Introduction

What Are Tax-Advantaged Retirement Accounts?

Why Using These Accounts is a Financial Non-Negotiable

Choosing to save in these accounts versus a standard savings account is one of the most impactful financial decisions you can make.

The Power of the 401(k) Match: Your Guaranteed Return

This is the single most important benefit of a 401(k). Most employers offer a “match,” where they contribute money to your account to match your own contributions, up to a certain limit. This is a 100% return on your investment before your money has even had a chance to grow. It is the closest thing to free money you will ever find.

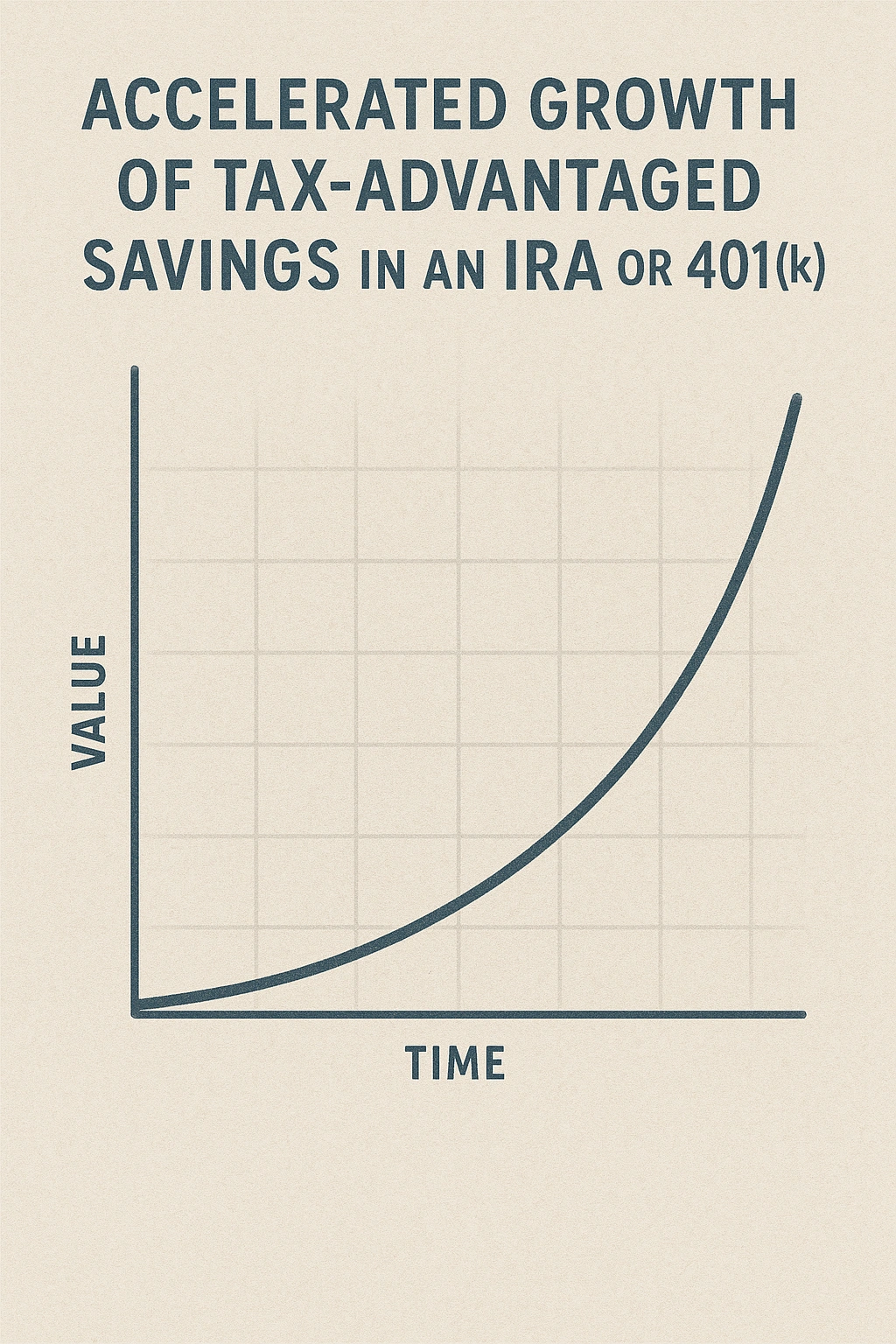

The Magic of Tax-Free Growth with a Roth Account

With a Roth IRA or Roth 401(k), you contribute after-tax money. This means that all the future growth and withdrawals from that account in retirement are completely, 100% tax-free. This is an incredibly powerful benefit, especially for young investors who have a long time for their money to grow.

