Introduction

Retirement planning can feel like trying to hit a moving target in the dark. General advice like “save 15% of your income” can help, but it often leaves you wondering if you’re truly on track. A retirement savings calculator helps remove that uncertainty, giving you a clear picture of what you need. By using a retirement savings calculator, you can set concrete goals and map out a realistic plan. With a reliable retirement savings calculator, you can finally turn financial anxiety into confidence and take actionable steps toward the retirement you want.

What is a Retirement Savings Calculator?

A retirement savings calculator is a digital tool that helps you forecast your investments and see if you’re on track for your retirement goals. By entering key details like your age, desired retirement age, current savings, and monthly contributions, a retirement savings calculator can project how your money might grow over time. Using a retirement savings calculator gives you a clear, long-term view of your financial habits and their impact. With a reliable retirement savings calculator, you can make informed decisions today to secure the retirement you want tomorrow.

In an era where traditional pensions are rare, the importance of these tools has skyrocketed. They are the most accessible **pension planning tools** for the modern worker. As reported by financial news outlets, a significant portion of the population feels unprepared for retirement. A retirement calculator is the first and most crucial step in bridging that gap, transforming a vague goal into a tangible number.

Why Using a Calculator is a Financial Wake-Up Call

Spending just 15 minutes with a retirement calculator can be one of the most enlightening and motivating things you do for your finances.

It Turns a Vague Goal into a Concrete Number

“Retirement” is an abstract concept. A calculator makes it real. Seeing that you need to aim for $1.5 million, for example, is a much more powerful motivator than a vague idea of “saving for the future.” It gives you a clear finish line to run towards.

It Visualizes the Magic of Compound Interest

It’s one thing to hear that compound interest is powerful; it’s another to see it in action. A calculator’s graph showing your savings growing exponentially over time is a powerful visual lesson on the importance of starting early and staying consistent.

It Empowers You to Make Informed Trade-Offs

The best part of a calculator is its interactivity. You can instantly see the impact of your choices.

- What happens if I increase my monthly savings by $200?

- How would retiring five years later affect my nest egg?

- What is the long-term cost of the high fees in my 401(k)?

This allows you to make conscious, informed decisions about your financial life. For more on making smart financial choices, explore this valuable resource.

How It Works: The Key Inputs That Drive Your Results

A retirement savings calculator is powered by a few key pieces of information. Understanding these inputs is crucial to getting an accurate and meaningful result.

Here’s a breakdown of the essential data points:

| Input | What It Means | Why It’s Important |

|---|---|---|

| Current Age & Retirement Age | Your starting point and your desired finish line. | This determines your investment time horizon, the single most important factor in compound growth. |

| Current Retirement Savings | The total amount you have already saved in all your retirement accounts. | This is the principal amount that your future growth will be built upon. |

| Monthly Contribution | The amount you consistently add to your retirement savings each month. | This is the most powerful lever you can control to change your outcome. |

| Expected Rate of Return | The average annual growth rate you expect from your investments. | This is a crucial (and often overestimated) variable. A conservative estimate is key to a realistic plan. |

