Introduction

Does investing feel intimidating? For decades, Wall Street seemed like an exclusive club with complex jargon and high barriers to entry. Today, investment apps beginners have changed the game, putting powerful tools right in your pocket. By exploring investment apps beginners, anyone can start building a portfolio with just a few taps and minimal funds. Using investment apps beginners provides a user-friendly way to take your first confident steps toward financial freedom. Relying on investment apps beginners ensures that even newcomers can navigate the stock market with clarity and control.

What Are Investment Apps Beginners?

Investment apps beginners are mobile platforms designed to make investing simple, accessible, and affordable for anyone. By exploring investment apps beginners, you can start investing without the complexity of traditional brokerage accounts. Using investment apps beginners allows you to open an account, link your bank, and begin buying stocks and other assets with small amounts of money. Relying on investment apps beginners provides powerful tools and educational resources to help you grow your wealth for retirement and other long-term goals.

The impact of these apps has been revolutionary. The number of individual investors has surged in recent years, largely driven by the accessibility of these mobile-first platforms. As reported by sources like Statista, a new generation is embracing investing, and these apps are the primary reason why.

Why Using an Investment App is a Smart Move

Getting started early is the most powerful step for your financial future, and investment apps beginners make it simple. By exploring investment apps beginners, you can open an account, link your bank, and start investing with ease. Using investment apps beginners helps you automate contributions and build a disciplined, long-term strategy. Relying on investment apps beginners ensures even those new to investing can take confident, consistent steps toward growing their wealth.

Overcome the Barrier of High Minimums

In the past, you often needed thousands of dollars to even open a brokerage account. Modern investment apps have no account minimums, and with the magic of fractional shares, you can start investing with as little as $1.

Harness the Power of Compound Interest

The earlier you start investing, the more time your money has to grow. These apps make it easy to set up small, automatic, recurring investments, which is the key to building wealth over the long term. Even $25 a week can grow into a significant sum over decades.

Learn by Doing in a Low-Risk Environment

The best way to learn about investing is to actually do it. These apps are packed with educational articles, videos, and tutorials. By starting with small amounts of money, you can learn how the market works without putting your life savings at risk. For more on planning your financial future, check out this valuable resource.

How It Works: The Core Features of a Beginner App

The best investment apps beginners focus on key features that make investing simple and accessible. By exploring investment apps beginners, you can find platforms that help automate contributions and guide your first investments. Using investment apps beginners allows new investors to navigate the market with ease and confidence. Relying on investment apps beginners ensures you have the tools and support needed to start building wealth effectively from day one.

Here’s a breakdown of the essential features:

| Feature | What It Is | Why It’s Great for Beginners |

|---|---|---|

| No Account Minimums | The ability to open an account with $0. | It removes the biggest barrier to getting started. |

| Fractional Shares | The ability to buy a small slice of a stock or ETF, rather than a full share. | It allows you to invest in your favorite companies, even if their stock price is high, with just a few dollars. |

| Recurring Investments | The ability to set up automatic, recurring purchases of your chosen investments. | It automates the habit of consistent investing, which is the key to long-term success. |

| User-Friendly Interface | A clean, simple, and intuitive app design that is easy to navigate. | It reduces the intimidation factor and makes investing feel accessible and even fun. |

