entire amount. You should always roll it over into an IRA or your new employer’s plan.

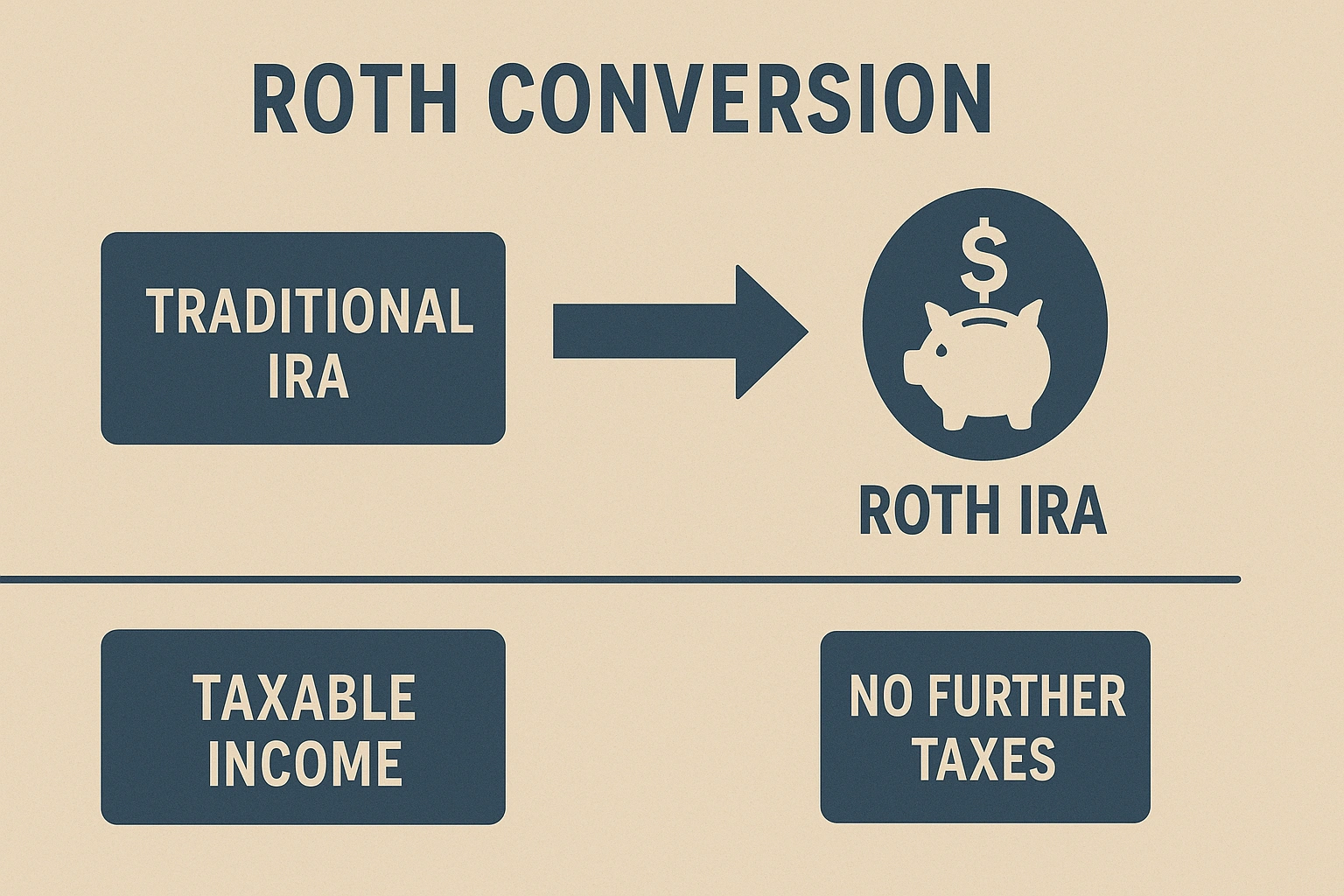

Mistake #5: Ignoring the Power of Roth Conversions

A Roth conversion—moving money from a Traditional IRA to a Roth IRA and paying the tax now—is a powerful tool. Not considering this strategy, especially during low-income years (like early retirement), is a missed opportunity to create a source of tax-free income for the future.

