Introduction

We’ve all heard the advice: “Don’t put all your eggs in one basket.” In investing, the key to long-term success is to diversify retirement investments. Many retirement savers take unnecessary risks by concentrating their savings, but using strategies to diversify retirement investments helps build a resilient portfolio. By exploring ways to diversify retirement investments and using safe investment tools, you can protect your nest egg from market volatility. Relying on methods to diversify retirement investments ensures a steady, secure path toward a comfortable retirement.

What is Diversification?

In simple terms, to diversify retirement investments means spreading your money across different financial instruments, industries, and regions. By choosing strategies to diversify retirement investments, you reduce the impact of any single underperforming asset on your overall portfolio. Using methods to diversify retirement investments is like building a strong team rather than relying on one superstar. Relying on ways to diversify retirement investments ensures your retirement portfolio remains resilient and able to grow steadily over time.

The importance of strategies to diversify retirement investments has been proven repeatedly. By choosing ways to diversify retirement investments, you create a portfolio that can achieve consistent long-term growth while managing risk. Using methods to diversify retirement investments is especially critical in volatile markets, helping protect your nest egg. Relying on approaches to diversify retirement investments ensures that your retirement plan remains strong, resilient, and well-positioned for the future.

Why Diversification is Your Best Defense

A diversified approach helps you diversify retirement investments and reduces the risk of relying on a single asset. By using strategies to diversify retirement investments, you can balance growth potential with stability. Exploring ways to diversify retirement investments allows you to spread your money across multiple sectors and regions. Relying on methods to diversify retirement investments ensures your portfolio remains resilient and positioned for long-term success.

It Smooths Out the Bumps in the Road

The stock market is volatile; that’s a fact. A diversified portfolio that includes different asset classes (like bonds) can help cushion the blow during market downturns. When stocks are down, high-quality bonds often hold their value or even go up, acting as a stabilizing force for your portfolio.

It Protects You from Single-Company Disasters

Even the most successful companies can fail. If you have all your money in a single stock and that company goes bankrupt, you could lose everything. By owning a broad-market index fund, you own thousands of stocks, so the failure of any one company will have a negligible impact on your overall wealth.

It Allows You to Capture Growth from Around the World

The U.S. stock market is not the only game in town. Some of the world’s most innovative and fastest-growing companies are located in Europe and Asia. A globally diversified portfolio ensures you participate in this growth, no matter where it happens. For more on planning your future, check out this valuable resource.

