Introduction

What Are Budgeting Apps with Investment Features?

This integrated approach is the future of personal finance. The FinTech industry is rapidly moving towards providing consumers with a holistic view of their financial health. As reported by leading tech publications like Wired, the demand for all-in-one financial platforms is surging as people seek simplicity and clarity in an increasingly complex financial world.

Why a Holistic Financial View is a Game-Changer

Connect Your Daily Habits to Your Long-Term Goals

This is the most powerful benefit. An integrated app makes the connection between your daily spending and your future wealth tangible. You can see, in real-time, how cutting back on a specific budget category frees up more money to invest, and then see how that investment impacts your projected net worth. It turns abstract goals into concrete actions.

Track the Most Important Metric: Your Net Worth

Your income is not a measure of your wealth. Your net worth—the total of your assets minus your liabilities—is the true measure of your financial progress. These apps are the easiest and most effective way to track this crucial number over time.

Optimize Your Entire Financial Life

By seeing everything in one place, you can spot both problems and opportunities that would otherwise be hidden.

- Identify high-fee investment funds that are dragging down your returns.

- Spot high-interest debt that should be a priority to pay off.

- Ensure you have a proper asset allocation across all your investment accounts combined.

For more on planning your financial future, check out this valuable resource.

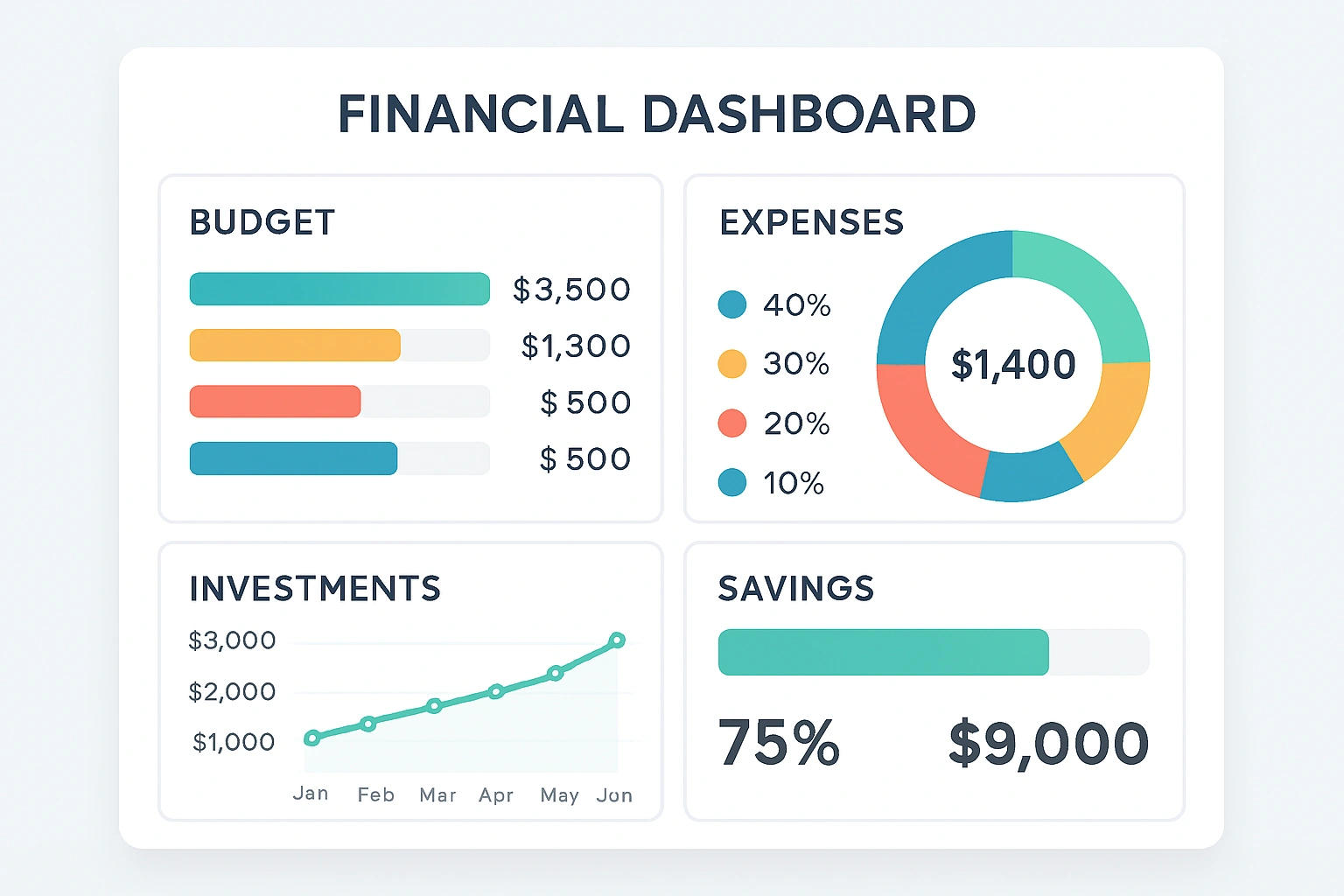

How It Works: The Core Features of an All-in-One App

These powerful apps are built on a foundation of secure data aggregation and intelligent analysis.

