Introduction

What if you could build a million-dollar nest egg and never have to pay a single cent of tax on it when you retire? It sounds like a financial fantasy, but it’s a reality for millions of savvy savers. The U.S. tax code is filled with powerful incentives to help you save for the future, and the most potent of all are **tax-free retirement accounts**. Understanding how to use these accounts is not just a smart money move; it’s the key to dramatically increasing your income in retirement. This guide will demystify the world of Roth IRAs, Roth 401(k)s, and HSAs, and show you how to build a fortress of tax-free wealth.

What Are Tax-Free Retirement Accounts?

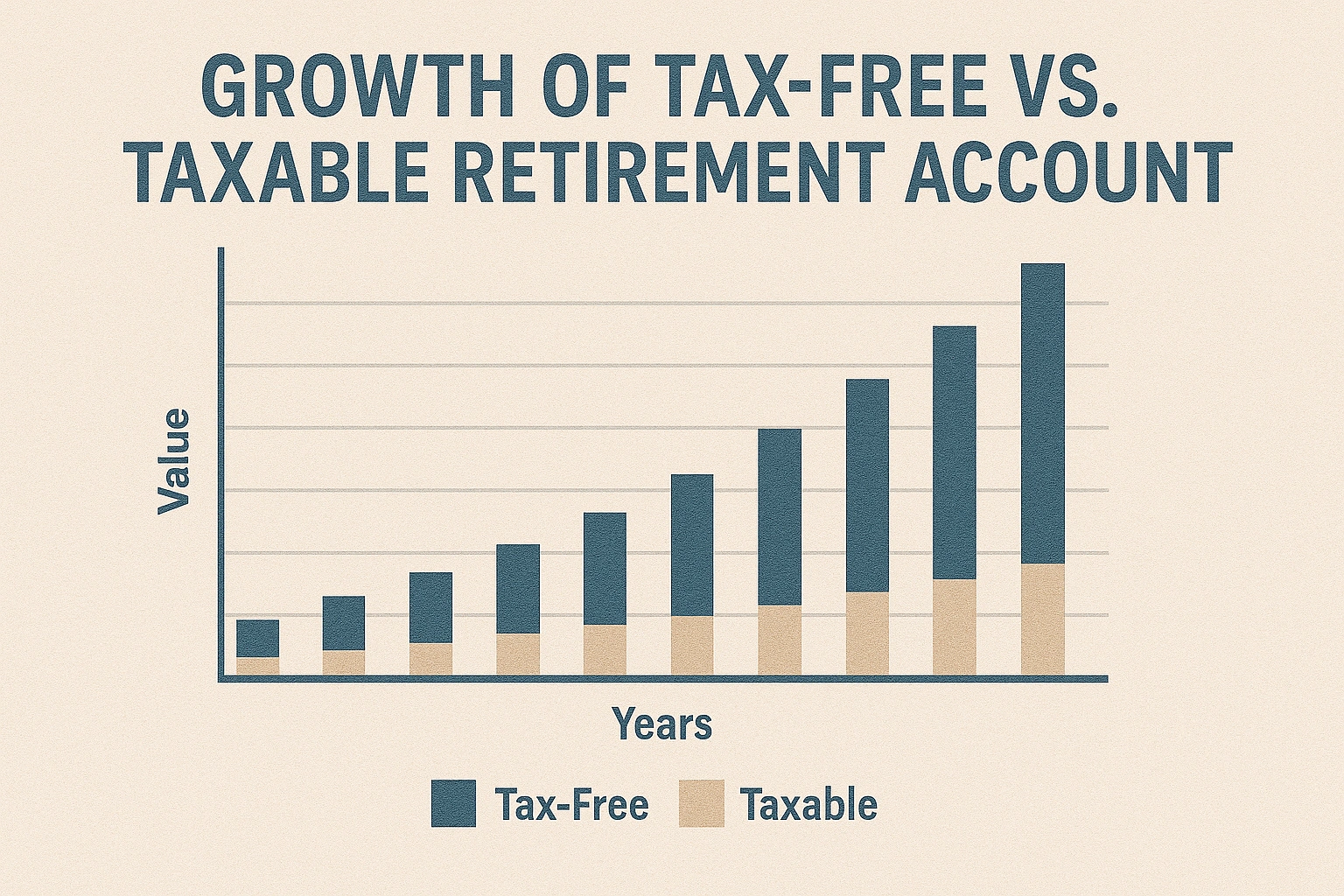

Why Tax-Free Growth is a Financial Superpower

Your Nest Egg is Truly Yours

When you look at a million-dollar balance in a Traditional 401(k), you have to remember that a significant portion of that money belongs to the IRS. With a Roth account, the number you see is the number you get. This provides incredible clarity and peace of mind in your planning.

