Introduction

What is Long-Term Wealth Management for Retirement?

The stakes are high. A study from the Schwab Retirement Plan Services found that participants believe they need, on average, $1.8 million to retire comfortably. Achieving this requires a forward-thinking plan for **secure retirement finance** that accounts for inflation, market volatility, and healthcare costs.

Why a Proactive Strategy is Non-Negotiable

A structured plan is the bedrock of a worry-free retirement. Here’s why it’s so critical:

Combat Inflation and Longevity Risk

Your retirement could span decades. A plan that doesn’t account for rising costs (inflation) will see its purchasing power erode over time. A proper wealth management strategy ensures your investments continue to grow, staying ahead of inflation and ensuring your money lasts as long as you do.

Create a Sustainable “Retirement Paycheck”

Once you stop working, you need to replace your salary. A distribution plan is designed to convert your nest egg into a reliable, predictable stream of income. This involves a careful balance of selling assets, collecting dividends, and using other income sources to fund your lifestyle without depleting your principal too quickly.

Optimize for Healthcare and Long-Term Care Costs

Healthcare is one of the largest and most unpredictable expenses in retirement. A comprehensive plan incorporates strategies like Health Savings Accounts (HSAs), Medicare planning, and potentially long-term care insurance to ensure medical costs don’t derail your financial security. For more on this, see our guide to financial wellness.

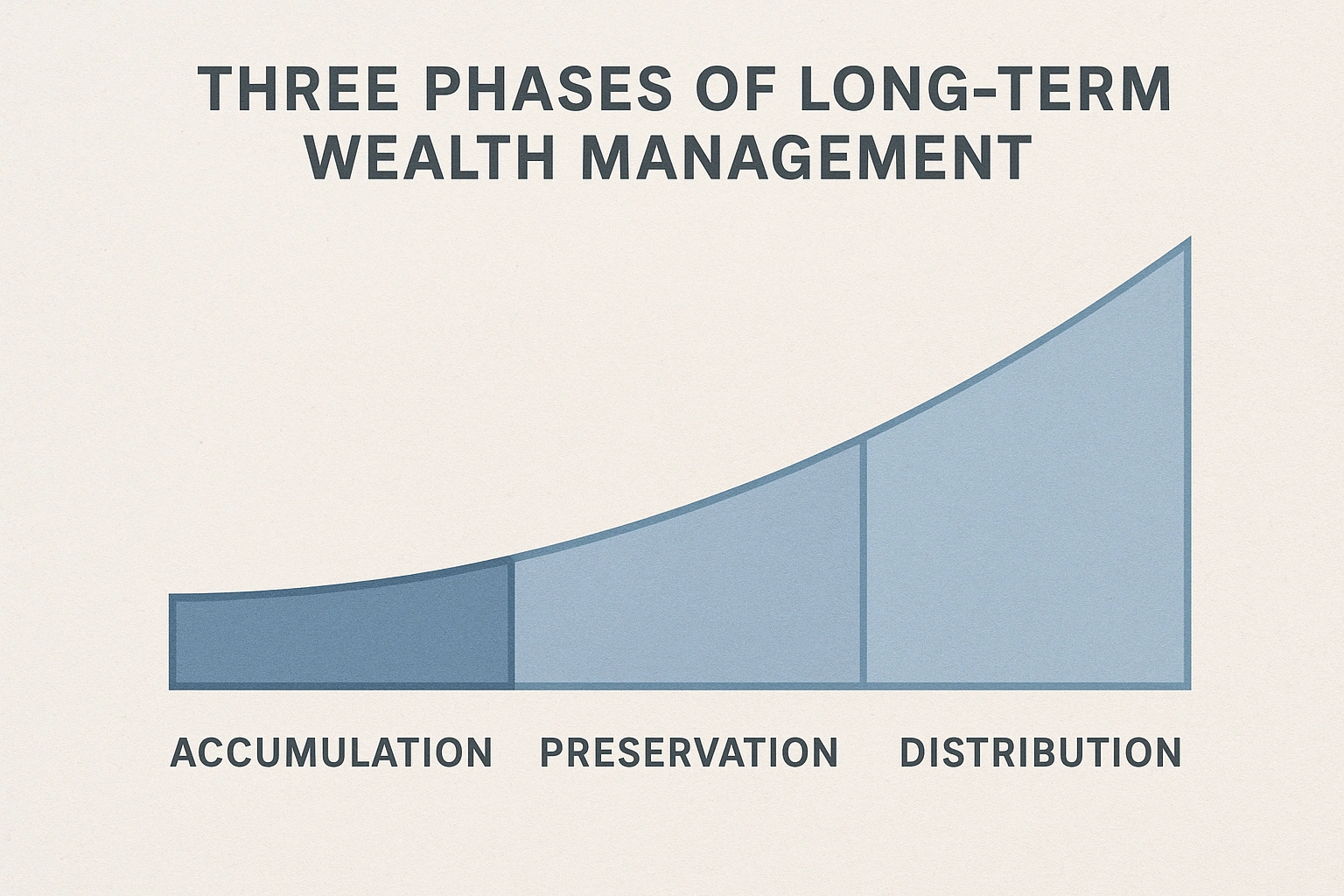

The Three Phases of Retirement Wealth Management

| Phase | Objective | Key Actions |

|---|---|---|

| 1. Accumulation (Age 20s-50s) | Aggressively grow your nest egg. | Maximize contributions to tax-advantaged accounts (401k, IRA), maintain a stock-heavy portfolio, leverage compound growth. |

| 2. Preservation (Age 50s-60s) | Protect your principal from major losses. | Gradually shift to a more conservative asset allocation (more bonds, less stock), build cash reserves, focus on risk management. |

| 3. Distribution (Age 65+) | Create a sustainable income stream. | Establish a systematic withdrawal strategy, optimize for taxes, manage required minimum distributions (RMDs). |

Use Case: The Wilsons’ Retirement Blueprint

John and Mary Wilson, both 60, planned to retire in five years. They had saved diligently but were unsure how to transition their $1.5 million portfolio from growth to income. They were worried about a market crash right before they retired and how to make their money last.

