Introduction

What Are Free Budgeting Apps?

**Free budgeting apps** are mobile and web-based applications that help you manage your finances at no cost. These are not just simple expense logs; many of these platforms offer robust features that were once reserved for premium software. They can securely link to your bank accounts, automatically categorize your transactions, track your bills, and provide a clear, visual overview of your financial life. These **personal finance tools** are designed to give you the insights you need to take control of your money, regardless of your budget.

The rise of the “freemium” model in the FinTech industry has been a huge win for consumers. As reported by sources like Forbes, many of the top-rated budgeting platforms now offer a free tier that is more than powerful enough for the average user, making smart money management accessible to everyone.

Why Using a Free App is a No-Brainer

Gain Financial Clarity Without a Financial Commitment

The biggest barrier to budgeting is often just getting started. A free app removes that barrier completely. You can get a complete picture of your spending habits and net worth without having to pay a subscription fee, making it a truly risk-free first step.

Build the Habit of Financial Awareness

The simple act of seeing where your money goes each month is often enough to inspire change. A free app automates this process, making it easy to build the habit of checking in on your finances regularly.

Access Powerful Features for Free

You might be surprised by what you can get for free. Many of these apps offer:

- Automatic syncing with your bank accounts.

- Spending categorization and tracking.

- Bill and subscription tracking.

- Net worth calculation.

For more on planning your future, check out this valuable resource.

How It Works: The Core Features of a Free Budgeting App

The best free budgeting apps are built around a few key features designed to provide maximum value without a price tag.

Here’s a breakdown of the essential components:

| Feature | What It Does | Why It’s a Game-Changer |

|---|---|---|

| Bank Synchronization | Securely connects to your bank and credit card accounts to automatically import your transactions. | Eliminates the need for manual data entry, the most tedious part of budgeting. |

| Spending Categorization | Automatically assigns your transactions to categories like “Groceries,” “Transport,” and “Entertainment.” | Gives you an instant, clear picture of where your money is actually going. |

| Financial Dashboard | Provides a single, visual overview of your cash flow, spending trends, and upcoming bills. | Makes it easy to understand your financial health at a glance. |