Protect Yourself from Future Tax Hikes

No one knows what tax rates will be in 20 or 30 years. By paying your taxes now, you are removing that uncertainty from your retirement equation. A Roth account is your personal insurance policy against a more expensive tax future.

Gain Flexibility and Control in Retirement

Having a source of tax-free income in retirement is a powerful strategic tool.

- You can make a large withdrawal for a big purchase (like a new car or a trip) without creating a massive tax bill.

- It can help you manage your income to keep the taxability of your Social Security benefits low.

- Roth IRAs have no Required Minimum Distributions (RMDs), giving you more control over when you access your money.

For more on planning your future, check out this valuable resource.

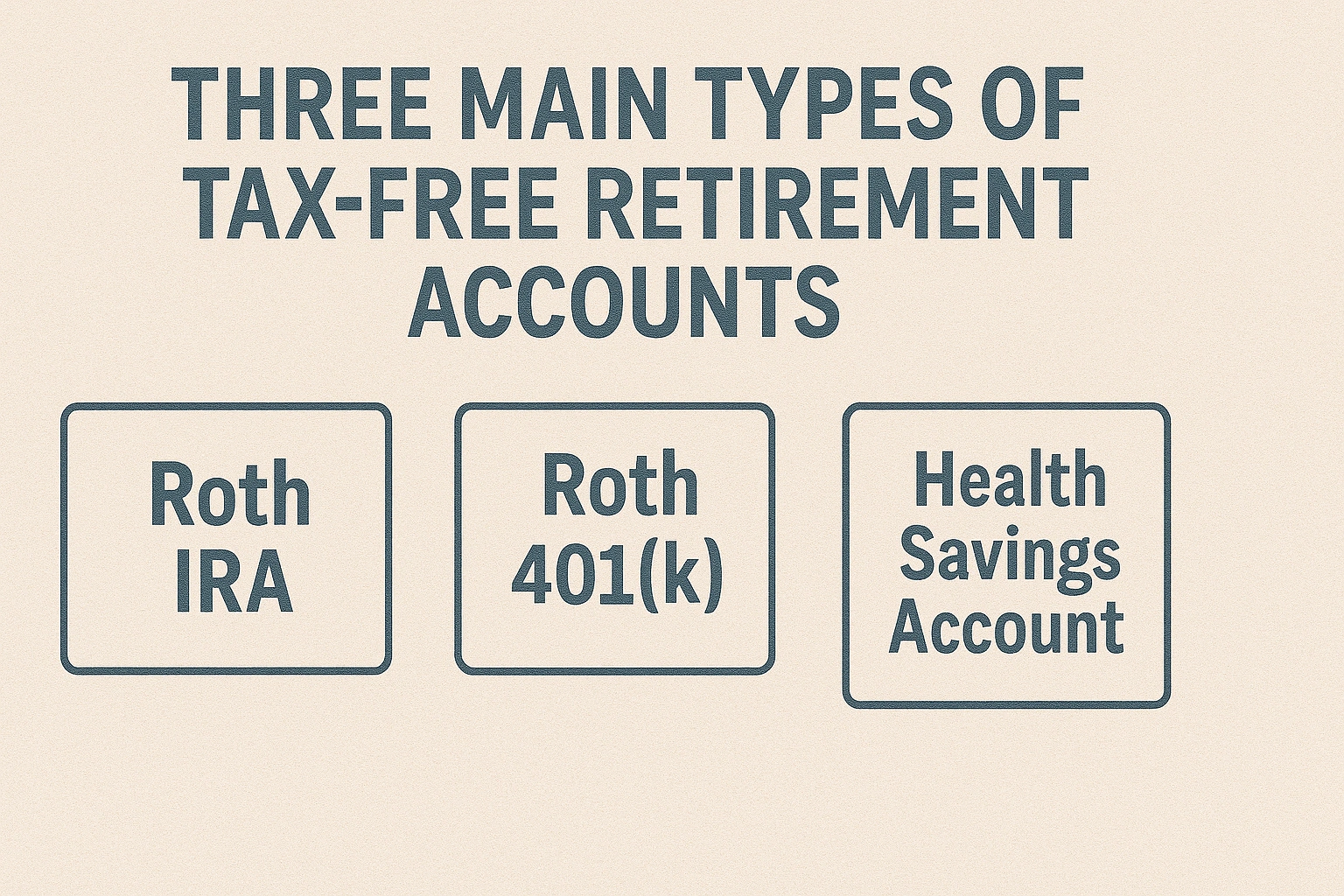

The Core Tax-Free Retirement Accounts Explained

There are three primary accounts that offer tax-free benefits. Understanding the differences is key to building your strategy.