How to Diversify: The Core Building Blocks

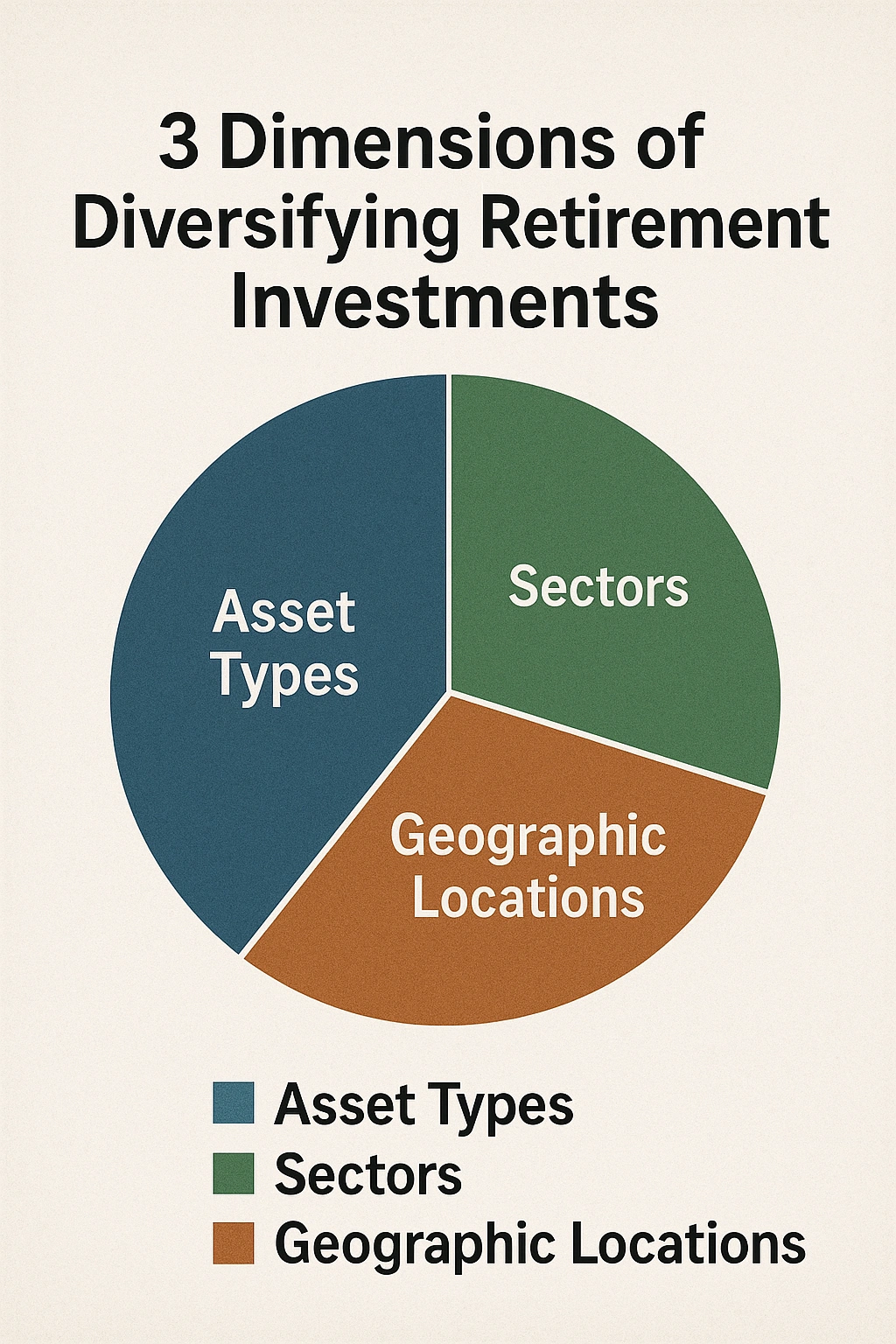

True diversification involves spreading your investments across three key dimensions: asset classes, geography, and industries.

Here’s a breakdown of the essential layers:

| Dimension | What It Means | How to Achieve It |

|---|---|---|

| 1. Across Asset Classes | Owning different types of investments that behave differently in various market conditions. | Holding a mix of stocks (for growth) and bonds (for stability). |

| 2. Across Geographies | Investing in companies based in different countries and regions around the world. | Holding both a U.S. stock fund and an international stock fund. |

| 3. Across Industries | Investing in companies across a wide range of sectors, like technology, healthcare, and consumer goods. | This is automatically achieved by buying a broad-market index fund. |

