Introduction

Investing for retirement can feel overwhelming, but using the best ETFs retirement simplifies the process. By exploring the best ETFs retirement, you can build a diversified portfolio without needing to analyze thousands of individual stocks or mutual funds. Relying on the best ETFs retirement provides low-cost, easy-to-understand investment options for long-term growth. Using the best ETFs retirement allows you to create a world-class portfolio with just a few carefully chosen funds, making retirement investing simple and effective.

What Are best ETFs retirement?

An Exchange-Traded Fund (ETF) is an investment fund that holds a collection of assets, such as stocks or bonds, but trades on an exchange like a single stock. Using the best ETFs retirement allows you to own a small piece of many companies with just one purchase. By exploring the best ETFs retirement, you can achieve broad diversification easily and efficiently. Relying on the best ETFs retirement provides a simple, low-cost way to grow your portfolio while reducing risk, making it an ideal choice for long-term retirement planning.

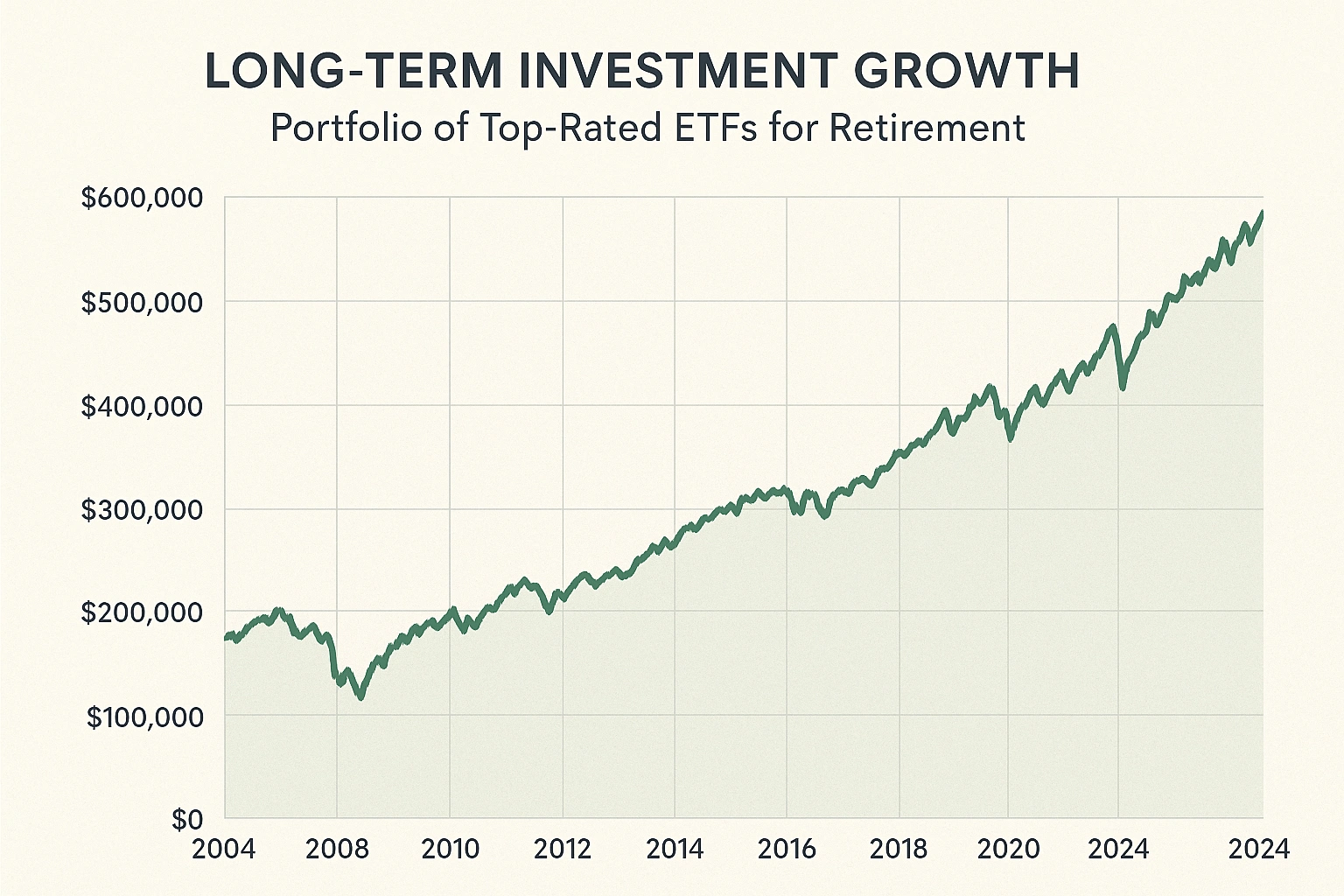

The popularity of ETFs has exploded over the past decade. The global market for ETFs has grown to over 11 trillion U.S. dollars, and they are now the preferred investment vehicle for many savvy long-term investors. This is because they offer a powerful combination of low costs, diversification, and simplicity that is perfectly suited for retirement saving.

Why ETFs are a Retiree’s Best Friend

