Introduction

Starting your first real job is exciting, but it comes with new responsibilities, including navigating a confusing benefits package. Retirement plans beginners can help you understand options like 401(k)s and Roth IRAs without feeling overwhelmed. By using retirement plans beginners, you can see how the choices you make today will grow over time and impact your future. Exploring retirement plans beginners breaks down complex decisions into simple, actionable steps. Following retirement plans beginners allows you to start building a secure financial future right away.

What Are retirement plans beginners?

In simple terms, a retirement plan is a special savings and investment account designed to grow your money with tax advantages. Retirement plans beginners can help you understand how these accounts work and why they are different from regular savings. By exploring retirement plans beginners, you can learn how to maximize tax-deferred or tax-free growth for your future. Using retirement plans beginners gives you the guidance needed to start saving effectively and make informed choices. Following retirement plans beginners ensures you build a strong foundation for long-term financial security.

In 2025, understanding retirement plans beginners is more important than ever. Unlike previous generations that relied on company pensions, the responsibility for funding retirement now falls mostly on the individual. By exploring retirement plans beginners, young people can gain the knowledge needed to start planning confidently. Using retirement plans beginners makes it easier to take advantage of the power of time and compound growth. Following retirement plans beginners helps turn uncertainty into actionable steps toward a secure financial future.

Why Starting Now is Your Financial Superpower

It’s easy to think of retirement as a problem for your future self, but retirement plans beginners show that starting early is key. By following retirement plans beginners, you can make the most of the time advantage and set a solid foundation. Using retirement plans beginners helps you understand the steps to take now rather than later. Exploring retirement plans beginners ensures that you begin with confidence and clarity, turning what seems like a distant concern into actionable progress today.

The Undeniable Magic of Compound Interest

Compound interest is the eighth wonder of the world. It’s the interest you earn on your interest, and over decades, it creates a snowball effect. For example, if a 25-year-old saves $300 a month, they could have over $1 million by age 65. If they wait until 35 to start, they’d need to save over twice as much each month to reach the same goal. Time is a more powerful ingredient than the amount of money you start with.

Powerful Tax Advantages That Boost Your Growth

Retirement accounts are like a cheat code for building wealth. They let your money grow without being eroded by taxes each year.

- Tax-Deferred (Traditional): You get a tax break now, and your money grows untouched by taxes until you withdraw it in retirement.

- Tax-Free (Roth): You pay taxes now, but your money grows and can be withdrawn in retirement completely tax-free.

Building a Lifelong Habit of Financial Discipline

Just like physical fitness, financial fitness is about building good habits. Setting up a small, automatic contribution to your retirement plan from your very first paycheck builds the discipline of “paying yourself first.” A well-funded retirement can mean more time for your passions, like exploring new places. For more on travel and leisure, check out this valuable resource.