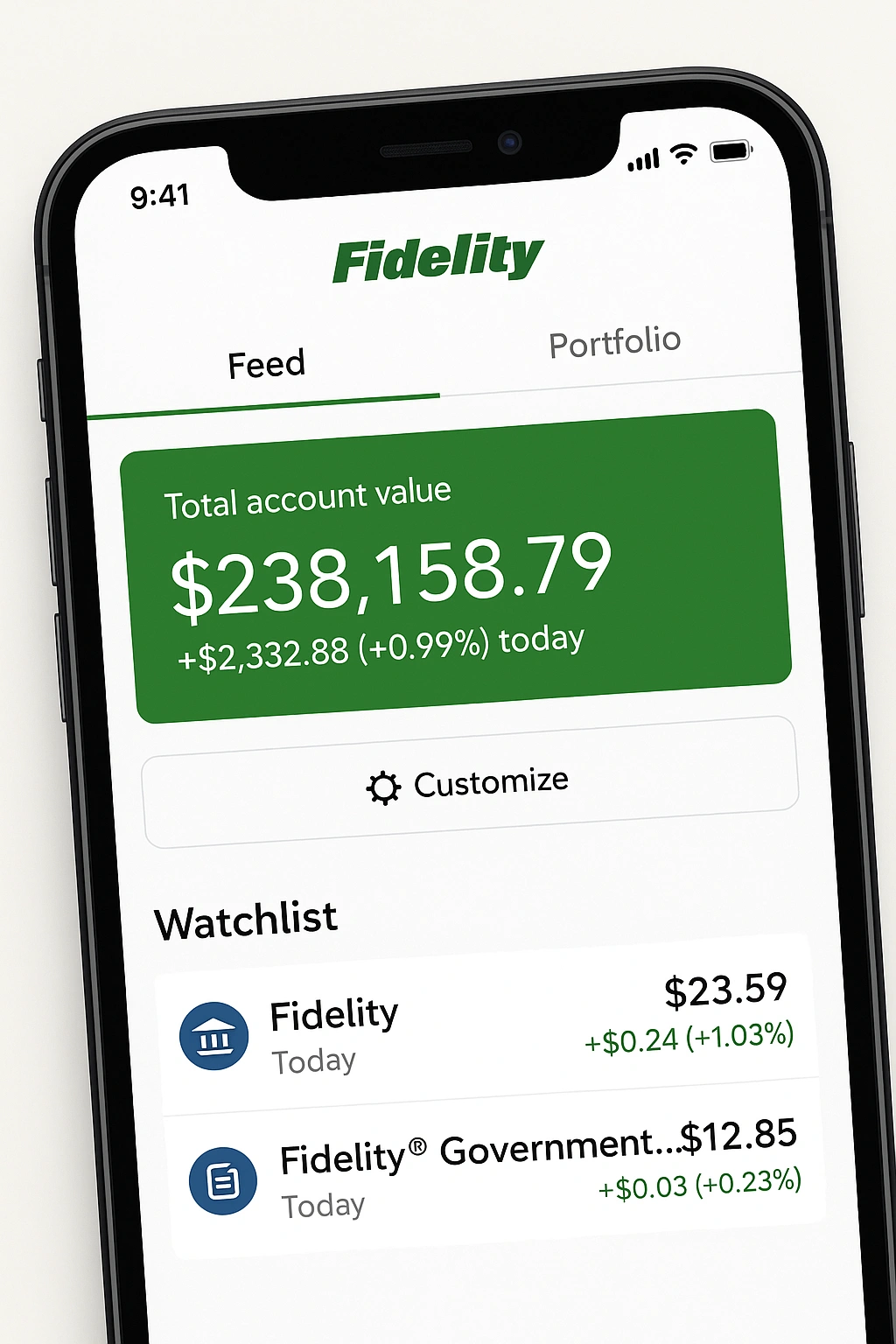

Real-Life Use Case: A Review of Fidelity

To evaluate a top-tier **investment app for beginners**, I walked through the process of opening an account and making a first investment with **Fidelity**. Fidelity is a massive, well-respected brokerage firm that has invested heavily in creating a user-friendly experience for new investors.

The entire process, from downloading the platform to making my first investment, was quick and easy thanks to investment apps beginners. By using investment apps beginners, I was guided step by step through account setup with simple, clear instructions. Exploring investment apps beginners allowed me to link my bank, choose a Roth IRA, and invest in an S&P 500 index fund with fractional shares. Relying on investment apps beginners made it easy to set up recurring investments and access helpful educational content, making the experience smooth and empowering.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ No Fees or Minimums: No account fees, no trading commissions on stocks/ETFs, and no account minimums. | ❌ Can Be Overwhelming: Because it’s a full-service brokerage, the sheer number of options can be a bit much at first. |

| ✅ Excellent for Beginners: The app is very user-friendly, and the educational resources are top-notch. | ❌ Interface is Less “Gamified”: It feels more like a serious financial tool than some newer, more gamified apps. |

| ✅ Fractional Shares: Makes it easy to invest small amounts in any stock or ETF. | ❌ Advanced Charting is Limited: The mobile app’s charting tools are basic, but sufficient for beginners. |

Top Investment Apps for Beginners Compared

Fidelity is a fantastic all-around choice, but other platforms offer different features and experiences. Here’s how the top **investment apps for beginners** compare.