For a long-term goal like retirement, using the best ETFs retirement provides unique advantages that make investing simpler and more effective. By exploring the best ETFs retirement, you can access diversified portfolios with low costs and minimal effort. Relying on the best ETFs retirement allows you to grow your savings steadily while reducing risk. Using the best ETFs retirement ensures your long-term investment strategy is both practical and powerful, helping you work toward a secure retirement.

Achieve Instant Diversification

The golden rule of investing is “don’t put all your eggs in one basket.” ETFs are the ultimate embodiment of this principle. With a single purchase of a broad-market ETF, you can own a small piece of the entire U.S. stock market, instantly spreading your risk across thousands of companies.

Enjoy Ultra-Low Costs

This is perhaps the most important advantage for a **long-term investment**. High fees are a cancer on your portfolio, slowly eating away at your returns over time. The best index ETFs have incredibly low annual fees (called expense ratios), often less than 0.10%. This means more of your money stays invested and working for you.

Simplify Your Investing Strategy

You don’t need to be a stock-picking genius to succeed at investing. In fact, studies consistently show that the majority of professional stock pickers fail to beat the market average over the long run. By buying a broad-market index ETF, you are essentially guaranteeing that you will capture the average return of the entire market, which has historically been a winning strategy. For more on planning your future, check out this valuable resource.

