Introduction

When you start investing for retirement, you’ll encounter two main options: mutual funds and ETFs. Understanding mutual funds vs ETFs helps you make smarter decisions about building a diversified portfolio. By exploring mutual funds vs ETFs, you can see how they differ in costs, tax efficiency, and long-term returns. Using mutual funds vs ETFs as a guide allows you to choose the right investment strategy for your financial goals. Relying on mutual funds vs ETFs ensures your retirement plan is clear, practical, and tailored to your needs.

What Are Mutual Funds and ETFs?

At their core, both mutual funds and ETFs are baskets of investments, and understanding mutual funds vs ETFs makes diversification simpler. By exploring mutual funds vs ETFs, you can own a small piece of many companies with just one purchase. Using mutual funds vs ETFs helps you see the differences in costs, management style, and tax implications. Relying on mutual funds vs ETFs allows you to build a broad-market portfolio efficiently, making it easier to achieve a well-diversified retirement strategy.

The popularity of both fund types has transformed investing, and understanding mutual funds vs ETFs is key to making smart choices. By exploring mutual funds vs ETFs, individual investors gain access to diversified portfolios at low cost. Using mutual funds vs ETFs helps highlight the subtle structural differences that can affect taxes, fees, and returns. Relying on mutual funds vs ETFs allows you to navigate this multi-trillion-dollar trend with confidence and clarity for your retirement strategy.

Why the Choice Matters for Your Retirement

Choosing between a mutual fund and an ETF requires understanding mutual funds vs ETFs and how each affects your long-term growth. By exploring mutual funds vs ETFs, you can see the differences in costs, tax treatment, and flexibility. Using mutual funds vs ETFs allows you to make informed decisions that protect and grow your nest egg. Relying on mutual funds vs ETFs helps ensure your investment strategy aligns with your retirement goals and long-term financial security.

