Introduction

What is Retirement Savings Millennials?

Despite facing unique economic challenges, millennials are actively engaging with their finances. As reported by sources like Statista, a new generation is embracing investing, largely thanks to accessible digital tools. The key is to channel that engagement into a disciplined, long-term strategy.

Why Starting in Your 20s and 30s is a Financial Superpower

Harness the Magic of Compound Interest

Compound interest is the interest you earn on your interest. Over decades, it creates a snowball effect that is almost unbelievable. A single dollar invested at age 25 is worth far more than a dollar invested at age 45. Time is a more powerful ingredient than the amount of money you start with.

Take Advantage of Tax-Free Growth

As a young professional, you are likely in the lowest tax bracket you’ll be in for your entire career. This makes the Roth IRA and Roth 401(k) incredibly powerful tools. By paying taxes on your contributions now, you allow all your future growth to be 100% tax-free in retirement.

Build Financial Independence and Flexibility

A strong savings habit isn’t just about retirement; it’s about creating options for your life. A healthy nest egg can give you the freedom to change careers, start a business, or take a sabbatical down the road. For more on planning your future, check out this valuable resource.

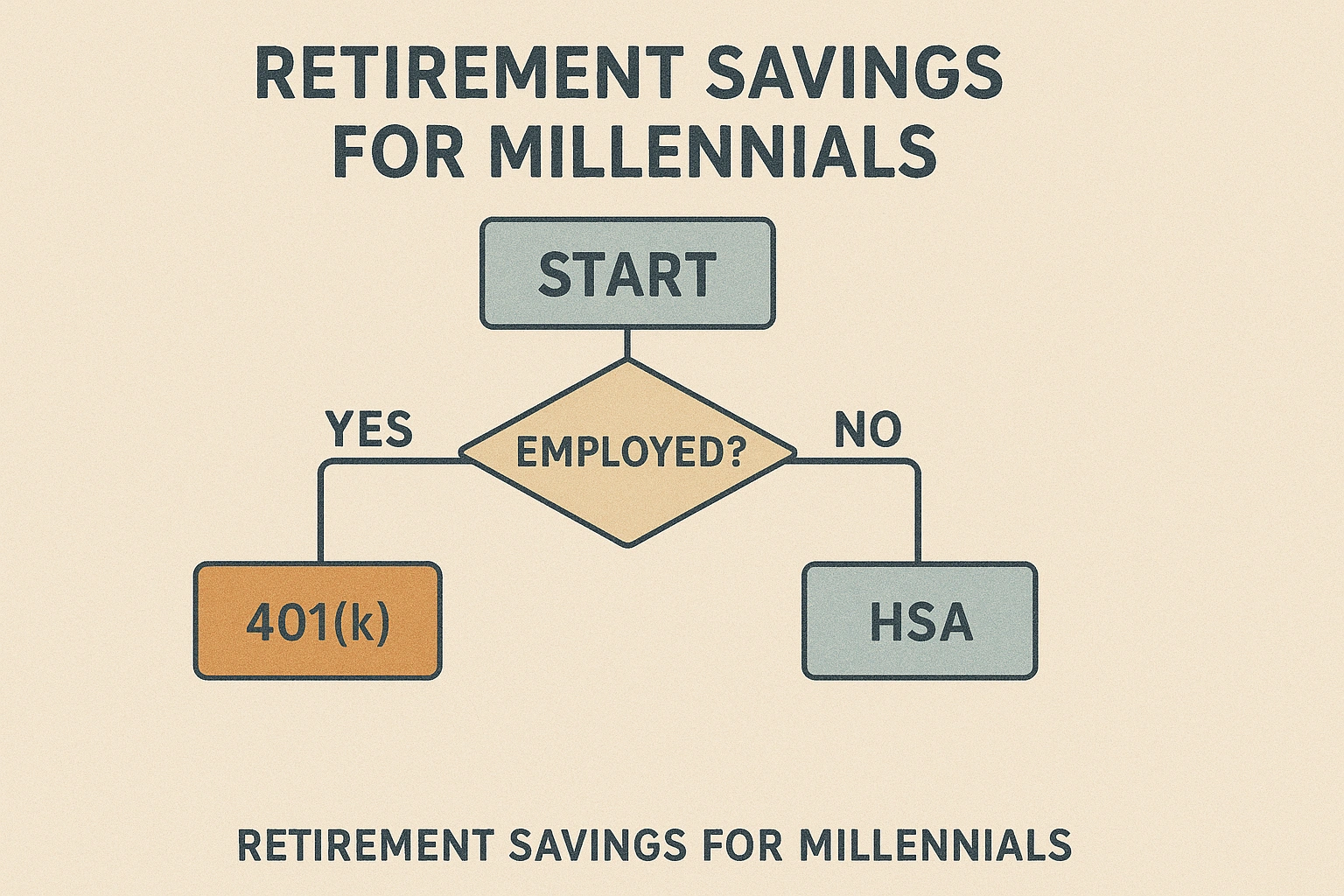

The Core Retirement Savings Options for Millennials

As a beginner, you only need to know about a few key types of accounts. Here’s a simple breakdown of your best options.