Mistake #6: Not Planning for State Taxes

Your tax bill doesn’t just come from the federal government. State tax laws on retirement income vary dramatically. Some states have no income tax, while others will tax your 401(k) withdrawals and Social Security benefits. This can be a major factor in deciding where to live in retirement.

Mistake #7: Forgetting About Healthcare Costs and HSAs

Healthcare is one of the biggest expenses in retirement. Not planning for it is a major error. If you are eligible for a Health Savings Account (HSA), it is the most tax-advantaged account in existence and a powerful tool for saving for future medical costs.

How to Correct Your Course

Recognizing a mistake is the first step. Here’s a simple guide to correcting these common errors.

| Mistake | The Simple Fix |

|---|---|

| No Tax Diversification | Start contributing to a Roth IRA or Roth 401(k) today to begin building your tax-free bucket. |

| Ignoring RMDs | Work with your brokerage firm or a financial advisor to calculate your RMD and set up an automatic annual withdrawal. |

| Ignoring Social Security Tax | Use a retirement planner to model how your withdrawals will impact your combined income and the taxability of your benefits. |

Expert Tips for Success

Implement a smart **financial tax planning** strategy with these pro tips.

- Use an HSA as a “Stealth IRA”: An HSA is triple tax-advantaged and is a fantastic vehicle for saving for healthcare costs.

- Consider a Qualified Charitable Distribution (QCD): If you are over 70.5, you can donate directly from your IRA to a charity to satisfy your RMD without it counting as taxable income.

- Practice Asset Location: Hold your tax-inefficient investments (like bonds) in your tax-advantaged accounts.

- Work with a Professional: Retirement tax planning is complex. A qualified financial advisor or CPA can provide personalized advice. As experts cited by Google often advise, professional guidance is key for complex financial matters.

“A good investment plan can make you wealthy. A good tax plan is what allows you to stay wealthy. They are two sides of the same coin.”

– A Certified Public Accountant (CPA)

Frequently Asked Questions (FAQ)

Q: What is the single biggest tax mistake people make in retirement planning?

A: The single biggest mistake is not having a tax diversification strategy. Many people save exclusively in pre-tax accounts like a Traditional 401(k), meaning 100% of their retirement income will be taxable. A smart strategy involves having a mix of pre-tax (Traditional), post-tax (Roth), and taxable accounts to effectively manage your tax bracket in retirement.

Q: What is a ‘tax torpedo’ and how can I avoid it?

A: The ‘tax torpedo’ is a situation where a small increase in your income triggers a much larger increase in your taxes because it causes a greater portion of your Social Security benefits to become taxable. You can avoid it by carefully managing your withdrawals, for example, by taking tax-free distributions from a Roth IRA to keep your ‘combined income’ below the taxation thresholds.

Q: Is it a mistake to have all my money in a Roth IRA?

A: While having all your money in a tax-free Roth account is a great ‘problem’ to have, it may not be the most optimal strategy. Making pre-tax contributions to a Traditional 401(k) during your peak earning years can provide a valuable tax deduction, lowering your tax bill today. A balanced approach is often best.

Q: What are Required Minimum Distributions (RMDs)?

A: RMDs are mandatory annual withdrawals that you must start taking from your pre-tax retirement accounts (like Traditional IRAs and 401(k)s) starting at age 73. The amount is determined by the IRS based on your account balance and life expectancy. Failing to take your RMD results in a severe tax penalty.

Q: Do I need a CPA to avoid these pension tax errors?

A: While you can avoid many common mistakes on your own by understanding the basics, a qualified CPA or financial advisor who specializes in retirement is invaluable for complex situations. They can provide personalized advice on strategies like Roth conversions and help you create the most efficient plan for your specific situation.

Conclusion