The Flexibility and Control of an IRA

While a 401(k) is a fantastic tool, you are typically limited to a small menu of investment options chosen by your employer. An IRA, on the other hand, is an account you open yourself at a brokerage firm. This gives you the freedom to invest in almost any stock, bond, or fund you choose, allowing you to build a portfolio of ultra-low-cost investments. For more on planning your future, check out this valuable resource.

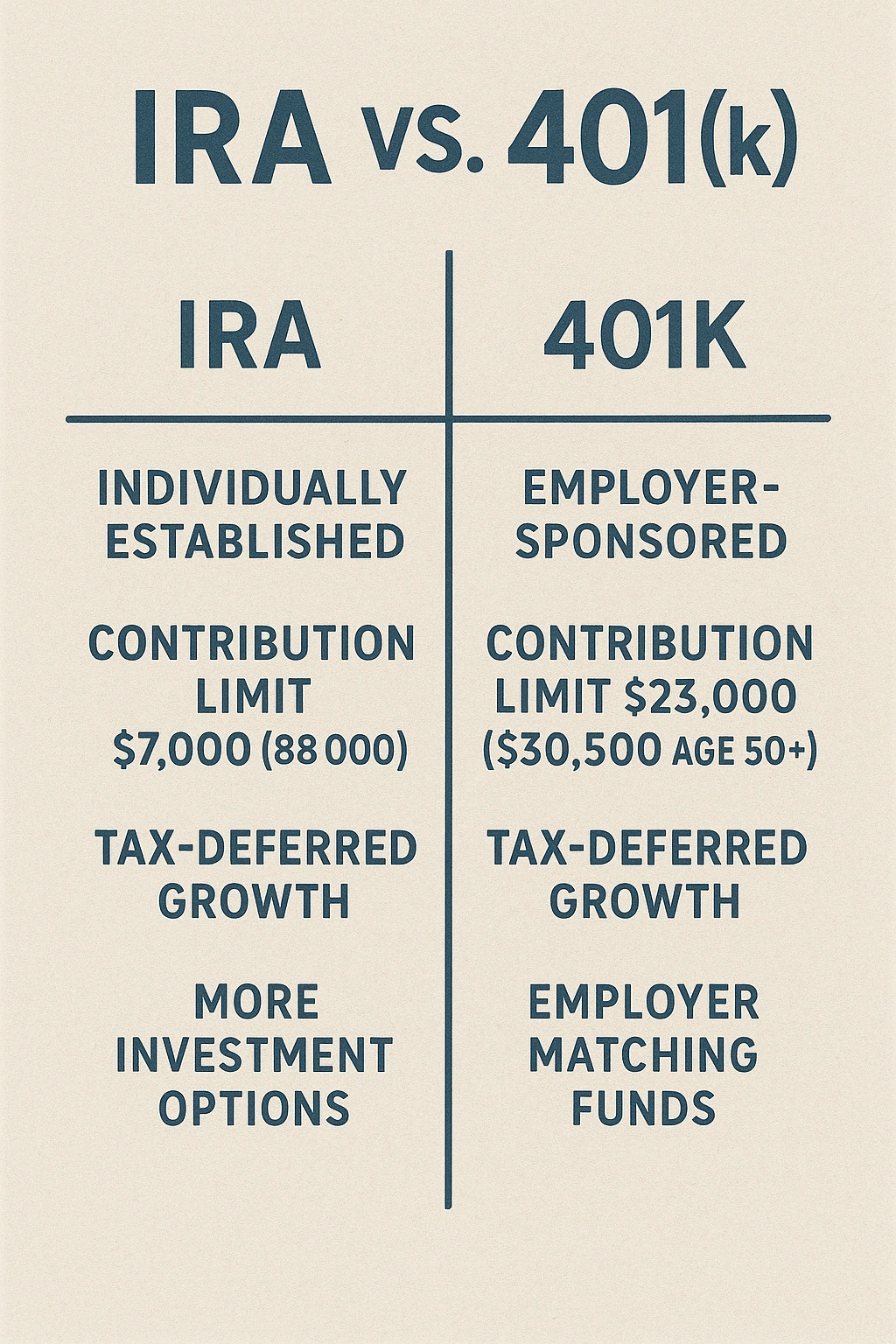

The Head-to-Head Comparison: 401(k) vs. IRA

Let’s put the 401(k) and the IRA side-by-side to understand their key differences.