Here’s a comparison of the main players:

| Account | How It Works | Key Feature |

|---|---|---|

| 401(k) with Employer Match | An employer-sponsored plan. Your contributions are deducted from your paycheck. | The employer match is a 100% return on your investment. This is your #1 priority. |

| Roth IRA | An Individual Retirement Account you open yourself. You contribute after-tax money. | Your money grows and can be withdrawn completely tax-free in retirement. |

| Health Savings Account (HSA) | A savings account for those with a high-deductible health plan. | It’s “triple tax-advantaged,” making it a powerful, under-the-radar retirement account. |

| Taxable Brokerage Account | A standard investment account with no contribution limits or tax advantages. | Offers the most flexibility for money you might need before retirement. |

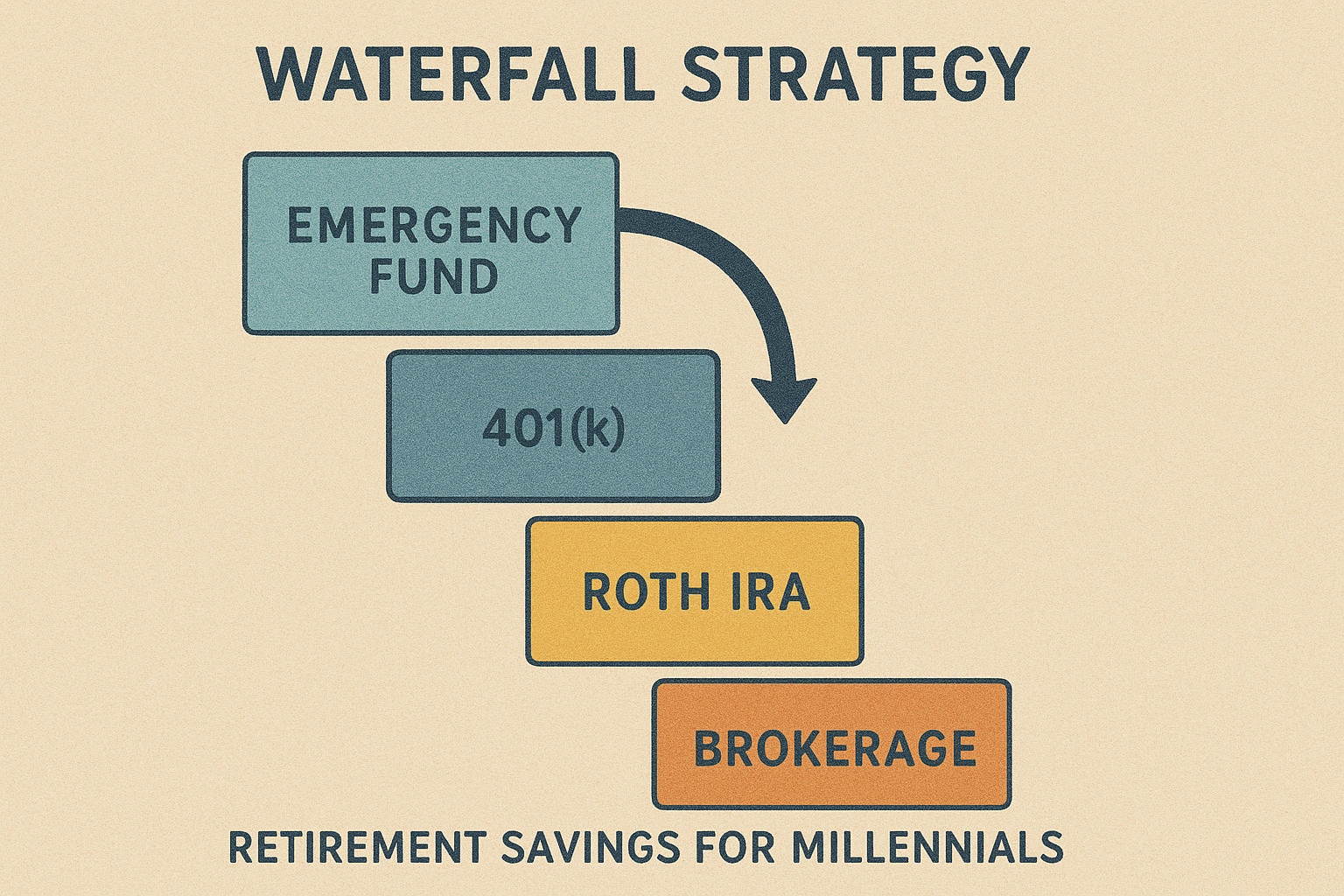

Real-Life Strategy: The Millennial Savings “Waterfall”

The best way to approach **financial planning for young adults** is with a clear, prioritized strategy. Let’s look at a fictional 28-year-old named Chloe.