Here’s a breakdown of the main players:

| Account | How It Works | Key Feature |

|---|---|---|

| Roth IRA | An Individual Retirement Account you open yourself. You contribute after-tax money, and it grows and can be withdrawn tax-free. | Offers the most flexibility in investment choices and has no RMDs. |

| Roth 401(k) | An employer-sponsored plan that works just like a Roth IRA. Many companies now offer this option alongside a Traditional 401(k). | Has a much higher annual contribution limit than an IRA. |

| Health Savings Account (HSA) | A savings account for those with a high-deductible health plan. It is “triple tax-advantaged.” | Contributions are tax-deductible, it grows tax-free, and withdrawals are tax-free for medical expenses. |

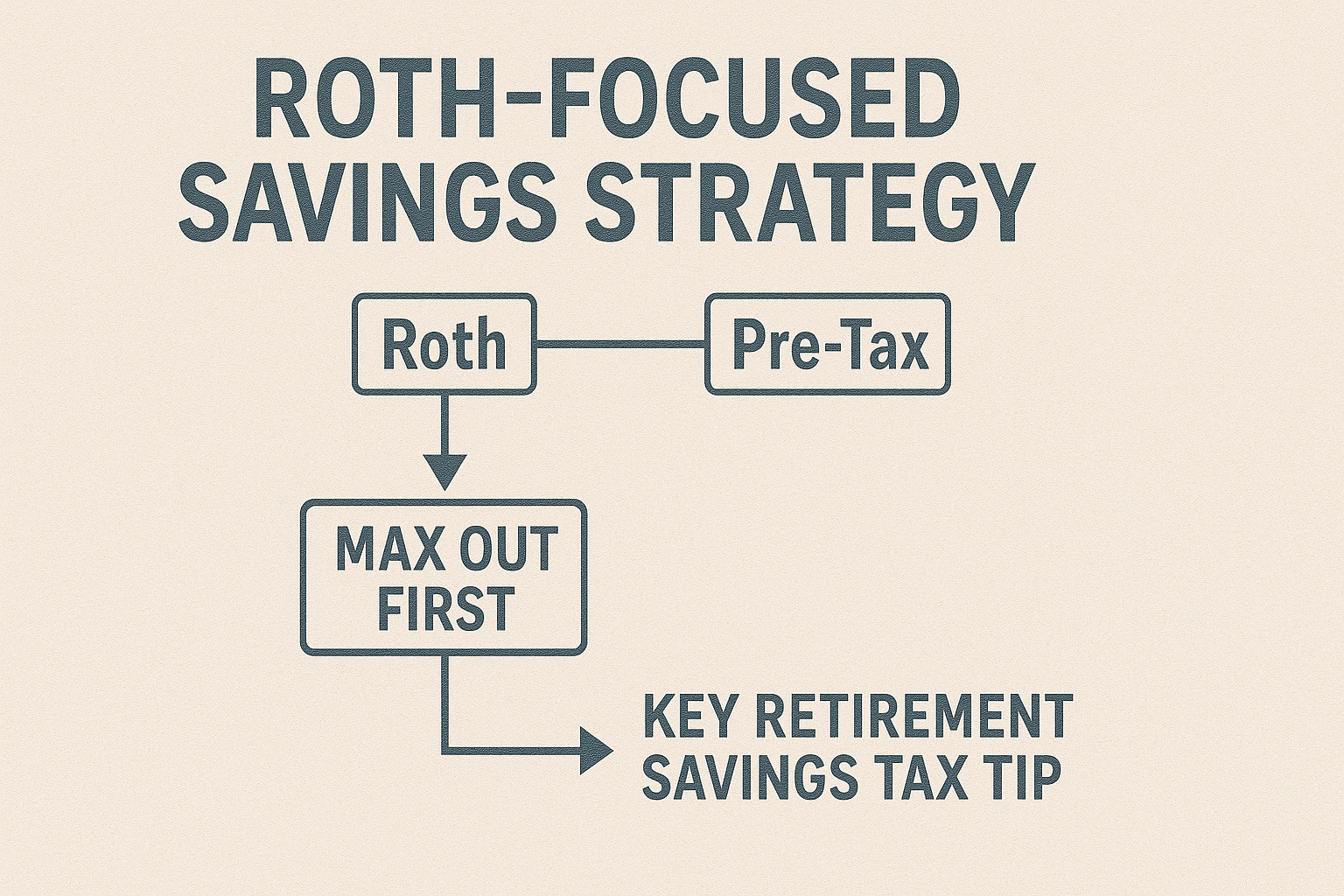

Real-Life Strategy: Prioritizing Roth for a Young Professional

Let’s look at a practical example. “Maria” is a 28-year-old software engineer. Her income is good, but she expects it to be much higher later in her career. This makes her a prime candidate for a Roth-focused strategy.