Real-Life Strategy: The 3-Fund Portfolio

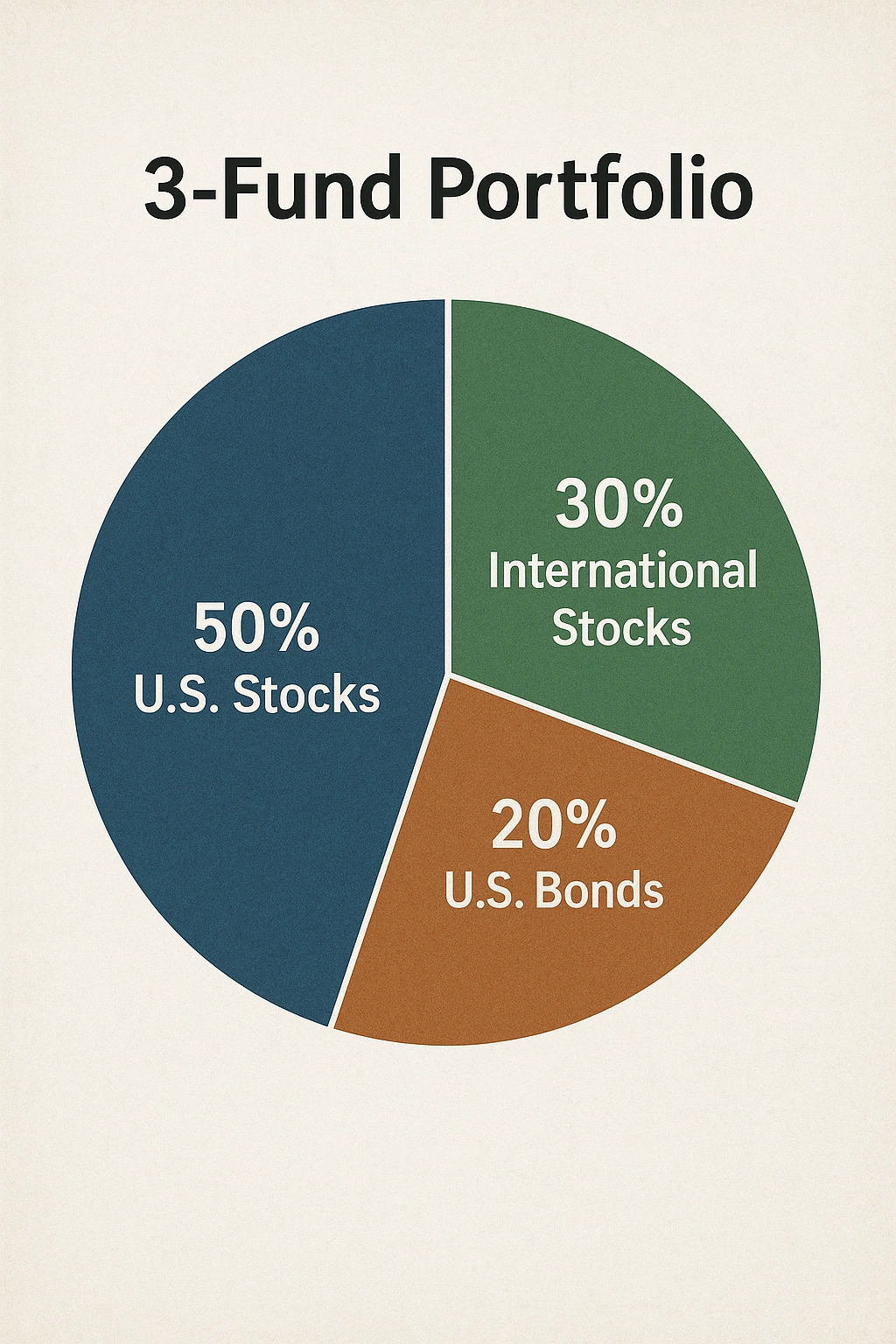

One of the most popular and effective ways to **diversify retirement investments** is the “3-Fund Portfolio.” This strategy, championed by the late Vanguard founder John Bogle, allows you to achieve global diversification with just three simple, low-cost index funds.

The strategy is simple. You invest in:

- A Total U.S. Stock Market Index Fund

- A Total International Stock Market Index Fund

- A Total U.S. Bond Market Index Fund

You then decide on your asset allocation based on your age and risk tolerance. A common rule of thumb is to hold your age in bonds (e.g., a 40-year-old might have 40% in bonds). This strategy is powerful because it’s simple, low-cost, and automatically diversified across thousands of companies and bonds.