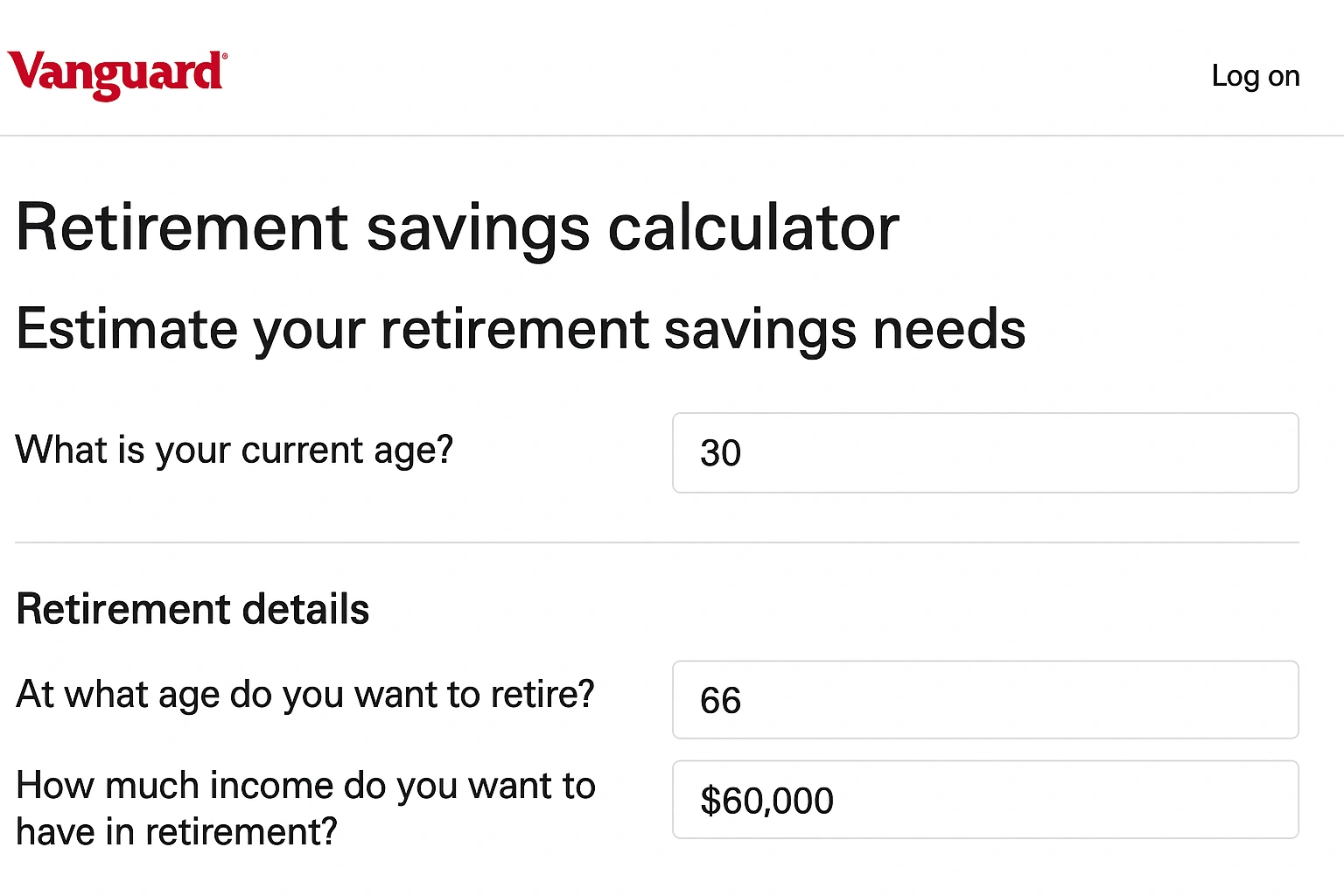

Real-Life Use Case: A Review of Vanguard’s Calculator

To evaluate a simple and effective **retirement savings calculator**, I used the **Vanguard Retirement Nest Egg Calculator**. It’s a free, straightforward tool designed to answer a slightly different question: “How long will my savings last?”

The experience was incredibly insightful. I input a hypothetical retirement portfolio of $1 million and an annual withdrawal of $40,000 (the classic 4% rule). The calculator then ran a Monte Carlo simulation—a complex model that runs thousands of potential market scenarios—to show the probability of my money lasting for 30 years. The visual results were powerful, showing a range of outcomes from best-case to worst-case scenarios. I could then adjust the variables, instantly seeing how a more conservative withdrawal strategy or a different asset allocation would increase my chances of success.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Uses Sophisticated Modeling: The Monte Carlo simulation provides a more realistic range of outcomes than a simple linear projection. | ❌ Focused on Decumulation: It’s designed for people near or in retirement, not for those in the early stages of saving. |

| ✅ Free and Easy to Use: The interface is clean, and the results are easy to understand. | ❌ Doesn’t Link to Your Accounts: You have to manually input your portfolio value and asset allocation. |

| ✅ From a Trusted Source: Vanguard is one of the most respected names in investing. | ❌ Doesn’t Account for Taxes or Social Security: The calculations are pre-tax and don’t include other income sources. |

Comparing Types of Retirement Planning Tools

Simple calculators are a great start, but more advanced tools offer deeper insights. Here’s how the different types of **pension planning tools** compare.