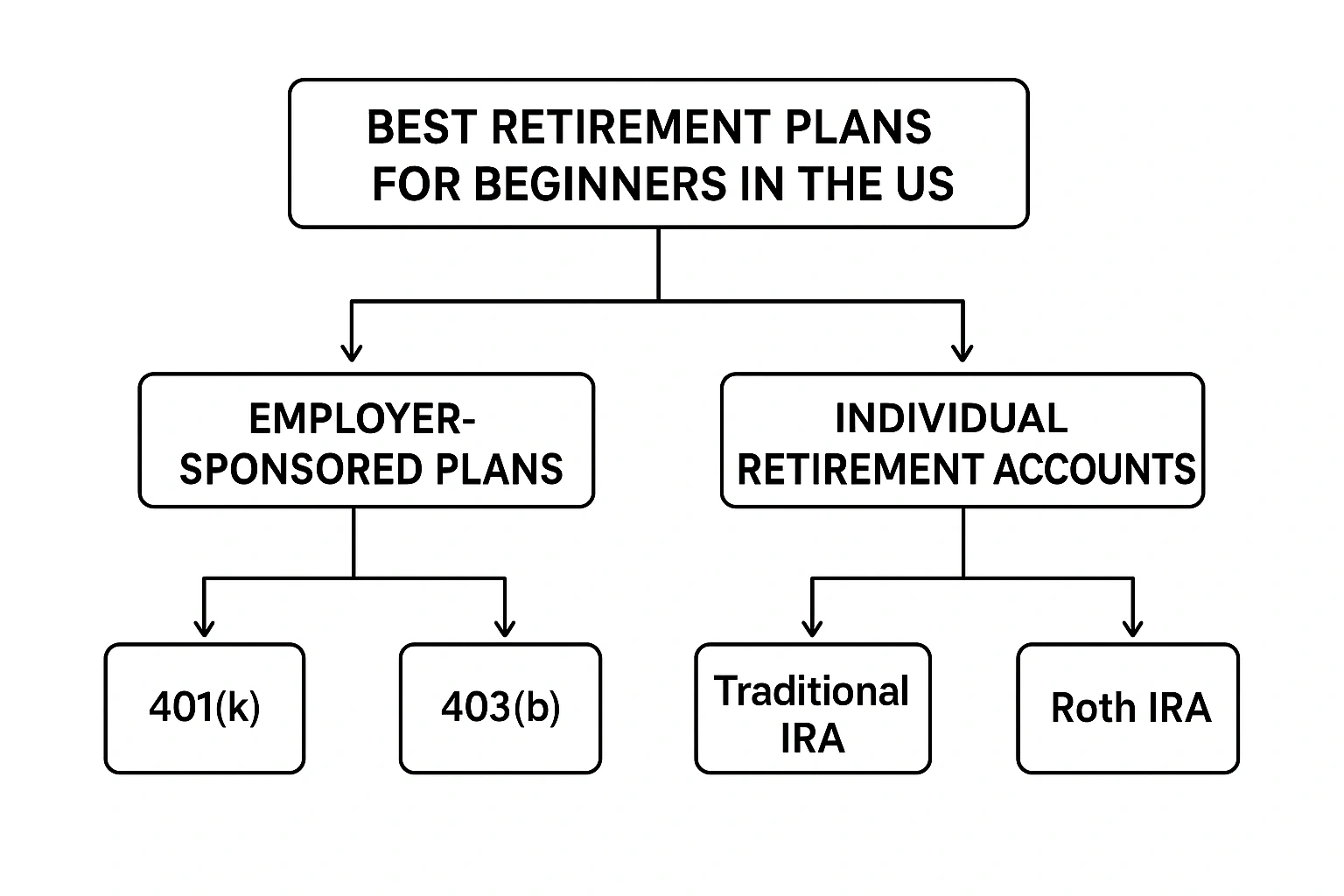

The Core Retirement Plans for Beginners Explained

As a beginner, you only need to know about a few key types of accounts. Here’s a simple breakdown of the most common options.

Here’s a comparison of the main players:

| Plan | How It Works | 2025 Contribution Limit | Best For |

|---|---|---|---|

| 401(k) / 403(b) | An employer-sponsored plan where contributions are deducted directly from your paycheck. Often comes with a company match. | $23,000 | Anyone whose employer offers one, especially with a match. |

| Traditional IRA | An Individual Retirement Account you open yourself. Contributions may be tax-deductible. | $7,000 | People who want a tax deduction now or who don’t have a 401(k). |

| Roth IRA | An IRA where you contribute after-tax money, and your withdrawals in retirement are tax-free. | $7,000 (subject to income limits) | Young professionals who expect to be in a higher tax bracket in the future. |

| SEP IRA | A simplified plan for self-employed individuals and small business owners. | Up to 25% of compensation, not to exceed $69,000. | Freelancers and self-employed individuals. |

Real-Life Use Case: Alex’s First Retirement Plan

Let’s walk through a simple decision-making process for a fictional 24-year-old named Alex, who just started a new job. This is a common scenario for those exploring **retirement plans for beginners**.

Alex’s first step is to check the company benefits. The company offers a 401(k) and will match 100% of contributions up to 5% of Alex’s salary. This is the most important piece of information. Alex’s absolute first priority is to contribute at least 5% of each paycheck to the 401(k). Not doing so would be turning down a 100% return on that money. After maxing out the match, Alex decides to save an additional $200 per month. Now, the choice is between contributing more to the 401(k) or opening an IRA. Alex decides to open a Roth IRA because, as a young professional, it’s likely that their income (and tax bracket) will be much higher in the future. Paying taxes now on that $200/month means all its future growth will be tax-free.