Here’s a breakdown of the essential components:

| Feature | What It Does | The Key Benefit |

|---|---|---|

| Holistic Account Aggregation | Securely links all your financial accounts into a single dashboard. | Provides a complete and accurate view of your entire financial life. |

| Net Worth Tracker | Calculates your real-time net worth by subtracting your debts from your assets. | The single best metric for tracking your long-term financial progress. |

| Budgeting and Spending Analysis | Tracks and categorizes your spending to show you where your money is going. | Helps you identify areas where you can save more to invest. |

| Investment and Retirement Planning | Analyzes your portfolio for fees and diversification, and projects your retirement readiness. | Ensures your savings are working hard for your future. |

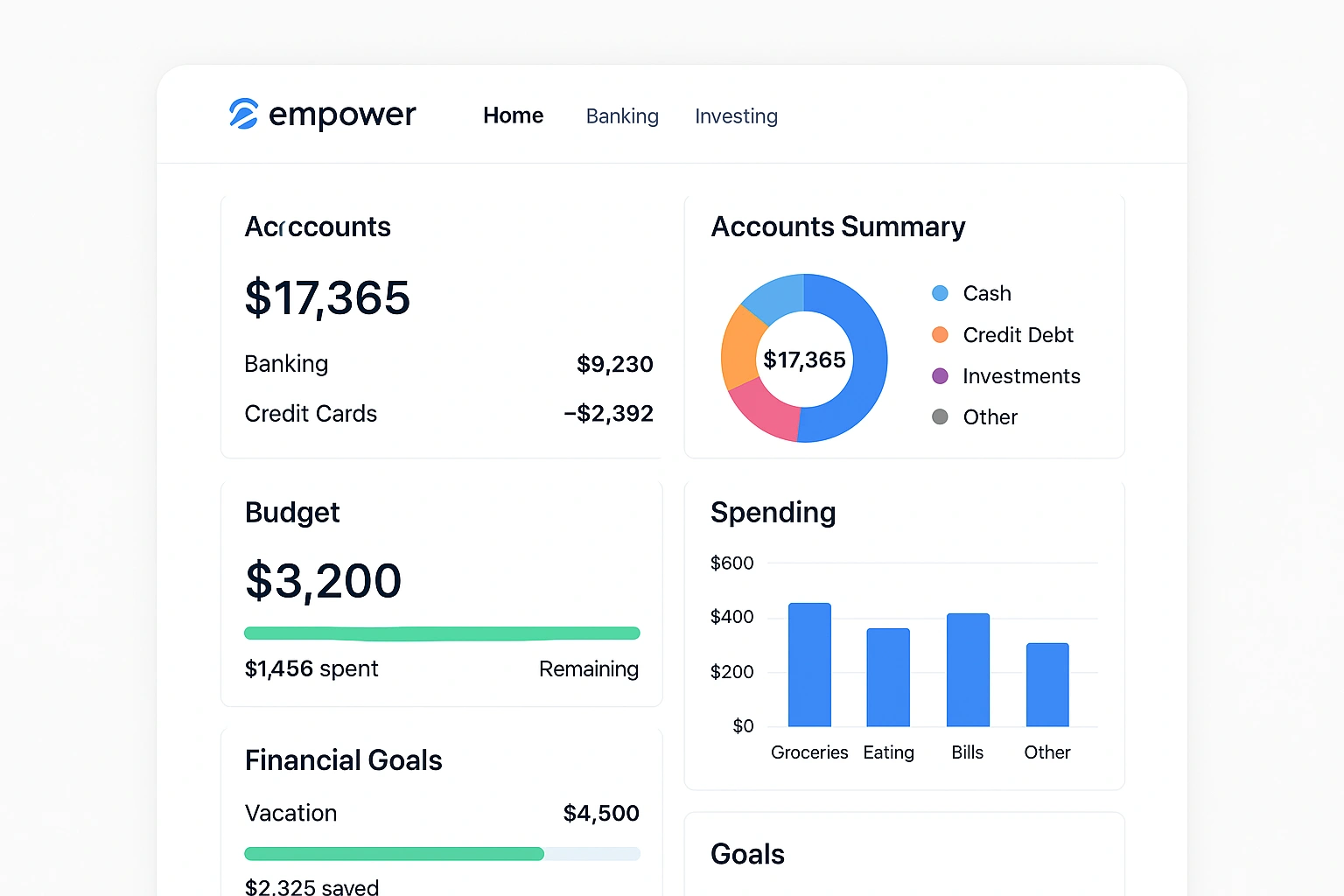

Real-Life Use Case: A Review of Empower Personal Dashboard

To evaluate a leading **budgeting app with investment** features, I used **Empower Personal Dashboard (formerly Personal Capital)**. This platform is widely considered the best free tool for getting a holistic view of your finances.

