Introduction

Remember when managing investments meant expensive meetings with a suited advisor in a stuffy office? Those days are quickly being replaced by digital wealth management that brings smarter tools straight to your pocket. The fintech revolution has made digital wealth management accessible, giving you the same advantages once reserved for the ultra-rich. In 2025, digital wealth management platforms can automate investments, optimize taxes, and provide a complete view of your finances. By embracing digital wealth management consistently, you’ll know exactly which tools can help you grow wealth smarter, not harder.

What Are Digital Wealth Management Tools?

Digital wealth management tools, often called “WealthTech,” are software platforms and apps that use technology to provide a wide range of financial services, from automated investing (robo-advisors) to comprehensive financial planning and tracking. They replace or supplement traditional human financial advisors by leveraging algorithms and data analytics to make sophisticated financial strategies accessible and affordable for everyone.

The shift is monumental. According to a report by Wired, fintech is fundamentally disrupting the traditional finance industry by democratizing access. These platforms are no longer just for tech-savvy millennials; they are becoming the standard for modern **online financial planning** across all age groups, offering transparency and control that was previously unimaginable.

Why These Tools are a Game-Changer

Adopting these platforms can fundamentally change your financial trajectory. Here’s why they matter:

Democratize Access to Sophisticated Investing

Previously, strategies like tax-loss harvesting and globally diversified portfolios were only available to high-net-worth clients. Digital tools automate these complex processes, making them standard features for accounts of any size, often with no or very low minimums.

Drastically Lower Costs

Traditional financial advisors often charge 1-2% of assets under management (AUM). Most digital platforms charge a fraction of that, typically between 0.25% and 0.50% AUM, with some even offering free services. Over decades, this cost difference can add up to tens or even hundreds of thousands of dollars in saved fees.

Provide a Holistic, 360-Degree Financial View

The best tools allow you to link all your financial accounts—bank accounts, credit cards, loans, and investments—in one place. This gives you a real-time, comprehensive dashboard of your net worth, spending habits, and progress toward your goals. For more on goal setting, check out our guide to financial goals.

Core Features of Top Digital Wealth Tools

While platforms vary, the best ones share a common set of powerful features.