The Critical Impact of Costs

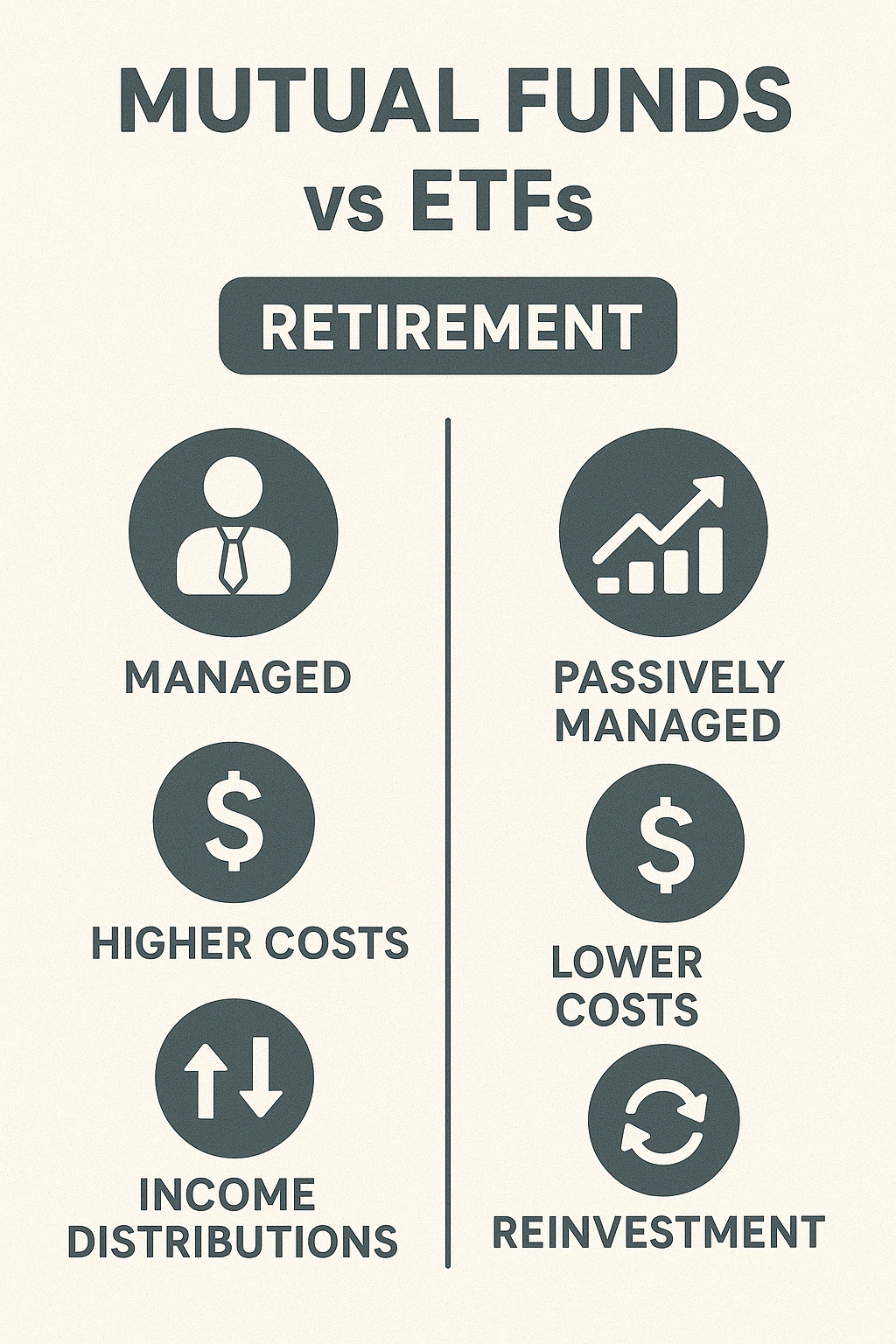

The single biggest factor in your long-term investment success is the amount you pay in fees. While both fund types have become much cheaper, ETFs generally have a slight edge, often carrying lower annual expense ratios than their mutual fund counterparts. Over 30 or 40 years, even a small difference in fees can add up to tens of thousands of dollars.

The Nuances of Tax Efficiency

This is a key differentiator, especially in a regular (taxable) brokerage account. Due to their structure, ETFs are generally more tax-efficient. They tend to generate fewer taxable capital gains distributions, meaning you keep more of your money working for you instead of sending it to the IRS each year.

Ease of Use and Automation

This is where mutual funds often have an advantage, particularly within a 401(k). It’s very easy to set up automatic, recurring investments of a specific dollar amount into a mutual fund. While this is becoming easier with ETFs, the process is often more seamless with mutual funds, which is a key component of successful, hands-off **retirement investment strategies**. For more on planning your future, check out this valuable resource.

How It Works: The Head-to-Head Comparison

Let’s put mutual funds and ETFs side-by-side to compare their key features.

Here’s a breakdown of the core differences:

| Feature | ETFs | Mutual Funds |

|---|---|---|

| Trading | Trade throughout the day on a stock exchange, just like a stock. | Are bought and sold at a single price (the Net Asset Value) at the end of the trading day. |

| Investment Minimum | The price of a single share (often with the option to buy fractional shares). | Often have a minimum initial investment, which can be $1,000 or more. |

| Expense Ratio | Index ETFs are known for their ultra-low fees, often below 0.10%. | Low-cost index mutual funds are competitive, but actively managed funds can be very expensive. |

| Tax Efficiency | Generally more tax-efficient in taxable accounts due to their structure. | Can be less tax-efficient, potentially generating annual capital gains distributions. |