Real-Life Use Case: A Review of Wave

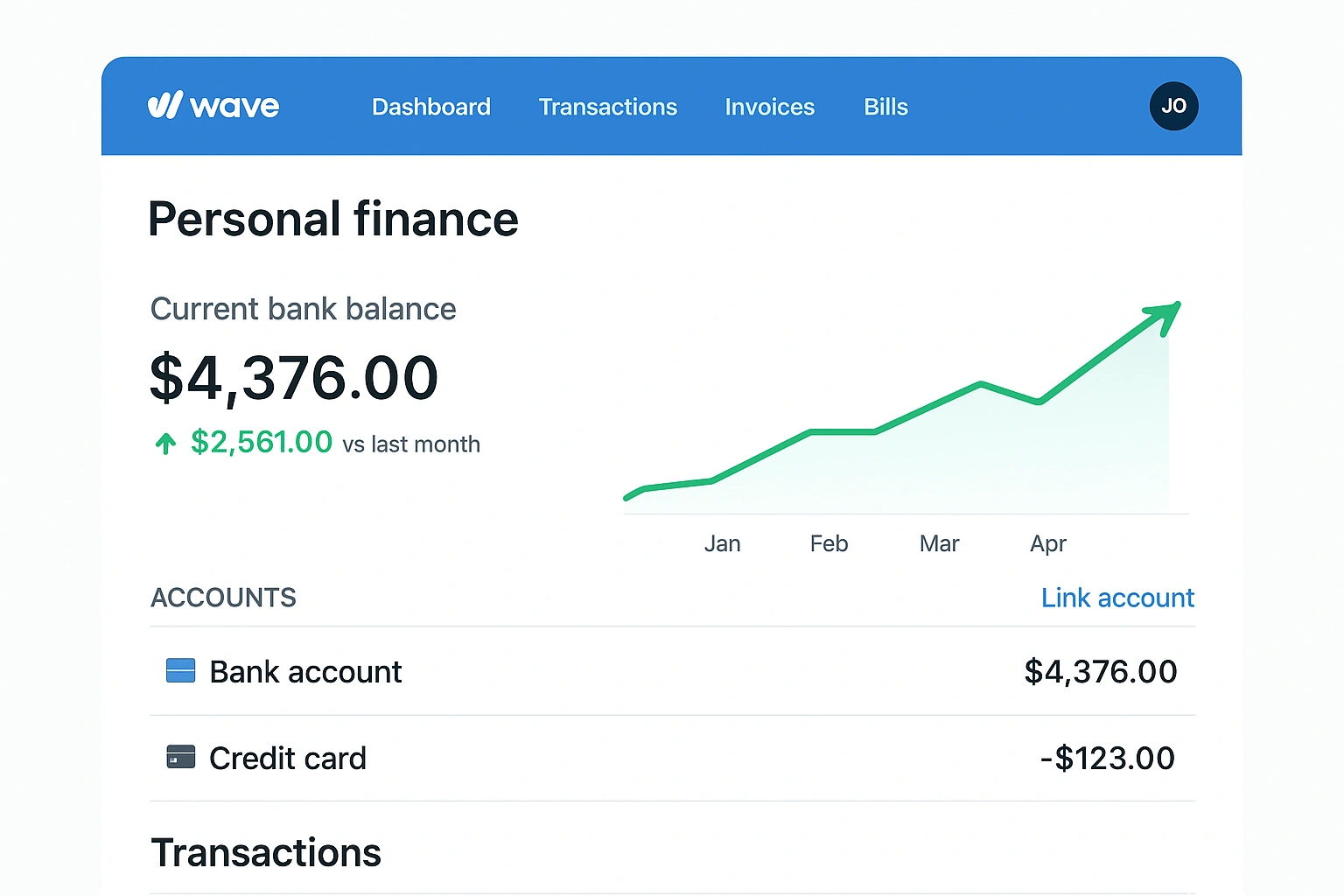

To evaluate a leading **free budgeting app**, particularly for those with side hustles or small businesses, I explored **Wave**. Wave is unique because it offers completely free invoicing and accounting software, which is an incredible value proposition.

The experience was impressive. I was able to create and send a professional-looking invoice in minutes. After connecting a business bank account, Wave automatically imported transactions and made intelligent suggestions for categorizing them as business expenses. The receipt scanning feature in the mobile app was simple and effective for capturing cash expenses on the go. For a freelancer or a small business owner who needs to track income and expenses for tax purposes, Wave provides a powerful suite of tools for an unbeatable price: free.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Truly Free: The core accounting, invoicing, and receipt scanning are completely free. | ❌ Not for Everyone: It’s designed for business finances, so it may be overly complex for personal budgeting. |

| ✅ Unlimited Invoices and Bills: No limits on the core features, which is rare for a free product. | ❌ Makes Money on Payments: They charge a standard processing fee if clients pay invoices via credit card. |

| ✅ Excellent for Tax Time: Makes it easy to generate the reports your accountant will need. | ❌ Mobile App is Limited: The mobile app is primarily for receipt scanning and invoicing, not full accounting. |

Top Free Budgeting Apps for 2025 Compared

Wave is fantastic for freelancers, but other apps are better suited for personal and family budgeting. Here’s how the top **free budgeting apps** compare.

| App | Key Free Feature | Best For |

|---|---|---|

| Empower Personal Dashboard | Holistic net worth and investment tracking. | Getting a complete, 360-degree view of your finances. |

| Rocket Money | Automated spending and subscription tracking. | Beginners who want to quickly find and cut expenses. |

| Wave | Free invoicing and accounting. | Freelancers and small business owners. |

| Honeydue | Shared accounts and bill tracking for couples. | Couples who want to manage their finances together. |

Common Mistakes to Avoid with Free Apps

Free is great, but it’s important to be a savvy consumer. Avoid these common mistakes.

- Ignoring the Business Model: Understand how the app makes money. Is it through premium upsells, payment processing, or offering other financial products? A clear business model is a sign of a reputable company.

- Not Checking the Security: Ensure the app uses bank-level encryption and a trusted service like Plaid to link to your accounts.

- Getting Frustrated by Limitations: A free app won’t have every feature. Understand the limitations of the free tier and don’t get frustrated if you hit a paywall for an advanced feature.

- Forgetting to Actually Budget: Tracking your spending is only the first step. You need to use that information to create a proactive plan for your money.

- Giving Up: The first month of budgeting is always the hardest. Stick with it for at least three months to build the habit and see the real benefits. As experts cited by Google often advise, consistency is the key to financial success.

Expert Tips for Success

Get the most out of your **personal finance tools** with these pro tips.

- Start with a “No-Budget Budget”: For the first month, don’t try to change anything. Just let the app track your spending to get an honest baseline.

- Pick One Category to Improve: Don’t try to overhaul your entire life at once. Pick one area where you’re overspending (like dining out) and focus on cutting back there first.

- Automate Your Savings: Use the insights from your app to “find” money in your budget, then set up an automatic transfer to your savings account.

- Have a Weekly “Money Minute”: Spend 15 minutes each week reviewing your spending. This small habit will keep you engaged and on track.

“A budget is telling your money where to go instead of wondering where it went. A free budgeting app is the simplest, most accessible tool to start that conversation.”

– A leading personal finance expert

Frequently Asked Questions (FAQ)

Q: What is the best free budgeting app overall?

A: For an overall view of your finances, including investments, Empower Personal Dashboard is the best free tool. For pure, hands-on budgeting, Wave is an excellent choice with free invoicing and accounting. For simple spending tracking, the free version of Rocket Money is also very powerful.

Q: How do free budgeting apps make money?

A: Free budgeting apps typically make money in a few ways. Many operate on a ‘freemium’ model, offering a robust free version and then upselling users to a premium plan with more advanced features. Others, like Empower, use their free dashboard as a lead generator for their paid wealth management services.

Q: Are my financial details safe on a free app?

A: Yes, as long as you choose a reputable app. The free apps on this list use bank-level security, including encryption and secure third-party services like Plaid, to link to your accounts with ‘read-only’ access. Your data security is a top priority for these companies.

Q: Can I really get a good budget without paying for an app?

A: Absolutely. The free tools available today are more powerful than the premium software of just a few years ago. You can get automated spending tracking, budget creation, and a clear view of your finances without paying a monthly fee.

Q: What is the best free budgeting app for couples?

A: Honeydue is specifically designed for couples and is a great free option for managing shared expenses and financial goals together.

Conclusion