Introduction

Saving for retirement is one thing; investing for it is another. Using investment tools retirement can help ensure your money grows faster than inflation and builds a lasting nest egg. With investment tools retirement, you can track and manage your portfolio across stocks, bonds, and funds with confidence. By exploring investment tools retirement, you get the guidance to make smarter, consistent investment decisions. Relying on investment tools retirement turns a complex financial landscape into a clear path toward long-term wealth and a secure retirement.

What Are Investment Tools Retirement?

Investment tools retirement are software and applications designed to help you manage your long-term investment strategy. By using investment tools retirement, you can see all your accounts—401(k)s, IRAs, and taxable accounts—consolidated in one dashboard. Investment tools retirement provide analytical features to review your asset allocation, uncover hidden fees, and model your readiness for retirement. Relying on investment tools retirement turns your financial data into actionable insights, helping you make smarter and more informed decisions for the future.

The rise of investment tools retirement has been a game-changer for individual investors. More people are using investment tools retirement to manage their portfolios with clarity and confidence. By exploring investment tools retirement, investors gain access to features that were once reserved for financial professionals. Using investment tools retirement makes sophisticated portfolio management accessible, helping anyone take control of their long-term investment strategy.

Why Using an Investment Tool is a Must for Serious Savers

Moving from a passive saver to an active, informed investor is a crucial step in building wealth. Investment tools retirement can help guide you through this transition with clear insights. By using investment tools retirement, you can track your portfolio, analyze performance, and make smarter decisions. Relying on investment tools retirement ensures that your investment strategy is aligned with your long-term goals. Exploring investment tools retirement gives you the confidence and control needed to grow your wealth effectively.

Get a True 360-Degree View of Your Portfolio

Most people have their investments scattered across multiple accounts: a 401(k) from a current job, an old 401(k) from a previous job, a Roth IRA, and maybe a taxable brokerage account. It’s impossible to know your true asset allocation without seeing everything in one place. These tools aggregate all your accounts to give you that crucial holistic view.

Uncover and Eliminate Hidden Fees

This is one of the most valuable features. High fees are the termites of your retirement portfolio, silently eating away at your returns. An investment tool can analyze all the funds you own and show you exactly how much you’re paying in fees, potentially saving you hundreds of thousands of dollars over your lifetime.

Make Informed, Data-Driven Decisions

These tools replace guesswork with data. Instead of wondering if you’re properly diversified, the tool can show you your exact allocation across asset classes, sectors, and geographic regions. This empowers you to make strategic adjustments based on your goals, not on emotion or market noise. For more on making smart financial choices, check out this valuable resource.

How It Works: The Core Features of an Investment Tool

Modern investment tools are built on a few key features that work together to provide a comprehensive analysis of your financial life.

Here’s a breakdown of the essential components:

| Feature | What It Does | The Key Benefit |

|---|---|---|

| Account Aggregation | Securely links all your investment accounts into a single dashboard. | Provides a complete and accurate view of your entire portfolio. |

| Portfolio Analyzer | Analyzes your combined holdings to show you your asset allocation, diversification, and risk level. | Helps you ensure your investments are aligned with your long-term goals. |

| Fee Analyzer | Scans your funds to identify their expense ratios and calculates the long-term impact of these fees on your portfolio. | Saves you a significant amount of money by helping you switch to lower-cost funds. |

| Retirement Simulator | Uses your portfolio data to run projections and determine your probability of reaching your retirement goals. | Answers the question, “Am I on track?” and allows you to model different scenarios. |