Their wealth advisor helped them implement a “bucket strategy.” They allocated funds into three buckets: Bucket 1 (1-3 years of living expenses in cash/short-term bonds), Bucket 2 (3-10 years of expenses in a balanced bond/stock portfolio), and Bucket 3 (10+ years of expenses in a growth-oriented stock portfolio). This structure gave them peace of mind, knowing their short-term income was safe from market volatility while their long-term funds could continue to grow.

| Factor | Pros of Their Strategy | Cons / Challenges |

|---|---|---|

| Bucket Strategy | Provides psychological comfort by segmenting funds, protects near-term income from market risk, allows for continued long-term growth. | Can be more complex to manage than a single portfolio. Determining the right size for each bucket requires careful planning. |

| Outcome | The Wilsons could retire confidently, knowing they had a clear plan to generate income and weather market downturns. | The plan requires annual reviews to refill the cash bucket and rebalance the other buckets as needed. |

Comparing Retirement Income Strategies

Once you retire, how do you draw down your assets? Here are three popular approaches:

| Strategy | How It Works | Best For |

|---|---|---|

| The 4% Rule | Withdraw 4% of your initial portfolio value in the first year of retirement, then adjust that amount for inflation each subsequent year. | Retirees looking for a simple, straightforward rule of thumb for withdrawals. |

| Bucket Strategy | Segment your portfolio into short-term (cash), mid-term (balanced), and long-term (growth) buckets to align assets with your spending timeline. | Retirees who want to protect their near-term income from market volatility while still growing their long-term assets. |

| Guaranteed Income (Annuities) | Use a portion of your savings to purchase an annuity from an insurance company, which provides a guaranteed paycheck for life. | Risk-averse retirees who prioritize a predictable, guaranteed income stream to cover essential expenses. |

Common Retirement Planning Mistakes to Avoid

- Underestimating Your Lifespan: Planning for retirement until age 85 when you might live to 95. Fix: Plan for a long life. It’s better to have money left over than to run out.

- Ignoring Healthcare Costs: Assuming government programs will cover everything. Fix: Factor in realistic out-of-pocket medical expenses and consider long-term care insurance.

- Claiming Social Security Too Early: Taking benefits at 62 instead of waiting for a larger payout at full retirement age or 70. Fix: Analyze your break-even point and delay claiming if possible to maximize your lifetime benefit.

- Being Too Conservative with Investments: Moving everything to cash too early and letting inflation destroy your purchasing power. Fix: Maintain a balanced portfolio with some allocation to stocks to ensure long-term growth.

- Forgetting About Taxes: Not realizing that withdrawals from traditional 401(k)s and IRAs are taxed as ordinary income. Fix: Work with an advisor to create a tax-efficient withdrawal strategy, utilizing Roth accounts and other vehicles.

Expert Tips & Best Practices

- Stress-Test Your Plan: Use retirement calculators to run simulations of different market scenarios (e.g., a major downturn) to see how your plan holds up.

- Create a Detailed Retirement Budget: Go beyond estimates. Track your spending for a few months to understand your true living costs.

- Plan for the “Go-Go, Slow-Go, and No-Go” Years: Your spending will likely be higher in early retirement (travel, hobbies), then slow down, and potentially rise again later due to healthcare costs.

- Optimize Your Withdrawal Sequence: A common strategy is to withdraw from taxable accounts first, then tax-deferred (Traditional IRA), and finally tax-free (Roth IRA) accounts to maximize tax efficiency.

- “A successful retirement plan isn’t a document; it’s a process,” says retirement expert Dr. Sarah Jenkins. “It requires regular check-ups, just like your health. Review your strategy annually to ensure it’s still aligned with your life, the market, and your long-term goals.”

Frequently Asked Questions (FAQ)

Q: How much money do I actually need to retire securely?

A: There’s no single number, but a common guideline is the ‘4% Rule,’ which suggests you need a portfolio 25 times your desired annual income. So, for an $80,000 annual income, you’d aim for a $2 million nest egg. However, this varies greatly based on your lifestyle, health, and longevity.

Q: What is the biggest financial risk in retirement?

A: Longevity risk—the risk of outliving your money—is arguably the biggest challenge. With increasing life expectancies, a retirement that could last 30 years or more requires a robust long-term wealth management plan that balances growth with capital preservation to ensure your income lasts.

Q: Is it too late to start planning for retirement in my 50s?

A: No, it’s never too late. While starting earlier is better, individuals in their 50s can still make significant progress by maximizing catch-up contributions to retirement accounts, re-evaluating their budget, and potentially planning to work a few years longer. A focused strategy is key.

Q: How should my investment strategy change as I approach retirement?

A: As you near retirement, your strategy should gradually shift from aggressive growth to capital preservation and income generation. This typically involves reducing your allocation to stocks and increasing your holdings in bonds and other lower-risk, income-producing assets to protect your principal.

Q: What role does insurance play in a secure retirement?

A: Insurance is a critical defensive component. Long-term care insurance can protect your assets from being depleted by high healthcare costs, while life insurance can provide for a surviving spouse or cover estate taxes. Annuities can also be used to guarantee a lifelong income stream.

Conclusion

For more data-driven insights into retirement planning, respected sources like the BlackRock retirement institute offer valuable research. Your journey to a secure retirement starts with the decisions you make today.