| App | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Fidelity | No minimums, fractional shares, excellent educational resources. | Great all-around choice, trusted brand, user-friendly. | The sheer number of options can be overwhelming. | The best overall experience for a new investor. |

| Vanguard | Access to Vanguard’s renowned low-cost index funds and ETFs. | The gold standard for low-cost, long-term passive investing. | The mobile app and interface are less modern than competitors. | Investors who want a simple, “set it and forget it” portfolio. |

| Betterment | Robo-advisor that builds and manages a portfolio for you. | Completely hands-off, great goal-planning tools. | Charges a small annual management fee (0.25%). | Beginners who want a completely automated, managed approach. |

| Public | Social features, fractional shares, access to alternative investments. | Great community features for learning from other investors. | The social feed can encourage more active trading. | Those who want to learn in a social, community-oriented environment. |

Common Beginner Investing Mistakes to Avoid

These apps make it easy to start, but they also make it easy to make mistakes. Avoid these common pitfalls.

- Treating It Like a Game: The ease of trading on an app can make it feel like a game. Remember that you are investing real money. Avoid making impulsive decisions.

- Chasing “Meme Stocks”: Don’t invest your life savings in a company just because it’s trending on social media. Stick to a disciplined, long-term strategy.

- Checking Your Portfolio Every Day: The market goes up and down. Constant checking will lead to emotional decisions. A buy-and-hold strategy is best for retirement.

- Putting All Your Eggs in One Basket: Don’t invest all your money in a single company. Diversification is key. A broad-market index fund is the easiest way to achieve this.

- Ignoring Fees: While most apps offer commission-free trades, the funds you invest in still have their own fees (expense ratios). As financial experts cited by Google often advise, always choose the lowest-cost option for a given strategy.

Expert Tips for Success

Use your **finance tools for retirement** like a pro with these best practices.

- Start with an IRA: For a beginner, a Roth IRA is often the best type of account to open due to its tax-free growth.

- Automate Your Investments: This is the single most important tip. Set up a recurring weekly or monthly investment and let it run automatically.

- Start with a Broad-Market Index Fund ETF: This is the simplest and most effective way to get started.

- Focus on Time in the Market, Not Timing the Market: Don’t try to guess when the market will go up or down. Just keep investing consistently.

“The best investment apps for beginners are the ones that make it boringly simple to do the right thing over and over again for a very long time.”

– A leading financial independence blogger

Frequently Asked Questions (FAQ)

Q: What is the absolute best investment app for a complete beginner?

A: For a complete beginner, Fidelity is often considered the best choice. It has no account minimums, offers fractional shares, provides a massive library of educational resources, and has a very user-friendly mobile app. It’s a platform that is easy to start with but powerful enough to grow with you.

Q: How much money do I need to start using these investment apps?

A: You can start with as little as $1. The rise of fractional shares, offered by most of the apps on this list, means you can buy a small slice of any stock or ETF, regardless of its full share price. This has completely removed the barrier of high minimum investments.

Q: Are my investments safe on these apps?

A: Yes. The reputable investment apps on this list are all members of the Securities Investor Protection Corporation (SIPC), which protects your investments up to $500,000 against the failure of the brokerage firm. It’s important to note that this does not protect you from normal market fluctuations and investment losses.

Q: What should I invest in as a beginner?

A: The simplest and most effective strategy for a beginner is to invest in a low-cost, broad-market index fund ETF, such as one that tracks the S&P 500 (like VOO) or the total stock market (like VTI). This gives you instant diversification and allows you to participate in the growth of the overall market.

Q: What is a robo-advisor?

A: A robo-advisor is a type of investment service that uses algorithms to build and manage a diversified portfolio for you. You answer a questionnaire about your goals and risk tolerance, and the service handles all the investing and rebalancing. It’s an excellent hands-off option for beginners.

Conclusion

The barrier to building wealth has never been lower. The **investment apps for beginners** available today have made it possible for anyone to start their journey toward financial independence, regardless of their income or expertise. By choosing a user-friendly platform, automating your contributions, and sticking to a simple, long-term strategy, you can harness the power of the market to build a secure and prosperous future. The most important step is the first one. Download an app, open an account, and start investing today.