Here’s a breakdown of the core features:

| Feature | 401(k) | IRA |

|---|---|---|

| How You Get It | Through your employer. | You open it yourself at a brokerage firm. |

| Contribution Limit (2025) | $23,000 (plus a catch-up for age 50+). | $7,000 (plus a catch-up for age 50+). |

| Employer Match | Often available. This is its biggest advantage. | Not available. |

| Investment Options | Limited to a small menu of funds chosen by your employer. | Virtually unlimited. You can invest in almost any stock, bond, or fund. |

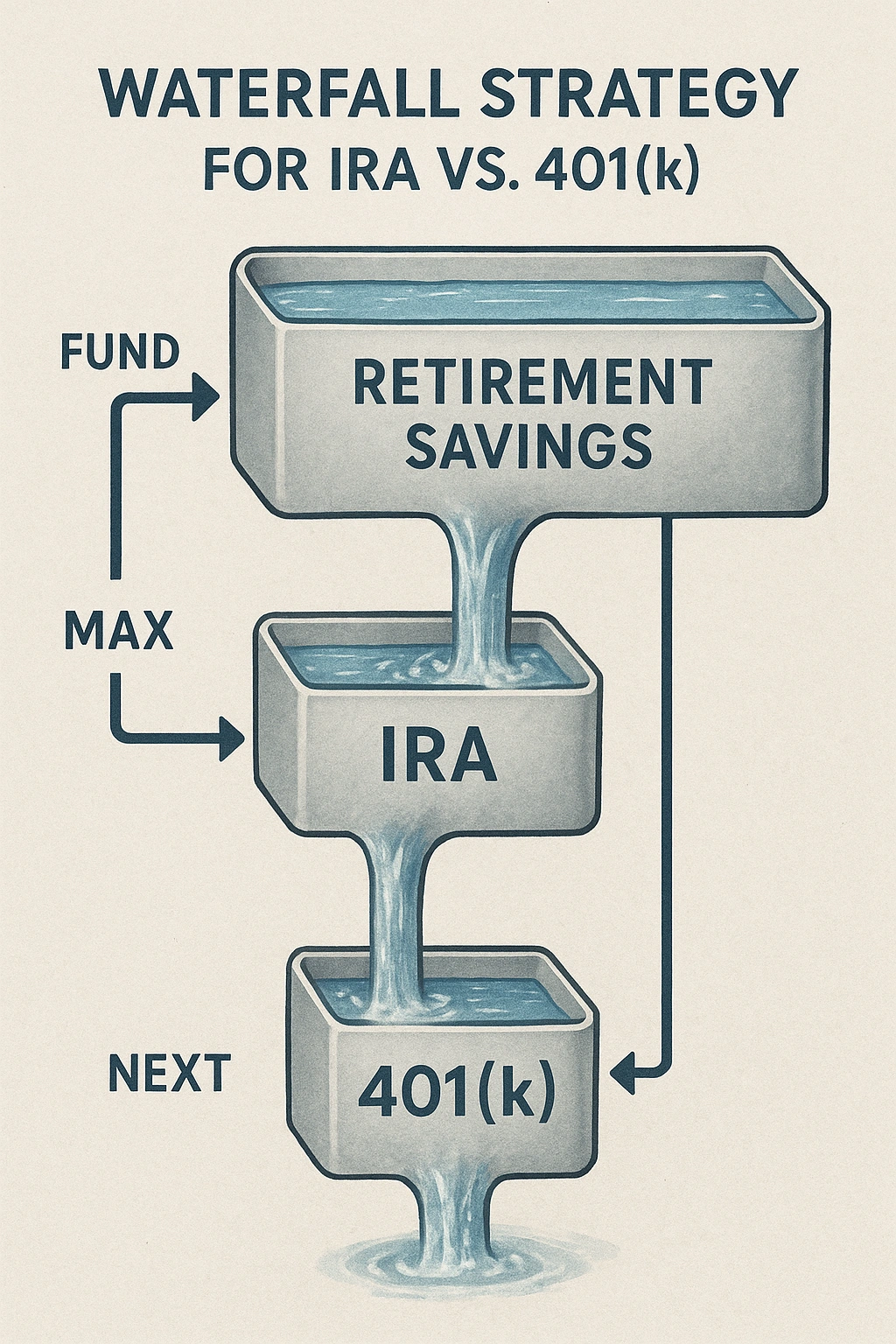

Real-Life Strategy: Using Both to Maximize Your Savings

The smartest strategy is not to choose one over the other, but to use them together. Let’s look at a common and effective strategy for a young professional named Ben.