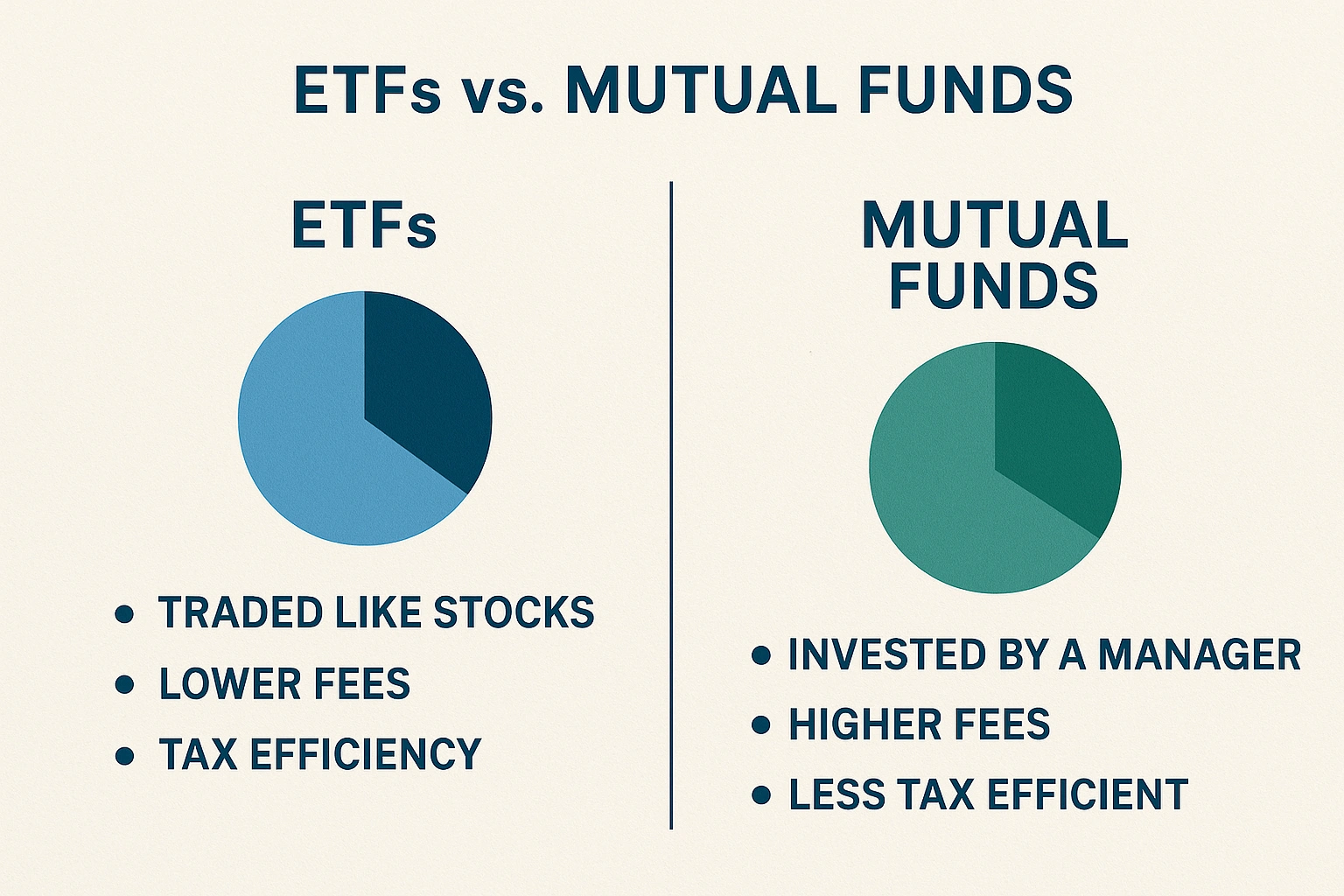

How It Works: ETF vs. Mutual Fund

For beginners, understanding the best ETFs retirement can make investing much clearer. While similar to mutual funds, the best ETFs retirement offer unique advantages like lower costs and easier trading. By exploring the best ETFs retirement, beginners can quickly build diversified portfolios without complexity. Using the best ETFs retirement allows new investors to start confidently and efficiently, making retirement planning simpler and more effective.

Here’s a simple breakdown:

| Feature | ETF (Exchange-Traded Fund) | Mutual Fund |

|---|---|---|

| Trading | Trades like a stock on an exchange throughout the day. | Priced once per day, at the end of the trading day. |

| Cost (Expense Ratio) | Typically very low, often below 0.10% for index funds. | Generally higher, especially for actively managed funds. |

| Tax Efficiency | Generally more tax-efficient due to their creation/redemption process. | Can generate unexpected capital gains distributions for investors. |