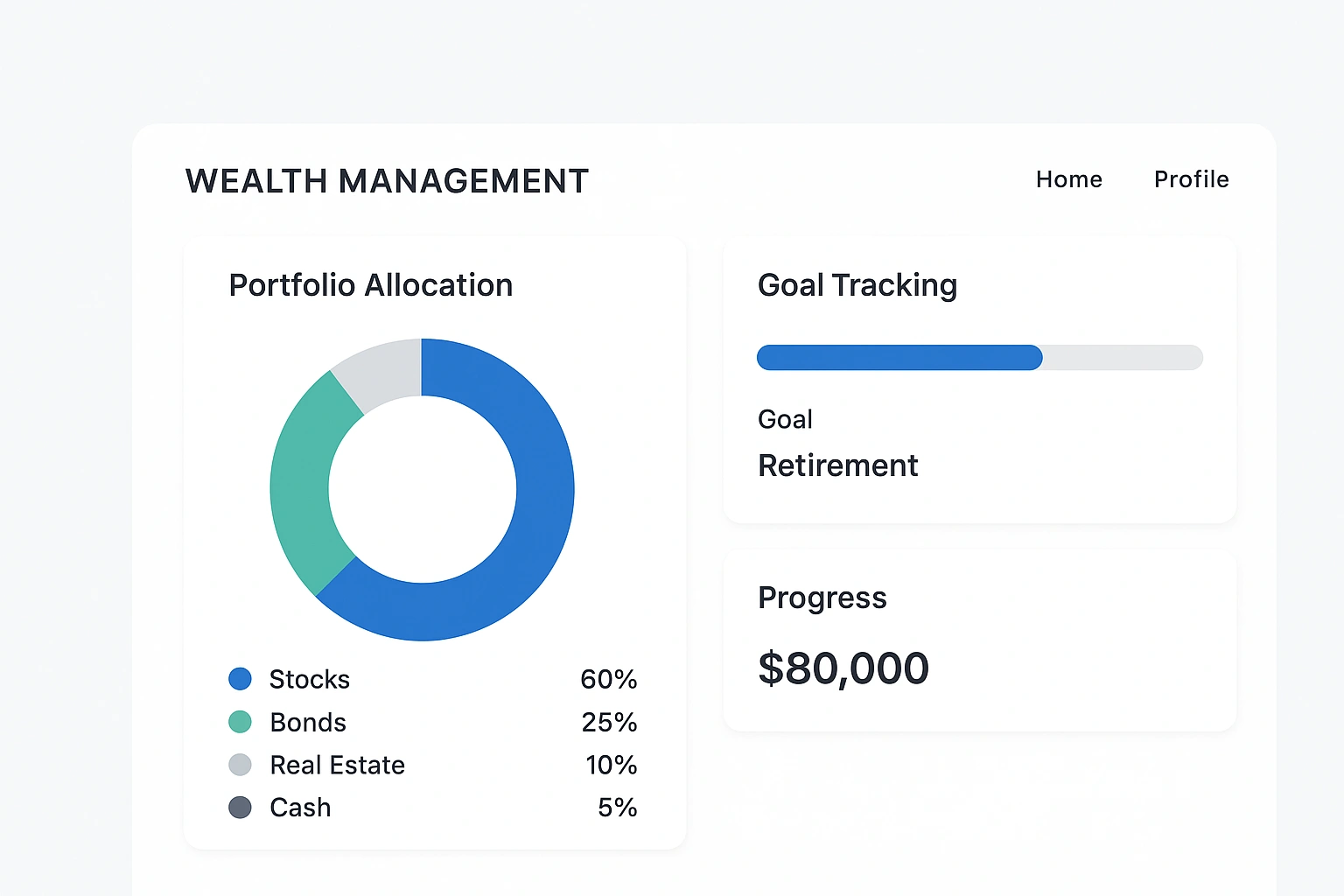

- Automated Investing (Robo-Advisors): Based on your risk tolerance and goals, these tools build and manage a diversified portfolio of low-cost ETFs for you.

- Automatic Rebalancing: The platform automatically buys or sells assets to maintain your desired portfolio allocation, ensuring you don’t become over-exposed to one area.

- Tax-Loss Harvesting: An advanced, automated strategy that sells losing investments to offset capital gains taxes, potentially boosting your after-tax returns.

- Financial Goal Setting & Tracking: Create specific goals (e.g., retirement, buying a house) and track your progress with clear projections and recommendations.

- Account Aggregation: A dashboard that syncs all your financial accounts to give you a real-time view of your complete financial picture.

Review: How “Empower” (Personal Capital) Works

Let’s look at a real-world example. Empower (formerly Personal Capital) is a leading platform that exemplifies the power of digital wealth management. It offers a free financial dashboard that aggregates all your accounts, showing you a detailed breakdown of your net worth, cash flow, and budget.

Its standout features are the Retirement Planner and Investment Checkup tools. The Retirement Planner runs thousands of simulations to show your probability of success, while the Investment Checkup analyzes your portfolio for hidden fees and improper diversification. For clients with over $100k, it offers a paid advisory service that combines its powerful technology with a dedicated human financial advisor.

| Factor | Pros | Cons |

|---|---|---|

| Free Tools | Excellent free dashboard, powerful retirement and fee analyzers, provides a holistic financial view. | The free version does not include automated investing (robo-advisor). Users may receive sales calls for the paid service. |

| Paid Service | Combines technology with dedicated human advisors, tax optimization strategies, and personalized advice. | Higher advisory fees (0.89% starting) and a $100,000 minimum compared to pure robo-advisors. |