Here’s a breakdown of Alex’s strategy:

| Pros of Alex’s Strategy | Cons of Alex’s Strategy |

|---|---|

| ✅ Never misses out on the “free money” from the company match. | ❌ Requires managing two separate accounts (a 401(k) and an IRA). |

| ✅ The Roth IRA provides tax diversification and tax-free growth. | ❌ Does not get a current-year tax deduction on the Roth IRA contributions. |

| ✅ The IRA likely offers a wider range of low-cost investment options than the company 401(k). |

Where to Open Your IRA: Top Brokerage Firms for Beginners

If you decide to open an IRA, you’ll need to choose a brokerage firm. Here are three of the best options for beginners, all of which offer no-fee IRAs and a wide selection of low-cost investments.

| Firm | Key Features for Beginners | Best For |

|---|---|---|

| Fidelity | User-friendly platform, excellent research tools, offers fractional shares. | An excellent all-around choice with great customer support. |

| Vanguard | The pioneer of low-cost index fund investing, known for its simple, long-term approach. | Investors who want to follow a simple, “set it and forget it” strategy. |

| Charles Schwab | Great educational resources, strong customer service, integrates with a great checking account. | Beginners who want access to a lot of educational content. |

Common Retirement Planning Mistakes for Beginners

The path to a secure retirement is long. Avoid these common early-career mistakes.

- Analysis Paralysis: Don’t let the perfect be the enemy of the good. It’s better to start saving in a “good enough” fund than to wait years trying to find the “perfect” investment.

- Ignoring the Company Match: This is the most expensive mistake you can make. It’s a guaranteed 100% return. Never leave this money on the table.

- Investing Too Conservatively: When you’re in your 20s, you have decades to ride out market fluctuations. Your portfolio should be aggressive (heavily weighted in stocks).

- Forgetting to Rebalance: Check your portfolio once a year to make sure your asset allocation hasn’t drifted too far from your target.

- Cashing Out When Changing Jobs: Never, ever cash out your 401(k). Always roll it over into your new employer’s plan or into an IRA. As financial experts cited by Google often warn, this can be a devastating blow to your long-term savings.

Expert Tips for Success

Take your **saving for retirement** to the next level with these pro tips.

- Automate Everything: Set up automatic contributions and forget about them. This is the key to consistency.

- Start with a Target-Date Fund: This is the simplest and most effective investment for a beginner.

- Increase Your Contribution with Every Raise: Every time you get a raise, increase your retirement contribution by at least 1-2%.

- Stay the Course: The market will go up and down. Don’t panic and sell during a downturn. Long-term investing is about time *in* the market, not *timing* the market.

“The two most powerful forces in investing are compound interest and starting early. As a beginner, you have the maximum possible advantage in both.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the absolute best retirement plan for a beginner?

A: The absolute best starting point is an employer-sponsored 401(k) that offers a company match. You should contribute at least enough to get the full match, as it’s a 100% return on your investment. After that, opening a Roth IRA is an excellent next step for most young professionals due to its tax-free growth.

Q: What’s the difference between a Roth and a Traditional retirement account?

A: The main difference is when you pay taxes. With a Traditional 401(k) or IRA, you contribute pre-tax money and pay taxes on withdrawals in retirement. With a Roth 401(k) or IRA, you contribute after-tax money, and your qualified withdrawals in retirement are completely tax-free.

Q: How much should I be saving for retirement as a beginner?

A: A great goal is to save 15% of your pre-tax income. However, if that’s not possible right away, the most important thing is to start. Begin with a smaller percentage, like 5%, and commit to increasing it by 1% every year. The key is to build the habit.

Q: What should I invest in within my retirement account?

A: For beginners, the simplest and most effective option is a Target-Date Fund. You simply choose the fund with the year closest to your expected retirement date (e.g., ‘Target-Date 2065 Fund’), and it automatically manages a diversified portfolio for you, becoming more conservative as you get older.

Q: Can I have both a 401(k) and an IRA?

A: Yes, and it’s a very common and effective strategy. Many people contribute to their 401(k) to get the employer match and then contribute additional savings to an IRA, which often has a wider range of investment options and lower fees.

Conclusion

Choosing your first retirement plan can feel overwhelming, but it doesn’t have to be complicated. Understanding retirement plans beginners can help you make informed decisions that benefit you for decades. By exploring retirement plans beginners, you can see which options fit your goals and financial situation. Taking action with retirement plans beginners, such as opening an account and automating contributions, allows time and compound interest to work in your favor. Using retirement plans beginners as a guide makes starting your retirement journey simple and effective, giving your future self a strong foundation.