Real-Life Use Case: The Hybrid Approach

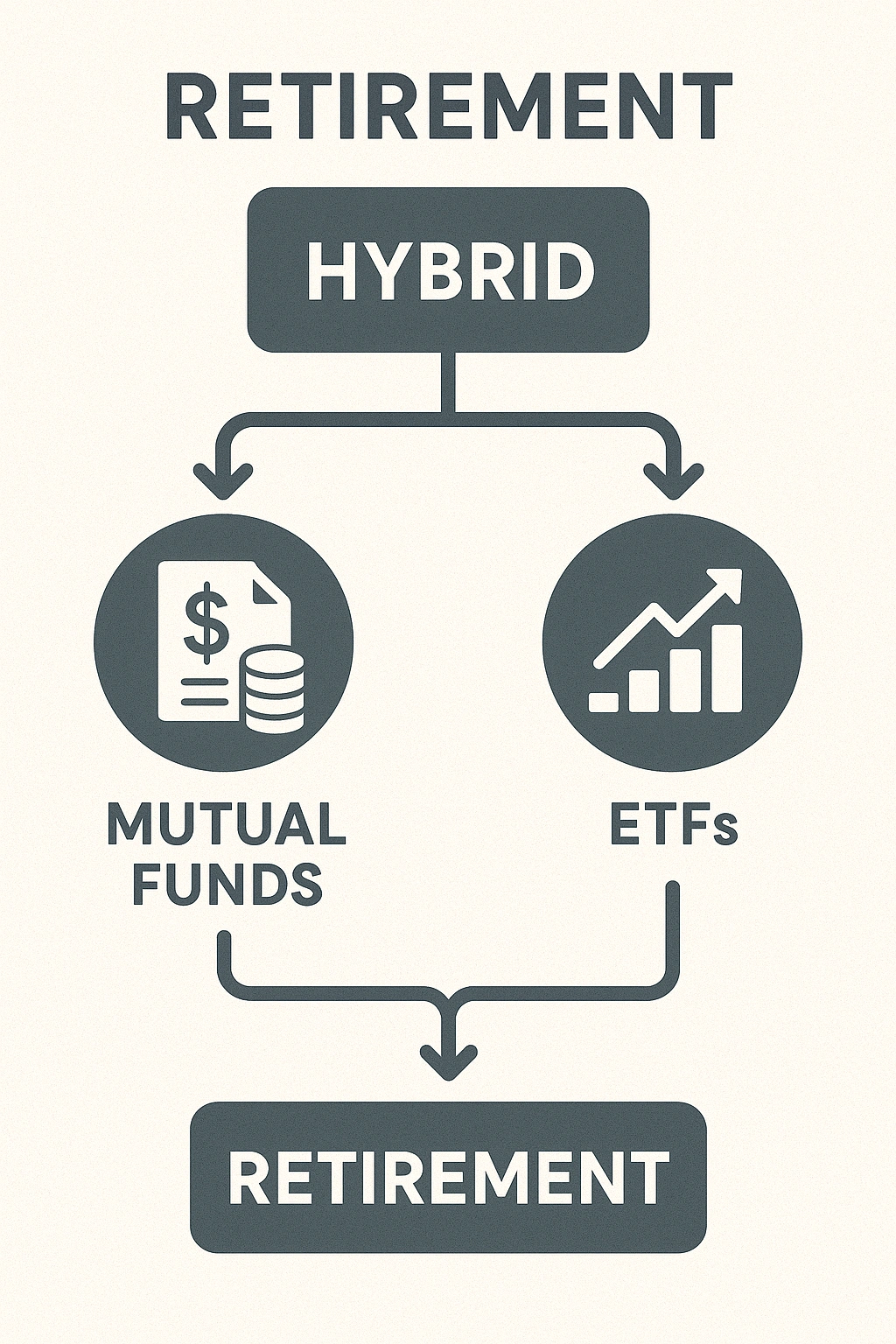

The best strategy often involves using both. Let’s look at a fictional 35-year-old named Maria who is optimizing her retirement savings.

Maria’s employer offers a 401(k) with a great selection of low-cost Vanguard index mutual funds. She contributes 10% of her salary to her 401(k), invested in a Target-Date mutual fund. This process is completely automated. She also has a separate Roth IRA at Fidelity. For this account, she chooses to invest in a portfolio of low-cost ETFs (a total US stock market ETF and a total international stock market ETF). This allows her to take advantage of the slightly lower fees and greater tax efficiency of ETFs for the money she is managing herself.

This hybrid strategy is a perfect example of using the right tool for the right job. She uses the mutual fund for its simplicity and automation within her 401(k) and the ETFs for their cost and tax advantages in her IRA.

