Introduction

Do you ever wonder where all your money goes each month? You’re not alone. In today’s fast-paced world, the best budgeting apps help track every dollar and provide clarity on your spending. By exploring the best budgeting apps, you can uncover hidden savings and plan a clear path toward your financial goals. Using the best budgeting apps makes managing money simple and stress-free. Relying on the best budgeting apps ensures you stay in control and build a secure financial future.

What Are Budgeting Apps?

Budgeting apps are powerful tools for managing your personal finances, and the best budgeting apps go far beyond a simple spreadsheet. By exploring the best budgeting apps, you can securely connect your bank accounts, credit cards, and loans to automatically track income and expenses. Using the best budgeting apps helps categorize your spending, visualize habits, and create a budget you can actually follow. Relying on the best budgeting apps gives you a real-time, complete picture of your financial health and makes managing money simpler and more effective.

The popularity of these apps has soared as people seek more control over their financial lives. The FinTech market is a multi-trillion dollar industry, with personal finance management being a key growth area. As reported by sources like Statista, millions of people are turning to these digital tools to navigate economic uncertainty and build a more secure future.

Why a Budgeting App is a Financial Game-Changer

Using the best budgeting apps is one of the most effective steps to improve your financial well-being. By exploring the best budgeting apps, you can track your spending, identify areas to save, and plan for future goals. Using the best budgeting apps helps simplify money management and brings clarity to your finances. Relying on the best budgeting apps ensures you take control of your financial life with confidence and consistency.

Gain Awareness and Control Over Your Spending

The first step to managing your money is knowing where it’s going. These apps automatically categorize every transaction, giving you a brutally honest look at your spending habits. This awareness is the foundation of behavioral change.

Find and Eliminate “Money Leaks”

Budgeting apps are brilliant at spotting the small, recurring charges that drain your bank account.

- Identify forgotten subscriptions and free trials that have converted to paid plans.

- Spot areas where you’re consistently overspending, like on dining out or online shopping.

- Negotiate better rates on your monthly bills.

Achieve Your Financial Goals Faster

Whether you’re saving for a down payment, paying off debt, or planning a dream vacation, a budgeting app can help you get there faster. By creating specific savings goals and tracking your progress, you can stay motivated and make your dreams a reality. For more on planning your future, check out this valuable resource.

How It Works: The Core Features of a Budgeting App

Modern budgeting apps are built around a few key features that work together to provide a seamless and insightful financial overview.

Here’s a breakdown of the essential components:

| Feature | What It Does | Why It’s Important |

|---|---|---|

| Account Aggregation | Securely links all your financial accounts (bank accounts, credit cards, loans) in one place. | Provides a single, complete view of your financial life. |

| Automatic Transaction Categorization | Uses AI to automatically categorize your spending into buckets like “Groceries,” “Rent,” and “Entertainment.” | Eliminates manual data entry and shows you exactly where your money is going. |

| Budget Creation and Tracking | Allows you to set spending limits for different categories and tracks your progress throughout the month. | Helps you stay on track and sends alerts when you’re approaching a limit. |

| Subscription Management | Identifies all your recurring subscriptions and bills. | Helps you find and cancel services you no longer use. |