Her employer offers both a Traditional and a Roth 401(k), with a match. Her first step is to contribute to her Roth 401(k) up to the full company match. After that, she prioritizes maxing out her separate Roth IRA because it offers better investment options. Finally, with any remaining savings, she goes back and contributes more to her Roth 401(k). By prioritizing the Roth options now, while she is in a relatively lower tax bracket, she is building a massive nest egg that will be completely tax-free in the future when her tax rate is likely to be much higher.

Comparing Traditional vs. Roth: A Numbers Example

Let’s look at a simple example to see the real-world impact of the Traditional vs. Roth choice.

| Scenario | Traditional IRA | Roth IRA |

|---|---|---|

| Initial Contribution | $5,000 (pre-tax) | $5,000 (after-tax) |

| Value after 30 years (at 8%) | $50,313 | $50,313 |

| Amount After Taxes in Retirement (25% tax rate) | $37,735 | $50,313 |

As you can see, even though both accounts grow to the same amount, the Roth account gives you significantly more money to spend in retirement because it’s not subject to taxes on withdrawal.

Common Mistakes to Avoid with Tax-Free Accounts

These accounts are powerful, but they have rules. Avoid these common mistakes.

- Not Understanding the 5-Year Rule: For a Roth IRA, your account must be open for five years before you can withdraw your earnings tax-free. This is a crucial rule to understand.

- Ignoring Income Limits for Roth IRAs: There are income limits for direct contributions to a Roth IRA. If you earn too much, you’ll need to use the “Backdoor Roth IRA” strategy.

- Forgetting About Your Roth 401(k) When You Leave a Job: If you have a Roth 401(k), make sure you roll it over into a Roth IRA to preserve its tax-free status.

- Using Your HSA for Non-Medical Expenses Before Age 65: If you withdraw money from an HSA for non-medical reasons before you turn 65, you’ll pay both income tax and a steep penalty.

- Not Investing Your HSA Funds: An HSA is not just a savings account; it’s an investment account. As financial experts cited by Google often advise, investing your HSA funds is key to maximizing its long-term growth.

Expert Tips for Success

Maximize your **retirement savings tax tips** with these pro strategies.

- Prioritize the Roth 401(k) Match: If your employer offers a match on Roth 401(k) contributions, this is an incredibly powerful way to get tax-free money.

- Use the “Backdoor Roth IRA”: If you’re a high-income earner, learn about this simple, legal strategy to fund a Roth IRA.

- Consider a “Mega Backdoor Roth”: If your 401(k) plan allows it, this advanced strategy lets you save a huge amount of extra money in a Roth account.

- Use Your HSA as a “Stealth IRA”: Pay for your current medical expenses out-of-pocket and let your HSA grow untouched as a dedicated, tax-free fund for healthcare in retirement.

“Paying taxes on the seed (your contributions) instead of the harvest (your withdrawals) is one of the most powerful strategic decisions a long-term investor can make.”

– A leading financial author

Frequently Asked Questions (FAQ)

Q: What is the best tax-free retirement account for a beginner?

A: For most beginners, the Roth IRA is the best starting point for tax-free savings. It’s easy to open, offers a wide range of investment options, and the rules for contributions and withdrawals are very flexible. If your employer offers a Roth 401(k), that is also an excellent choice, especially if it comes with a company match.

Q: What’s the difference between a Roth IRA and a Roth 401(k)?

A: Both offer tax-free growth and withdrawals. The main differences are how you get them and the contribution limits. A Roth 401(k) is an employer-sponsored plan with a high contribution limit ($23,000 in 2025). A Roth IRA is an individual account you open yourself with a lower contribution limit ($7,000 in 2025) but more investment flexibility.

Q: What if I earn too much to contribute to a Roth IRA?

A: If your income is above the IRS limits for direct Roth IRA contributions, you can likely still contribute using a strategy called the ‘Backdoor Roth IRA.’ This involves contributing to a Traditional IRA (which has no income limits) and then immediately converting it to a Roth IRA. It’s a legal and common strategy used by high-income earners.

Q: Is a Health Savings Account (HSA) really a retirement account?

A: Yes, it is often called the ‘ultimate’ retirement account because it is triple tax-advantaged. Contributions are tax-deductible, the money grows tax-free, and withdrawals are tax-free for qualified medical expenses. After age 65, you can withdraw the money for any reason, and it’s simply taxed as ordinary income, just like a Traditional IRA.

Q: Should I choose a Traditional (pre-tax) or Roth (after-tax) account?

A: The general rule of thumb is to choose Roth accounts when you are young and in a lower tax bracket than you expect to be in during retirement. Choose Traditional accounts when you are in your peak earning years and expect to be in a lower tax bracket in retirement. Having a mix of both provides valuable tax diversification.

Conclusion