| Tool Type | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Simple Calculators | Basic inputs, single projection graph. | Quick, easy to use, great for getting a basic estimate. | Often overly simplistic, requires manual data entry. | Beginners and quick check-ins. |

| All-in-One Dashboards | Account aggregation, net worth tracking, scenario planning. | Holistic view of your finances, uses real-time data. | Often have an upsell for paid advisory services. | Anyone who wants a complete picture of their financial health. |

| Advanced Planners | Detailed tax modeling, Social Security optimization, Roth conversion analysis. | Extremely comprehensive and detailed. | Often have a subscription fee and can be complex. | People within 5-10 years of retirement. |

Common Mistakes to Avoid with Calculators

A calculator is a powerful tool, but it’s only as good as the assumptions you feed it. Avoid these common mistakes.

- Using an Overly Optimistic Rate of Return: Don’t assume your investments will return 12% every year. A more conservative estimate of 6-8% will give you a much more realistic plan.

- Forgetting About Inflation: A million dollars will be worth much less in 30 years. Ensure your calculator is accounting for a historical average inflation rate of around 3%.

- Ignoring Fees: High investment fees can decimate your returns. Use a tool that analyzes your fees so you can see their true long-term cost.

- Treating the Output as Gospel: A calculator provides a projection, not a guarantee. It’s a tool to help you plan, not a perfect prediction of the future.

- Letting a Bad Result Discourage You: If the calculator shows you’re behind, don’t panic. Use it as a motivator to adjust your plan and increase your savings rate. As experts cited by Google often advise, the best time to start saving was yesterday; the second best time is today.

Expert Tips for Success

Use your **retirement savings calculator** like a pro with these best practices.

- Use a Few Different Calculators: Get a second and third opinion. Using multiple tools can give you a more balanced range of potential outcomes.

- Be Conservative in Your Assumptions: It’s always better to plan for a 6% return and get 8% than the other way around.

- Update Your Plan Annually: Your income, savings, and life goals will change. Re-run your numbers once a year to make sure you’re still on the right path.

- Focus on Your Savings Rate: This is the one variable you have almost complete control over. The single most effective way to improve your retirement outlook is to save more.

“A retirement calculator’s greatest power is its ability to connect your abstract future goals with your concrete daily habits. It shows you, in stark numbers, how the extra $100 you save today can become thousands of dollars in the future.”

– A personal finance author

Frequently Asked Questions (FAQ)

Q: What is the best free retirement savings calculator?

A: There are many excellent free calculators from reputable financial institutions. The Vanguard Retirement Nest Egg Calculator is great for its simplicity and focus on withdrawal strategies. For a more comprehensive view that links all your accounts, Empower’s free dashboard is a powerful option. It’s best to try a few to see which one you find most intuitive.

Q: How much money do I need to retire?

A: This is the classic question, and the answer is highly personal. A common rule of thumb is the ‘4% Rule,’ which suggests you need a nest egg that is 25 times your desired annual retirement income. A good retirement savings calculator will help you determine a more personalized number based on your specific lifestyle, age, and savings.

Q: What is a realistic rate of return to use in a calculator?

A: A conservative and commonly used long-term estimate for the stock market’s average annual return is between 6% and 8%, after accounting for inflation. Using a more conservative number in your calculations can help create a more resilient plan.

Q: Do these calculators account for taxes and Social Security?

A: Most basic calculators do not automatically account for taxes, so you should consider your withdrawals as pre-tax. More advanced calculators and pension planning tools will allow you to input estimated Social Security benefits and model different tax scenarios to give you a more accurate picture of your post-tax retirement income.

Q: How often should I use a retirement savings calculator?

A: It’s a good practice to check in with your retirement plan at least once a year. This allows you to update your savings and income numbers, see your progress, and make any necessary adjustments to your strategy to ensure you stay on track to meet your goals.

Conclusion

The path to a secure retirement starts with understanding your goals, and a retirement savings calculator is an essential first step. Using a retirement savings calculator can help you see exactly where you stand and what you need to reach your target. With a reliable retirement savings calculator, you can turn financial uncertainty into a clear, actionable plan. By taking a few minutes with a retirement savings calculator today, you can start building the retirement you’ve always envisioned.