Comparing Specific Fund Examples

To make the comparison more concrete, let’s look at two of the most popular S&P 500 index funds from Vanguard: the mutual fund (VFIAX) and the ETF (VOO).

| Feature | Vanguard 500 Index Fund (VFIAX) | Vanguard S&P 500 ETF (VOO) |

|---|---|---|

| Investment Minimum | $3,000 | The price of one share (approx. $480). |

| Expense Ratio | 0.04% | 0.03% |

| Trading | Once per day at the closing price. | Throughout the day on the stock exchange. |

As you can see, both are excellent, low-cost options that track the same index. The ETF is slightly cheaper and has a lower barrier to entry, making it a great choice for a new investor opening an IRA. The mutual fund is the standard, simple option available in millions of 401(k) plans.

Common Mistakes to Avoid

When choosing between these funds, avoid these common mistakes.

- Chasing Actively Managed Mutual Funds: While some active managers beat the market, studies consistently show that the vast majority do not over the long term, especially after accounting for their higher fees. Stick with low-cost index funds.

- Over-Trading ETFs: The ability to trade ETFs all day is a feature, not a requirement. For retirement, a buy-and-hold strategy is almost always the best approach.

- Ignoring the Tax Implications: In a taxable brokerage account, the tax efficiency of ETFs can be a significant advantage. Don’t hold a tax-inefficient mutual fund in a taxable account if an ETF equivalent is available.

- Focusing on Past Performance: Past performance is not an indicator of future results. Choose funds based on their strategy and their costs, not on how well they did last year.

- Not Understanding Your 401(k) Options: Take the time to review the funds available in your 401(k). As financial experts cited by Google often advise, choosing the low-cost index fund option in your plan is one of the most important financial decisions you can make.

Expert Tips for Success

Make the most of your **retirement investment strategies** with these pro tips.

- Prioritize Low Costs Above All Else: This is the one factor you can control, and it has the biggest impact on your long-term returns.

- Use Mutual Funds in Your 401(k): Take advantage of the simplicity and automation of mutual funds within your employer-sponsored plan.

- Use ETFs in Your IRA and Taxable Accounts: Leverage the lower costs and greater tax efficiency of ETFs for the accounts you manage yourself.

- Keep It Simple: A globally diversified portfolio of two or three low-cost index funds is all you need to succeed.

“The great battle of investing is not man versus the market; it’s man versus himself. The simple, automated, low-cost nature of index funds—whether they are ETFs or mutual funds—is the best defense against our own worst instincts.”

– John C. Bogle, Founder of Vanguard

Frequently Asked Questions (FAQ)

Q: For a beginner, are ETFs or mutual funds better for retirement?

A: For a beginner investing in a taxable account or an IRA, low-cost index ETFs are often the better choice due to their lower fees, greater tax efficiency, and lower investment minimums. However, inside a 401(k), low-cost index mutual funds are an excellent and often the only, option available.

Q: What is the main advantage of ETFs over mutual funds?

A: The main advantages of ETFs are typically lower costs (expense ratios), better tax efficiency in taxable accounts (as they tend to generate fewer capital gains distributions), and the ability to be traded throughout the day like a stock.

Q: What is the main advantage of mutual funds over ETFs?

A: The main advantage of mutual funds is the ability to invest a specific dollar amount and the simplicity of automated investing. When you set up automatic contributions from your paycheck to a 401(k), you are typically buying fractional shares of a mutual fund, a process that is seamless and encourages disciplined, hands-off investing.

Q: Does it matter if I choose a mutual fund or an ETF in my 401(k)?

A: Inside a tax-advantaged account like a 401(k), the tax efficiency benefits of ETFs are irrelevant. Therefore, the choice should be based purely on the investment strategy and, most importantly, the expense ratio. A low-cost index mutual fund is an excellent choice within a 401(k).

Q: What are the best retirement investment strategies involving these funds?

A: One of the best strategies is to use low-cost index mutual funds within your 401(k) to get your employer match, and then use low-cost, tax-efficient ETFs in a separate IRA or taxable brokerage account. This approach takes advantage of the best features of both fund types.

Conclusion

The mutual funds vs ETFs debate doesn’t have a single winner because both can be excellent investment tools. Understanding mutual funds vs ETFs helps you choose the right option based on your retirement goals. By exploring mutual funds vs ETFs, you can weigh factors like cost, tax efficiency, and account type to make informed decisions. Using a mutual funds vs ETFs approach allows you to create a simple, low-cost portfolio that supports a secure and confident retirement.