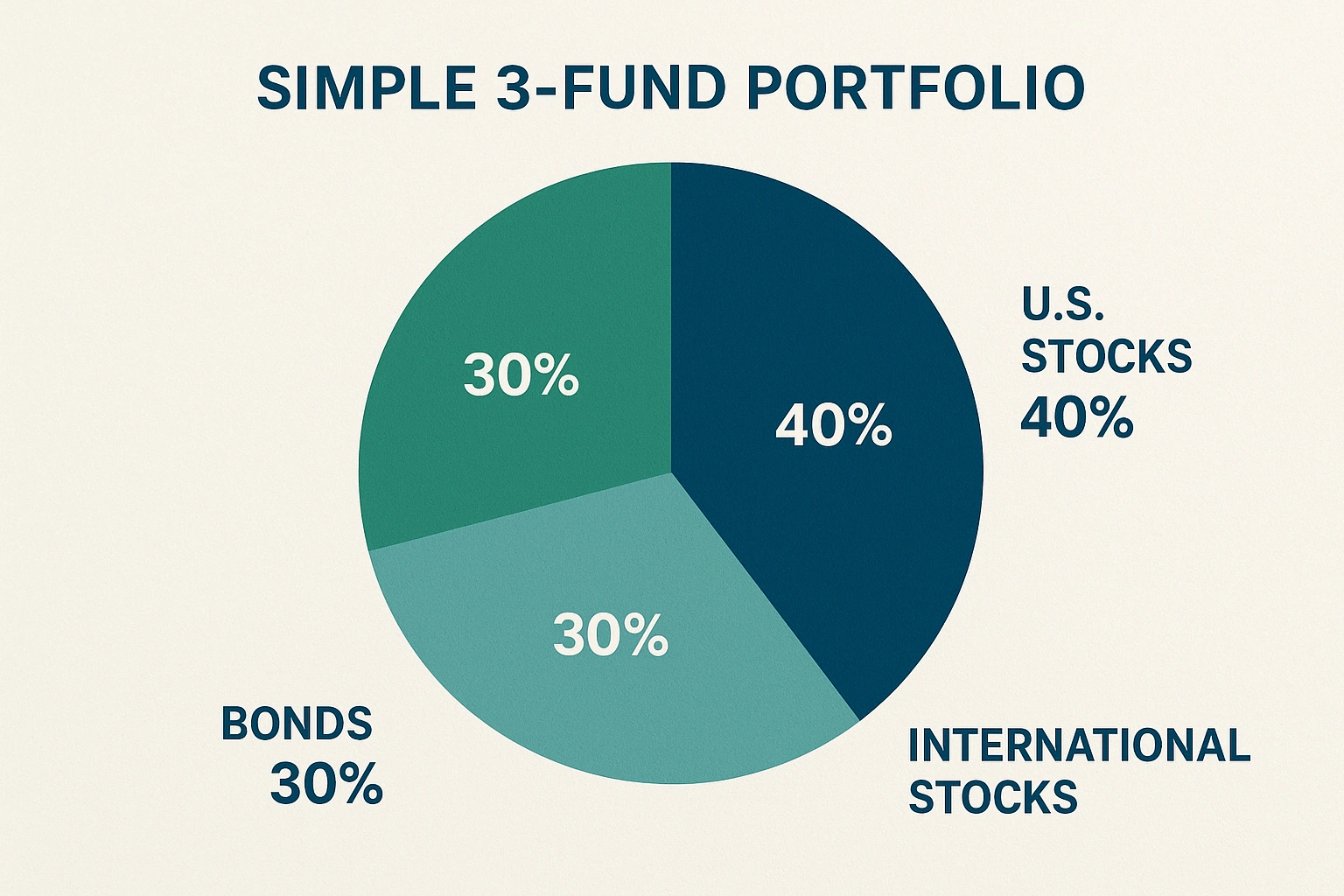

Real-Life Use Case: Building a Simple 3-Fund Portfolio

Let’s look at a simple, powerful strategy using the **best ETFs for retirement**. We’ll follow a fictional 30-year-old named Sarah who is building her retirement portfolio from scratch.

Instead of trying to pick individual stocks, Sarah decides to use the classic “3-Fund Portfolio” strategy, which provides global diversification with just three simple ETFs. She allocates her portfolio as follows:

- 60% in a Total US Stock Market ETF (like VTI): This gives her ownership in over 3,000 US companies.

- 30% in a Total International Stock Market ETF (like VXUS): This provides diversification across thousands of companies in both developed and emerging markets outside the US.

- 10% in a Total US Bond Market ETF (like BND): This adds a layer of stability to her portfolio.

With just three purchases, Sarah has created a globally diversified, low-cost portfolio that is more robust than what most professional investors build. She sets up automatic monthly investments into these three funds and plans to review and rebalance her portfolio once a year.