The experience was a true eye-opener. After linking my various accounts—from my checking account to my 401(k)—the app presented me with a single, powerful number: my net worth. Seeing it all in one place was incredibly motivating. The budgeting tools were great for tracking my monthly cash flow, but the real power was in the “Retirement Planner” and “Fee Analyzer.” The app showed me that the fees in my old 401(k) were projected to cost me over $100,000 in growth by retirement. This single insight prompted me to roll over the account into a low-cost IRA, a move that will have a massive impact on my future.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Powerful Free Tools: The dashboard, analyzers, and planners are all free to use. | ❌ Upsell for Advisory Services: The company uses the free tools as a lead generator for its paid wealth management. |

| ✅ Excellent for Investment Tracking: The retirement planner and fee analyzer are best-in-class. | ❌ Budgeting Tools are Basic: It’s more focused on tracking past spending than proactive, zero-based budgeting. |

| ✅ Holistic Financial View: Unmatched for seeing your entire net worth in one place. | ❌ Occasional Account Sync Issues: Like all aggregators, it can sometimes have trouble connecting to certain institutions. |

Top Budgeting Apps with Investment Features Compared

Empower is a fantastic free tool, but other platforms offer different features and budgeting philosophies. Here’s how the top all-in-one **financial planning software** options compare.

| App | Key Feature | Pros | Cons | Best For |

|---|---|---|---|---|

| Empower Personal Dashboard | Holistic net worth and retirement tracking. | Best free tool for a complete view of your finances. | Budgeting tools are more for tracking than planning. | Investors who want a free, powerful financial dashboard. |

| Monarch Money | Modern interface, collaborative tools for couples, goal setting. | Great for couples, strong investment tracking and goal features. | It is a premium, subscription-only tool. | Couples and families who want a premium all-in-one tool. |

| Copilot Money | AI-powered categorization and a beautiful, modern interface. | Sleek design, intelligent insights, great for Mac and iPhone users. | Subscription-only and currently only available on Apple devices. | Design-conscious Apple users who want a smart, automated experience. |

| YNAB (You Need A Budget) | Proactive, zero-based budgeting method. | The best tool for gaining intentional control over your spending. | Investment tracking is a newer, less robust feature. | Hands-on budgeters who prioritize cash flow management. |

Common Mistakes to Avoid

An all-in-one app is powerful, but it’s only as good as the data and habits you bring to it. Avoid these common mistakes.

- Not Linking All Your Accounts: To get a true picture of your net worth, you need to link everything—including your debts like student loans and mortgages.

- Ignoring High Investment Fees: The app can show you that you’re paying high fees, but it can’t make you switch to a lower-cost fund. You need to take action on the insights it provides.

- Focusing Only on Net Worth: While net worth is a great long-term metric, you still need to manage your day-to-day cash flow. Don’t neglect the budgeting features.

- “Set It and Forget It”: You need to actively engage with the app. A weekly check-in is crucial for reviewing your spending and tracking your progress.

- Using a Weak Password: You are linking all of your financial data to one place. It is absolutely critical that you use a long, strong, unique password and enable two-factor authentication. As security experts cited by Google often advise, account security is paramount.

Expert Tips for Success

Use your **budgeting apps with investment** features like a pro with these best practices.

- Schedule a Weekly “Financial Check-In”: Block 15 minutes on your calendar each week to review your dashboard.

- Use the Insights to Create a “Savings Snowball”: Find one area to cut back on, and automate the savings from that cut directly into your investment account.

- Focus on the Big Picture: Don’t get bogged down in categorizing every last transaction perfectly. Focus on the big trends in your spending and your net worth.

- Celebrate Your Milestones: When your net worth crosses a new threshold, take a moment to celebrate your progress!

“An integrated financial app is the ultimate tool for accountability. It forces you to confront the reality of your financial life in one place, which is the necessary first step to changing it for the better.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the best all-in-one budgeting and investing app?

A: Empower Personal Dashboard is widely considered the best free tool for getting a holistic view of your budget and investments. For a premium, paid experience with excellent collaborative features for couples, Monarch Money is a top contender. Copilot Money is another great premium option known for its beautiful design and AI-powered insights.

Q: How does connecting my budget to my investments help me?

A: It connects your daily financial habits to your long-term goals. By seeing in one place how cutting back on a specific spending category can free up more money to invest, you gain a powerful motivation to save. It turns abstract financial goals into concrete, daily actions.

Q: Are these financial planning software apps safe to use?

A: Yes, reputable apps use bank-level security, including 256-bit encryption and secure services like Plaid to link to your financial accounts. This connection is typically ‘read-only,’ meaning the app can see your data but cannot initiate transactions. Always use a strong, unique password and enable two-factor authentication.

Q: Can I actually invest money through these apps?

A: Most of the apps on this list are designed for tracking and analysis, not for placing trades. They aggregate data from your existing brokerage accounts (like Fidelity or Vanguard) to give you a complete picture. However, some robo-advisor apps like Betterment do combine budgeting features with direct investing.

Q: What is a ‘net worth tracker’ and why is it important?

A: A net worth tracker calculates your total financial value by subtracting your liabilities (debts like mortgages and loans) from your assets (cash, investments, property). It is the single most important metric for measuring your financial progress over time, and it’s a core feature of the best budgeting apps with investment tracking.

Conclusion