Comparing Core Diversification Tools (ETFs)

Here are the core building blocks—the **safe investment tools**—you can use to build your own diversified portfolio.

| ETF Ticker | Asset Class | What It Holds | Role in Portfolio |

|---|---|---|---|

| VTI | U.S. Stocks | The entire U.S. stock market. | The primary engine for long-term growth. |

| VXUS | International Stocks | The entire stock market outside of the U.S. | Provides geographic diversification and captures global growth. |

| BND | U.S. Bonds | A mix of U.S. government and corporate bonds. | Provides stability and reduces volatility during stock market downturns. |

| VNQ | Real Estate (REITs) | A portfolio of U.S. real estate investment trusts. | An optional addition for further diversification into real estate. |

Common Diversification Mistakes to Avoid

True diversification is about more than just owning a lot of different things. Avoid these common mistakes.

- “Diworsification”: Owning too many funds that all hold the same underlying stocks is not diversification. Owning five different U.S. large-cap stock funds is redundant, not diversified.

- Home Country Bias: Many investors put all their money in their home country’s stock market. A truly diversified portfolio has significant international exposure.

- Forgetting to Rebalance: Over time, your best-performing assets will become an oversized part of your portfolio. You need to periodically sell some of your winners and buy more of your losers to get back to your target allocation.

- Confusing a Single Stock with Diversification: Owning stock in a large company like Apple or Amazon is not diversification. You are still exposed to the risks of a single company.

- Ignoring Bonds: Many young investors think they don’t need bonds. While you should have a small allocation when you’re young, bonds play a crucial role in providing stability and are an essential part of a long-term plan. As financial experts cited by Google often advise, a balanced approach is key.

Expert Tips for Success

Implement your diversification strategy like a pro with these best practices.

- Keep It Simple: A 2 or 3-fund portfolio is all you need. Complexity is often the enemy of good returns.

- Automate Your Investments: Set up automatic monthly investments into your chosen funds. This is the key to disciplined, long-term success.

- Use a Target-Date Fund for Ultimate Simplicity: If you want a completely hands-off approach, a single target-date fund will automatically diversify and rebalance for you.

- Rebalance Annually: Pick one day each year—like your birthday—to review your portfolio and rebalance it back to your target allocation.

“Diversification is the only free lunch in investing. It allows you to reduce your risk without necessarily reducing your expected returns. It’s the closest thing to a magic formula that exists.”

– A Nobel Prize-winning economist

Frequently Asked Questions (FAQ)

Q: What is the easiest way to diversify my retirement investments?

A: The easiest way is to invest in a single Target-Date Fund. This one fund automatically holds a diversified mix of U.S. stocks, international stocks, and bonds, and it rebalances for you, becoming more conservative as you approach your target retirement date.

Q: How many stocks or funds do I need to be diversified?

A: You don’t need hundreds of stocks. You can achieve excellent global diversification with as few as 2-3 broad-market index funds or ETFs (e.g., a U.S. total market fund, an international total market fund, and a bond fund). The goal is broad exposure, not a high number of holdings.

Q: Are bonds a safe investment tool for retirement?

A: Yes, high-quality government and corporate bonds are considered one of the safest investment tools. While they offer lower returns than stocks, they are also much less volatile. Their role in a retirement portfolio is to provide stability and income, especially as you get closer to retirement.

Q: What does it mean to ‘rebalance’ my portfolio?

A: Rebalancing is the process of periodically buying or selling assets in your portfolio to maintain your original desired asset allocation. For example, if stocks have a great year and now make up too much of your portfolio, you would sell some stocks and buy some bonds to get back to your target mix. It’s a disciplined way to manage risk.

Q: Should I diversify with cryptocurrency or other alternative investments?

A: For the vast majority of retirement investors, it’s best to stick with traditional asset classes like stocks and bonds. While alternative investments like cryptocurrency can offer high returns, they also come with extreme volatility and risk. They should only be considered for a very small, speculative portion of your portfolio, if at all.

Conclusion

Building a secure retirement doesn’t require you to be a stock market expert; it starts with knowing how to diversify retirement investments. By choosing strategies that diversify retirement investments, you can spread your money across asset classes and regions to reduce risk. Using methods to diversify retirement investments ensures your portfolio remains resilient in market ups and downs. Relying on ways to diversify retirement investments helps you grow your wealth steadily, creating a comfortable and stress-free future.