Introduction

What Are Budgeting Apps for Couples?

Why a Shared Budgeting App is a Relationship Game-Changer

Using an app designed for couples is about more than just tracking numbers; it’s about building a stronger partnership.

Eliminate Financial Secrets and Build Trust

A shared dashboard creates complete transparency. Both partners can see every transaction, every bill, and every savings goal in real-time. This eliminates misunderstandings and builds a foundation of trust and open communication around money.

Work Together Towards Shared Dreams

It’s much easier to save for a big goal when you’re working as a team. These apps allow you to create and track shared goals, turning saving into a collaborative and motivating experience.

- Save for a down payment on a house.

- Plan and save for a dream vacation.

- Work together to pay off debt faster.

Reduce Stress and Money Arguments

A shared app replaces arguments based on assumptions with conversations based on data. When you both have access to the same information, it’s easier to have calm, productive discussions about your spending and priorities. For more on planning your future, check out this valuable resource.

How It Works: The Core Features of a Couples Budgeting App

The best family finance apps are built around a few key features designed to facilitate collaboration and transparency.

Here’s a breakdown of the essential components:

| Feature | What It Does | Why It’s a Game-Changer for Couples |

|---|---|---|

| Shared Dashboard | Syncs all your individual and joint accounts into a single, unified view that both partners can access. | Creates a single source of truth for your entire financial life. |

| Joint Goal Setting | Allows you to create shared savings goals and tracks your collective progress towards them. | Turns saving into a fun, collaborative team effort. |

| Bill Tracking and Reminders | Tracks all your upcoming bills and due dates, often allowing you to assign responsibility for each one. | Ensures that no bill ever falls through the cracks. |

| In-App Communication | Many apps include a feature to comment on specific transactions. | Allows you to ask a quick question (“What was this Amazon charge?”) without it turning into a big conversation. |

Real-Life Use Case: A Review of Monarch Money

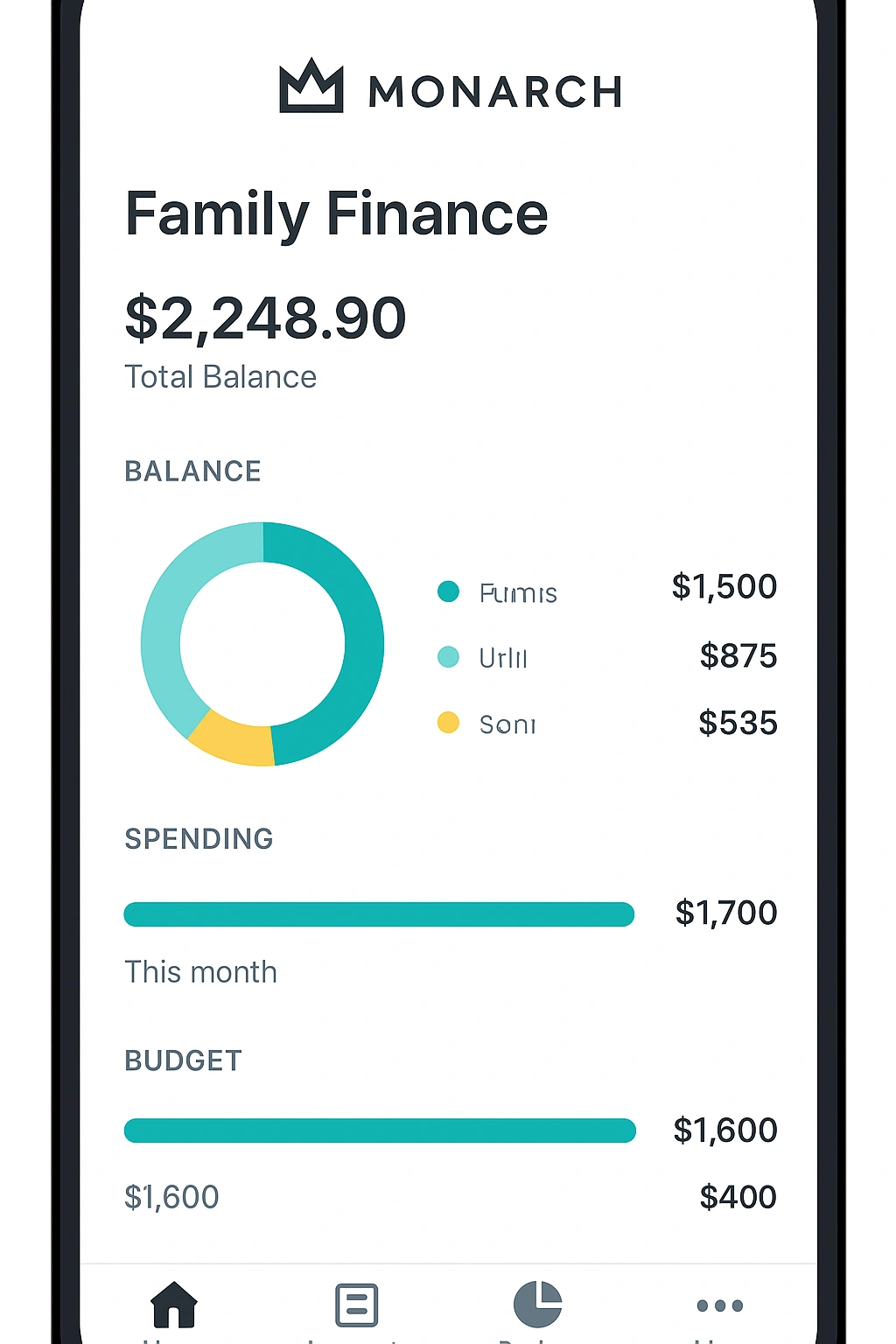

To evaluate a leading **budgeting app for couples**, I used **Monarch Money**. Monarch is a premium tool that is renowned for its beautiful design, powerful features, and excellent collaborative tools.