Top ETFs for a Retirement Portfolio Compared

Here’s a closer look at some of the most popular and effective ETFs that can serve as the core building blocks of your retirement portfolio.

| Ticker | Name | What It Tracks | Best For |

|---|---|---|---|

| VTI | Vanguard Total Stock Market ETF | The performance of the entire U.S. stock market. | The core U.S. stock holding for most investors. |

| VOO | Vanguard S&P 500 ETF | The 500 largest companies in the U.S. | A simple, powerful way to invest in America’s biggest companies. |

| VXUS | Vanguard Total International Stock ETF | The performance of stock markets outside the U.S. | Providing essential global diversification to your portfolio. |

| BND | Vanguard Total Bond Market ETF | The performance of the entire U.S. bond market. | Adding stability and diversification to a stock-heavy portfolio. |

Common Mistakes to Avoid with ETFs

While ETFs are simple, there are still a few common mistakes that investors make.

- Chasing Niche or Thematic ETFs: There are now ETFs for everything from robotics to cryptocurrency. While these can be tempting, the core of your retirement portfolio should be in broad, diversified funds, not narrow, speculative themes.

- Ignoring International Diversification: Many investors have a “home country bias” and only invest in U.S. stocks. A globally diversified portfolio is more resilient.

- Forgetting to Rebalance: Over time, your portfolio’s allocation will drift. You need to rebalance at least once a year to get back to your target mix.

- Trading Them Like Stocks: Just because you *can* trade ETFs all day doesn’t mean you *should*. For retirement, you should buy and hold for the long term.

- Not Understanding What You Own: Always read the fund’s prospectus to understand exactly what index it tracks and what its top holdings are. As financial experts cited by Google often advise, never invest in something you don’t understand.

Expert Tips for Success

Use these **financial investment apps** and ETFs like a pro with these best practices.

- Automate Your Investments: This is the single most important tip. Set up automatic monthly investments and let the system run on its own.

- Keep It Simple: You don’t need a dozen different funds. A simple 2 or 3-fund portfolio is all most people need.

- Focus on Low Costs: When comparing similar ETFs, the one with the lower expense ratio is almost always the better choice for a long-term investment.

- Stay the Course: The market will have good years and bad years. The key to success is to stay invested and not panic during downturns.

“The secret to successful investing is not to find the perfect investment, but to build a simple, disciplined process. Low-cost index fund ETFs are the best tool ever invented for creating that process.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What are the best types of ETFs for retirement?

A: For long-term retirement investing, the best ETFs are typically broad-market, low-cost index funds. A simple and effective portfolio can be built with just a few core holdings: a Total US Stock Market ETF (like VTI), a Total International Stock Market ETF (like VXUS), and a Total Bond Market ETF (like BND).

Q: What is the difference between an ETF and a mutual fund?

A: The main difference is how they are traded. ETFs (Exchange-Traded Funds) trade like stocks on an exchange throughout the day, while mutual funds are priced once at the end of each day. ETFs also tend to have lower expense ratios and greater tax efficiency than their mutual fund counterparts.

Q: How many ETFs should I have in my retirement portfolio?

A: You can build a globally diversified portfolio with as few as two or three ETFs. A combination of a total US stock market ETF and a total international stock market ETF covers thousands of companies worldwide. Adding a total bond market ETF provides stability. Simplicity is often the most effective strategy for a long-term investment.

Q: Are ETFs a risky long-term investment?

A: All stock market investing involves risk. However, broad-market index ETFs are considered one of the least risky ways to invest in stocks because they are highly diversified. Instead of betting on a single company, you are investing in the overall growth of the entire market, which has historically trended upward over the long term.

Q: What is an expense ratio and why does it matter?

A: The expense ratio is the annual fee that a fund charges, expressed as a percentage of your investment. It matters immensely for a long-term investment because high fees can dramatically reduce your returns over time due to the effects of compounding. The ETFs recommended for retirement typically have ultra-low expense ratios, often below 0.10%.

Conclusion

Building a strong retirement portfolio doesn’t have to be complicated or expensive. Using the best ETFs retirement can provide a simple, effective path to long-term growth. By exploring the best ETFs retirement, you gain access to low-cost, diversified funds that make investing straightforward. Relying on the best ETFs retirement allows you to automate and discipline your investment strategy, helping you take control of your financial future and build a secure retirement.