Ben earns $60,000 a year, and his company offers a 401(k) with a 100% match on contributions up to 4% of his salary. He also wants to save an additional $2,000 a year on his own. He follows a simple “waterfall” approach:

- Step 1: Get the Full Match. Ben sets his 401(k) contribution to 4% of his salary ($2,400/year). His company adds another $2,400, for a total of $4,800.

- Step 2: Fund a Roth IRA. He opens a Roth IRA at a low-cost brokerage and sets up an automatic transfer for his additional $2,000 of savings.

- Step 3: Increase 401(k) Contributions. If he gets a raise or has more to save, he will go back and increase his 401(k) contribution percentage.

This strategy is powerful because it ensures he never leaves the “free money” of the match on the table, while also taking advantage of the superior investment options and tax-free growth of the Roth IRA.

Comparing the Two Flavors: Traditional vs. Roth

Both 401(k)s and IRAs come in two main varieties: Traditional and Roth. The choice between them is one of the most important parts of your **tax-advantaged savings** strategy.

| Feature | Traditional (Pre-Tax) | Roth (After-Tax) |

|---|---|---|

| Tax on Contributions | Contributions are tax-deductible, lowering your taxable income today. | Contributions are made with after-tax dollars (no immediate tax break). |

| Tax on Withdrawals | Withdrawals in retirement are taxed as ordinary income. | Qualified withdrawals in retirement are 100% tax-free. |

| Best For | People who expect to be in a lower tax bracket in retirement. | People who expect to be in a higher tax bracket in retirement (most young professionals). |

Common Mistakes to Avoid

When managing your 401(k) and IRA, avoid these common and costly mistakes.

- Not Getting the Full Match: This is the most expensive mistake you can make. It’s a guaranteed 100% return.

- Ignoring High Fees in Your 401(k): You may be limited in your choices, but always choose the fund with the lowest expense ratio.

- Cashing Out When You Change Jobs: Never cash out your 401(k). Always roll it over.

- Thinking You Earn Too Much for a Roth IRA: If your income is above the limit for direct contributions, you can likely still contribute via the “Backdoor Roth IRA” strategy.

- Letting Your Old 401(k)s Languish: If you have old 401(k)s from previous jobs, consolidate them by rolling them over into a single IRA. As financial experts cited by Google often advise, simplification is key to good financial management.

Expert Tips for Success

Maximize your **tax-advantaged savings** with these pro tips.

- Automate Your Contributions: Set it and forget it. This is the key to consistency.

- Increase Your Contributions Annually: Every time you get a raise, increase your contribution percentage.

- Choose Low-Cost Index Funds: For both your 401(k) and IRA, a simple portfolio of low-cost index funds is the most effective strategy for most people.

- Understand Your Vesting Schedule: Know when your employer’s matching contributions are fully yours to keep.

“Think of your 401(k) as the solid foundation of your retirement house, and your IRA as the custom-designed rooms you build on top of it. You need both to create a complete and comfortable home.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: Which is better for retirement, a 401(k) or an IRA?

A: It’s not a question of which is better, but how to use them together. The best strategy for most people is to first contribute to their 401(k) up to the full employer match. After that, contributing to a Roth IRA is often the next best step due to its tax-free growth and greater investment flexibility. If you can max out both, that’s even better.

Q: What is a 401(k) match and why is it so important?

A: A 401(k) match is when your employer contributes money to your 401(k) to match your own contributions, up to a certain limit. It is the most important part of a 401(k) because it is a 100% return on your investment. Not contributing enough to get the full match is like turning down a guaranteed bonus.

Q: What is the main difference between a Roth and a Traditional account?

A: The main difference is when you pay taxes. With a Traditional 401(k) or IRA, your contributions are pre-tax (reducing your taxable income today), and you pay taxes on withdrawals in retirement. With a Roth 401(k) or IRA, your contributions are after-tax, and your qualified withdrawals in retirement are completely tax-free.

Q: Can I have both a 401(k) and an IRA at the same time?

A: Yes, absolutely. Having both is a very common and powerful retirement strategy. This allows you to take advantage of the employer match in your 401(k) and the greater investment flexibility and potential for tax-free growth in an IRA.

Q: What should I do with my 401(k) when I leave my job?

A: You should almost always perform a ‘rollover.’ This means moving the money from your old 401(k) directly into an IRA that you control, or into your new employer’s 401(k) plan. You should avoid the ‘cash-out’ option, as this will trigger significant taxes and penalties.

Conclusion