The experience was fantastic for managing a household’s finances. My partner and I were both able to link our separate accounts as well as our joint accounts, giving us a complete picture of our family’s net worth. The “Goals” feature was a highlight; we created a goal for a family vacation and the app automatically showed us how much we needed to save each month to reach it. The customizable dashboard allowed each of us to see the information that was most important to us. The ability to upload documents, like warranties for appliances, directly to the app was another surprisingly useful feature.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Excellent Collaboration Features: Designed from the ground up for couples and families. | ❌ Subscription-Only: It is a premium tool with no free plan after the initial trial. |

| ✅ Beautiful and Intuitive Interface: The app is a pleasure to use. | ❌ Can Be Expensive: The subscription cost is higher than some other budgeting apps. |

| ✅ Holistic Financial View: Includes robust investment tracking alongside budgeting. | ❌ Newer Than Competitors: It’s a newer player in the market, so it has fewer integrations than a tool like YNAB. |

Top Budgeting Apps for Couples and Families Compared

Monarch is a top-tier premium option, but other apps offer different features and price points. Here’s how the best **family finance apps** compare.

| App | Key Feature | Pros | Cons | Best For |

|---|---|---|---|---|

| Monarch Money | Collaborative dashboard and goal setting. | Powerful all-in-one tool, great design. | Premium subscription model. | Couples who want a premium, all-in-one financial hub. |

| Honeydue | Free collaborative budgeting and bill tracking. | Completely free, designed specifically for couples. | Lacks investment tracking features. | Couples who want a simple, free tool to start. |

| YNAB (You Need A Budget) | “YNAB Together” for shared budgeting. | Excellent for proactive, zero-based budgeting. | Has a steep learning curve and a subscription fee. | Couples who are serious about intentional spending. |

| Empower Personal Dashboard | Free net worth and investment tracking. | Best free tool for a holistic view of your finances. | Budgeting tools are more for tracking than planning. | Couples who are focused on tracking their investments and net worth. |

Common Mistakes to Avoid with Couples Budgeting

An app is just a tool; it can’t fix underlying relationship issues. Avoid these common mistakes.

- Not Having a “Money Date”: You need to set aside regular, calm time to review your budget together. Don’t just talk about money when there’s a problem.

- Forgetting to Set Shared Goals: A budget without a goal is just a list of restrictions. Get excited about what you’re saving for together.

- Being Judgmental: The goal is transparency, not to criticize your partner’s spending. Approach the conversation with curiosity and teamwork.

- Not Allowing for Personal Spending: A successful couples budget includes a “no questions asked” allowance for each partner to spend on their own.

- One Person Doing All the Work: Budgeting should be a team sport. Both partners need to be engaged in the process for it to be successful. As financial experts cited by Google often advise, financial intimacy is a key part of a strong relationship.

Expert Tips for Success

Use your **budgeting app for couples** like a pro with these best practices.

- Start with a “No-Judgment” Month: For the first month, just let the app track your combined spending to get an honest baseline before you try to make any changes.

- Use the “Yours, Mine, and Ours” Approach: Consider maintaining separate accounts for personal spending and a joint account for shared bills.

- Automate Your Shared Savings: Set up an automatic transfer from your joint checking to your joint savings account every payday.

- Celebrate Your Wins: When you hit a savings goal, celebrate it together! This reinforces the positive aspects of budgeting.

“A couples budgeting app is less about the money and more about the conversation. It’s a tool that facilitates the communication and teamwork needed to build a life together.”

– A relationship and finance counselor

Frequently Asked Questions (FAQ)

Q: What is the best budgeting app for couples overall?

A: For couples who want a comprehensive, all-in-one platform with great collaboration features, Monarch Money is often considered the best choice. For couples looking for a powerful free option, Honeydue is specifically designed for partners and is an excellent starting point.

Q: Should a couple have separate or joint bank accounts?

A: There’s no single right answer; it depends on the couple. Many find success with a ‘yours, mine, and ours’ approach: separate accounts for personal spending and a joint account for shared bills and goals. The best budgeting apps for couples can accommodate any of these setups.

Q: How can a budgeting app help reduce arguments about money?

A: A budgeting app reduces arguments by creating transparency and a single source of truth. It replaces assumptions and accusations with clear, objective data about spending. This allows couples to have productive conversations about their shared goals rather than arguments about past transactions.

Q: What if my partner doesn’t want to use a budgeting app?

A: The key is to frame it as a tool for achieving your shared dreams, not for restricting spending. Start by focusing on a fun, shared goal, like a vacation. Show them how the app can help you save for that goal together. Start with a user-friendly, free app like Honeydue to make the initial adoption as easy as possible.

Q: Are family finance apps secure?

A: Yes, reputable apps use bank-level security, including 256-bit encryption and secure services like Plaid to link to your financial accounts with ‘read-only’ access. This means the app can see your transactions but cannot move or transfer your money, ensuring your data is safe.

Conclusion