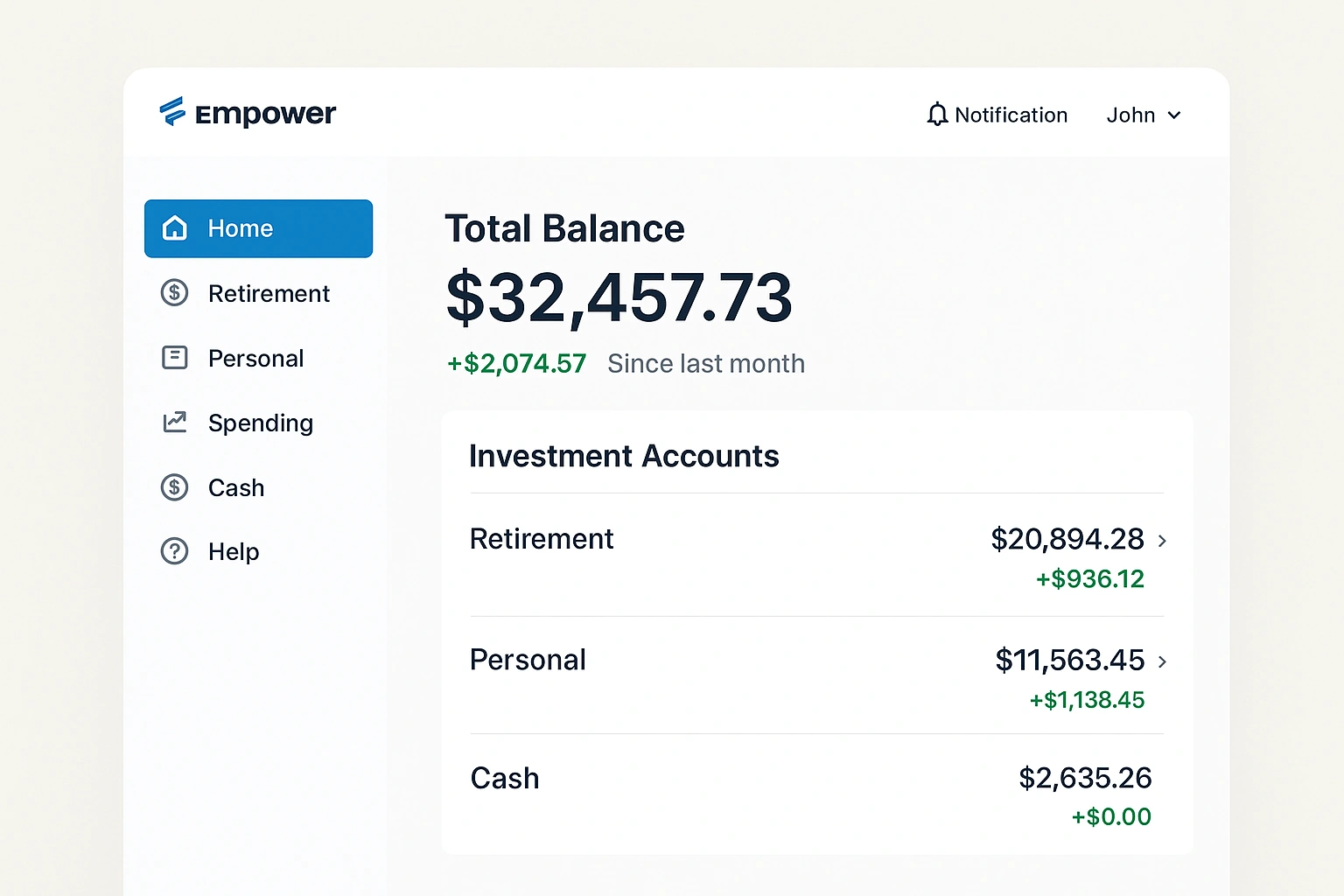

Real-Life Use Case: A Review of Empower Personal Dashboard

To evaluate a leading **investment tool for retirement**, I used **Empower Personal Dashboard (formerly Personal Capital)**. This platform is renowned for its powerful, free financial dashboard and analytical tools.

The setup process was seamless, involving securely linking my 401(k), Roth IRA, and taxable brokerage account. Within minutes, I had a real-time view of my entire net worth. The “Investment Checkup” tool was particularly insightful. It analyzed my overall asset allocation across all accounts and flagged that I was slightly overweight in U.S. large-cap stocks. The “Retirement Fee Analyzer” was a wake-up call, showing that one of the mutual funds in my old 401(k) had an expense ratio of over 1.2%, which was significantly higher than the low-cost index funds in my IRA. This single insight prompted me to roll over that old account, a move that will save me thousands in the long run.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Powerful Free Tools: The dashboard, analyzers, and planners are all free to use. | ❌ Upsell for Advisory Services: The company uses the free tools as a lead generator for its paid wealth management. |

| ✅ Holistic Financial View: Aggregating all your accounts provides incredible clarity. | ❌ Budgeting Tools are Basic: It’s much stronger as an investment tool than a day-to-day budgeting app. |

| ✅ Excellent User Interface: The charts and graphs are intuitive and easy to understand. | ❌ Occasional Account Sync Issues: Like all aggregators, it can sometimes have trouble connecting to certain institutions. |

Top Investment Tools for Retirement Compared

Empower is a fantastic dashboard, but other tools offer different strengths for managing your retirement investments. Here’s how they compare.