Chloe follows a simple but powerful “waterfall” approach to her savings:

- Step 1: Fill the 401(k) Match Bucket. Chloe’s top priority is to contribute enough to her 401(k) to get the full employer match.

- Step 2: Fill the Roth IRA Bucket. After getting the match, she directs her next savings dollars to max out her Roth IRA.

- Step 3: Fill the HSA Bucket. Because she has a high-deductible health plan, she then contributes the maximum to her HSA.

- Step 4: Overflow into the 401(k). With any remaining money, she goes back and contributes more to her 401(k) until she hits the annual limit.

This strategy is effective because it prioritizes the most advantageous accounts first, ensuring she never leaves “free money” on the table and maximizes her tax-free growth potential.

Comparing Your Key Savings Options

Let’s put the core retirement accounts side-by-side to help you choose.

| Account | Pros | Cons | Best For |

|---|---|---|---|

| 401(k) | Employer match, high contribution limits, automated contributions. | Limited investment options, can have high fees. | Getting the employer match. It’s your first priority. |

| Roth IRA | Tax-free growth and withdrawals, huge investment flexibility, can withdraw contributions early without penalty. | Lower contribution limits, income limitations may apply. | Young professionals who want tax-free growth. |

| HSA | Triple tax-advantaged (tax-deductible contributions, tax-free growth, tax-free withdrawals for medical). | You must have a high-deductible health plan to be eligible. | A powerful “stealth” retirement account for healthcare costs. |

Common Mistakes Young Adults Make

Your long time horizon is a huge advantage, but it can also lead to complacency. Avoid these common mistakes.

- Waiting for the “Perfect” Time to Start: The perfect time is now. Don’t wait until you get a raise or pay off your student loans. Start small, but start today.

- Ignoring the 401(k) Match: This cannot be overstated. It is the best return on investment you will ever get.

- Being Too Afraid of the Stock Market: As a young investor, stock market downturns are a good thing for you; they allow you to buy more shares at a discount. Your portfolio should be aggressive.

- Paying High Fees: Choose the low-cost index funds in your 401(k). High fees will decimate your returns over the long run.

- Cashing Out Your 401(k) When You Change Jobs: This is a catastrophic mistake. Always roll it over. As financial experts cited by Google often advise, this is one of the most damaging financial errors you can make.

Expert Tips for Success

Maximize your **retirement savings for millennials** with these pro tips.

- Automate Everything: Set up automatic contributions to your 401(k) and IRA and let the system do the work.

- Choose a Target-Date Fund: This is the simplest and most effective investment for a beginner.

- Increase Your Savings with Every Raise: Every time your income goes up, increase your savings rate before you get used to the bigger paycheck.

- Live Below Your Means: The gap between what you earn and what you spend is where wealth is built.

“The most powerful force in the universe is compound interest. The second most powerful is the discipline to let it work its magic. As a millennial, you have a multi-decade head start. Don’t waste it.”

– A leading financial independence author

Frequently Asked Questions (FAQ)

Q: What is the single best retirement account for a millennial?

A: The best starting point is a 401(k) with an employer match. You should always contribute enough to get the full match, as it’s a 100% return on your money. After that, a Roth IRA is often the best choice for millennials due to the benefit of tax-free growth and withdrawals in retirement.

Q: How much should a millennial be saving for retirement?

A: A great goal is to save 15% of your pre-tax income. If that’s not possible due to student loans or other debts, the most important thing is to start. Begin with a smaller percentage and commit to increasing it by 1% each year. The habit is more important than the initial amount.

Q: Should I pay off my student loans before I start saving for retirement?

A: This is a common dilemma. Most financial advisors recommend a balanced approach. You should absolutely contribute enough to your 401(k) to get the employer match (don’t turn down free money). After that, you can decide whether to aggressively pay down high-interest debt or contribute more to retirement accounts. It’s not an all-or-nothing choice.

Q: What should I invest in as a young adult?

A: For beginners, the simplest and most effective investment is a low-cost Target-Date Fund. You choose the fund with the year closest to your expected retirement (e.g., ‘Target-Date 2060’), and it automatically manages a diversified portfolio of stocks and bonds for you.

Q: What if I’m self-employed or a freelancer?

A: If you’re self-employed, you have excellent retirement savings options. The most common are the SEP IRA and the Solo 401(k). Both allow you to save a much higher percentage of your income than a traditional IRA, and they offer the same powerful tax advantages.

Conclusion