Comparison of Top Digital Wealth Management Tools in 2025

Choosing the right tool depends on your specific needs. Here’s a breakdown of the leaders:

| Tool | Key Features | Best For |

|---|---|---|

| Betterment | Goal-based investing, tax-loss harvesting, fractional shares, access to human advisors (premium). | Beginners and goal-oriented investors who want a simple, effective robo-advisor. |

| Wealthfront | Advanced tax-loss harvesting, direct indexing (for large accounts), automated financial planning. | Investors focused on maximizing after-tax returns with a purely digital experience. |

| Empower | Best-in-class free financial dashboard, retirement planner, fee analyzer, hybrid advisor model. | Individuals who want a complete, 360-degree view of their finances and a hybrid digital/human advice model. |

| SoFi Invest | Active and automated investing, fractional shares, crypto trading, access to human advisors for free. | Investors looking for an all-in-one platform that combines banking, loans, and investing with free access to advisors. |

Common Mistakes to Avoid With Digital Tools

- Chasing Performance: Constantly switching platforms based on short-term returns. Fix: Choose a platform that aligns with your long-term philosophy and stick with it. Consistency is key.

- Ignoring the Underlying Investments: Not understanding what ETFs your portfolio is invested in. Fix: Take 30 minutes to read about the core ETFs in your portfolio to understand the diversification you have.

- Setting and Forgetting Completely: Automation is great, but your life changes. Fix: Review your goals and risk tolerance on the platform annually or after a major life event.

- Misunderstanding Fees: Assuming “free” means no costs at all. Fix: Understand the platform’s advisory fee and the expense ratios of the underlying ETFs.

- Panicking During Market Downturns: The ease of access can make it tempting to sell when the market drops. Fix: Trust the automated process. These platforms are designed for long-term investing, and panic selling is almost always a mistake.

Expert Tips & Best Practices

- Start with the Dashboard: Before committing money, use a free tool like Empower or Copilot Money to aggregate your accounts and get a clear financial picture.

- Automate Your Savings: Set up automatic, recurring deposits into your investment account. This enforces discipline and takes advantage of dollar-cost averaging.

- Understand the “Why” Behind the Algorithm: Know your risk score and why the platform chose your specific asset allocation.

- Leverage Hybrid Models for Complex Needs: If your finances are complex, choose a platform that offers access to human CFPs for periodic check-ins.

- “The best tool is the one you’ll actually use consistently,” says fintech analyst Mark Chen. “Don’t get paralyzed by choice. Pick a reputable, low-cost platform, set up automatic contributions, and let the technology do the heavy lifting for you. The power is in automation and consistency.”

Frequently Asked Questions (FAQ)

Q: Are digital wealth management tools safe?

A: Reputable digital wealth management platforms use bank-level security, including two-factor authentication and encryption, to protect your data. Investment accounts are also typically SIPC insured up to $500,000, which protects you against the failure of the brokerage firm.

Q: What is the difference between a robo-advisor and a digital wealth platform?

A: A robo-advisor primarily focuses on automated investing based on algorithms. A comprehensive digital wealth management platform often includes a robo-advisor but also adds features for budgeting, net worth tracking, and holistic online financial planning, sometimes with access to human advisors.

Q: How much money do I need to start using these tools?

A: One of the biggest advantages of digital tools is their accessibility. Many platforms, like SoFi Invest or Betterment, have no minimum investment requirement, allowing you to start with as little as $1. This lowers the barrier to entry for professional-grade investment management.

Q: Can these tools replace a human financial advisor?

A: For many people with straightforward financial goals, digital tools can be a sufficient and cost-effective solution. However, for those with highly complex situations (like owning a business or intricate estate planning needs), a hybrid approach that combines digital tools with a human advisor is often the best strategy.

Q: What is tax-loss harvesting?

A: Tax-loss harvesting is an automated strategy offered by many robo-advisors. It involves selling an investment that has experienced a loss to offset taxes on both capital gains and income. The tool then typically reinvests the money in a similar, but not identical, asset to maintain your portfolio’s balance.

Conclusion

The rise of WealthTech has permanently transformed personal finance, making digital wealth management more accessible than ever. With digital wealth management, high-quality advice and low-cost solutions are within reach for anyone seeking smarter control of their money. The most effective digital wealth management platforms provide automation, transparency, and a complete view of your assets. By adopting digital wealth management consistently, you can strengthen your financial foundation and achieve long-term goals with greater efficiency.

To stay updated on the latest fintech innovations, authoritative sources like TechCrunch offer excellent coverage. The first step is the most important—start exploring these tools today.