| Tool | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Empower Personal Dashboard | Account aggregation, portfolio analysis, fee analyzer. | Excellent free tools for a holistic view of your finances. | Upsell for paid advisory services. | Tracking your net worth and analyzing your overall portfolio. |

| Fidelity | Full-service brokerage with integrated planning tools. | Excellent all-in-one platform for both investing and planning. | The tools work best if most of your assets are held at Fidelity. | Investors who want their trading and planning in one place. |

| Morningstar | Professional-grade fund analysis and research. | Provides the most in-depth, unbiased analysis of mutual funds and ETFs. | It’s a research tool, not a portfolio tracker, and requires a paid subscription. | DIY investors who want to do deep research on their investments. |

| Vanguard | Low-cost brokerage with simple planning tools. | The best place for low-cost, passive index fund investing. | The tools and interface are more basic than competitors. | Long-term, passive investors who follow a simple strategy. |

Common Investment Mistakes to Avoid

These tools can give you incredible insight, but they can’t protect you from poor investment decisions. Avoid these common mistakes.

- Chasing “Hot” Stocks: Don’t try to pick the next big thing. The most reliable path to wealth is through broad, diversified index funds.

- Checking Your Portfolio Too Often: Looking at your investments every day will cause you to overreact to normal market fluctuations. Check in once a quarter, not once an hour.

- Having Too Many Accounts: If you have multiple old 401(k)s and IRAs, consolidate them. It simplifies your financial life and makes it easier to manage your asset allocation.

- Ignoring Your Risk Tolerance: Don’t take on more risk than you’re comfortable with. A good tool can help you assess your risk tolerance and build an appropriate portfolio.

- Analysis Paralysis: Don’t let the sheer volume of data overwhelm you into inaction. As experts cited by Google often advise, a simple, good plan that you stick with is better than a perfect plan that you never start.

Expert Tips for Success

Use your **financial investment apps** like a pro with these best practices.

- Automate Your Investments: Set up automatic monthly investments into your chosen funds. Consistency is key.

- Focus on Low-Cost Index Funds: For the core of your portfolio, you can’t beat a simple, diversified, low-cost index fund like an S&P 500 or a total stock market fund.

- Rebalance Annually: Once a year, review your asset allocation and sell some of your winners to buy more of your losers to get back to your target mix.

- Use the Tools to Stay the Course: During a market downturn, use the retirement simulator to see that your long-term plan is still on track. This can help you avoid panic selling.

“The best investment tools are the ones that turn you from a passive spectator into an informed, confident owner of your financial future. They provide the clarity needed to tune out the noise and focus on what really matters.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the best all-in-one investment tool for retirement planning?

A: For a comprehensive, all-in-one view of your entire financial picture, Empower Personal Dashboard (formerly Personal Capital) is widely considered the best free tool. It allows you to link all your accounts to track your net worth, analyze your portfolio, and use its powerful retirement planner.

Q: Do I need to be an expert to use these investment tools?

A: No, not at all. The tools on this list are specifically chosen for their user-friendly interfaces. They are designed to translate complex financial data into simple, easy-to-understand charts and insights, making them perfect for beginners and seasoned investors alike.

Q: Are financial investment apps safe to use?

A: Reputable financial investment apps use bank-level security, including 256-bit AES encryption and two-factor authentication, to protect your data. Most aggregation tools have ‘read-only’ access to your accounts, meaning they cannot initiate transactions. It is crucial to use a strong, unique password for these apps.

Q: What is a robo-advisor, and is it a good investment tool for retirement?

A: A robo-advisor is an automated investment service that builds and manages a diversified portfolio for you based on your goals and risk tolerance. For beginners or those who want a hands-off approach, robo-advisors from firms like Vanguard or Fidelity can be an excellent, low-cost investment tool for retirement.

Q: How can these tools help me save money?

A: The primary way these tools save you money is by identifying and quantifying the fees you’re paying on your investments. High fees are a major drag on long-term growth. By using a fee analyzer, you can identify expensive funds and switch to lower-cost alternatives, potentially saving you tens or even hundreds of thousands of dollars over your lifetime.

Conclusion

Building a strong retirement portfolio is no longer only for the wealthy or financially savvy. With the right investment tools retirement, anyone can take control of their financial future. Using investment tools retirement gives you a clear picture of your portfolio, highlights hidden fees, and helps you stay on track with your goals. By exploring investment tools retirement, you can make informed decisions and create a plan that works for your situation. Choosing the right investment tools retirement allows you to simplify your strategy and let the power of the market work in your favor.