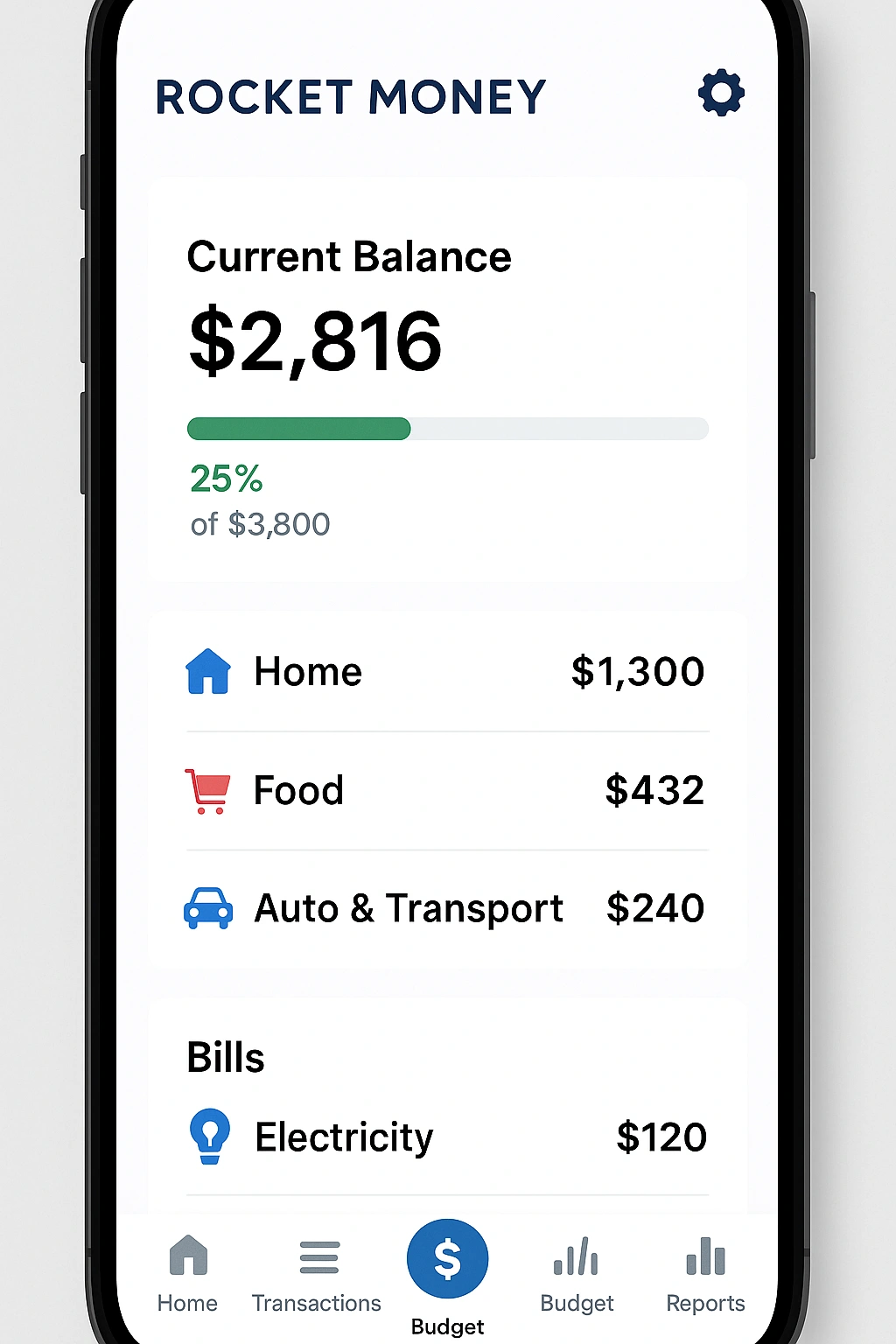

Real-Life Use Case: A Review of Rocket Money

To evaluate a leading **money management app**, I used **Rocket Money (formerly Truebill)** for a month. Rocket Money excels at automated tracking and subscription management.

The setup was simple: I securely linked my primary checking and credit card accounts. Within minutes, the app had pulled in my transaction history and presented me with a clean dashboard of my spending habits. The most eye-opening feature was the subscription finder. It immediately identified three small, recurring subscriptions that I had completely forgotten about, totaling over $40 a month. The app’s bill negotiation feature was also impressive; it successfully negotiated a lower rate on my internet bill, saving me an additional $20 a month with just a few taps.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Excellent Automated Tracking: The app is fantastic at automatically categorizing spending and identifying subscriptions. | ❌ Budgeting Features are Premium: The most powerful budgeting and goal-setting features require a paid subscription. |

| ✅ Action-Oriented Features: The subscription cancellation and bill negotiation services are genuinely useful. | ❌ Bill Negotiation Takes a Cut: The bill negotiation service takes a percentage of the annual savings it finds for you. |

| ✅ User-Friendly Interface: The app is clean, modern, and easy to navigate. | ❌ Focus is on Tracking, Not Planning: It’s better for understanding past spending than for proactively planning future spending. |

Top 10 Budgeting Apps for 2025 Compared

Rocket Money is a great tracker, but other apps excel in different areas, like proactive budgeting. Here’s how the top **best budgeting apps** compare.

| App | Key Feature | Best For |

|---|---|---|

| Rocket Money | Automated spending and subscription tracking. | Beginners who want to understand where their money is going. |

| YNAB (You Need A Budget) | Proactive, zero-based budgeting philosophy. | Users who want to be highly intentional with their spending. |

| Empower Personal Dashboard | Holistic net worth and investment tracking. | Users who want to track both their budget and their investments. |

| Monarch Money | Collaborative budgeting for couples and families. | Couples who want to manage their finances together. |

| Honeydue | Free budgeting app specifically for couples. | Couples who want a free tool to manage shared expenses. |

| PocketGuard | Simplifies budgeting by showing you what’s “in your pocket.” | Users who feel overwhelmed and want a very simple approach. |

| Goodbudget | Digital version of the “envelope” budgeting system. | Visual budgeters who like the cash envelope method. |

| Simplifi by Quicken | Personalized spending plan and cash flow projections. | Users who want a simple but powerful tool from a trusted name. |

| Copilot | AI-powered categorization and a beautiful, modern interface. | Design-conscious users who want a sleek, intelligent app. |

| EveryDollar | Zero-based budgeting app from Dave Ramsey. | Followers of the Dave Ramsey “Baby Steps” financial plan. |

Common Budgeting Mistakes to Avoid

An app is just a tool. To be successful, you need to avoid these common behavioral mistakes.

- Setting an Unrealistic Budget: If you try to cut your spending to zero overnight, you’ll fail. Create a realistic budget that allows for some fun, and make small, sustainable changes.

- “Set It and Forget It”: You need to actively engage with your budget. Spend 10-15 minutes each week reviewing your spending and checking your progress.

- Not Having a “Why”: A budget without a goal is just deprivation. Get clear on *why* you’re saving. This motivation is crucial for sticking with it.

- Giving Up After a Bad Month: You will have months where you go over budget. That’s normal. The key is to not get discouraged, learn from it, and get back on track the next month.

- Ignoring Small Purchases: As financial experts cited by Google often advise, the daily $5 coffee can add up to over $1,800 a year. Track everything.

Expert Tips for Success

Use your **money management apps** like a pro with these best practices.

- Follow the 50/30/20 Rule: As a starting point, allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment.

- Use a “Zero-Based” Approach: Give every dollar a job. This proactive method, championed by apps like YNAB, is incredibly effective.

- Automate Your Savings: Set up an automatic transfer to your savings account the day you get paid.

- Have a Weekly “Money Date”: Spend 15 minutes every Sunday reviewing your budget. This small habit makes a huge difference.

“A budget isn’t about restricting what you can do; it’s about empowering you to do the things you truly want to do. It’s the tool that aligns your spending with your values.”

– A leading personal finance expert

Frequently Asked Questions (FAQ)

Q: What is the best budgeting app for a complete beginner?

A: For a complete beginner, Rocket Money (formerly Truebill) is an excellent choice. Its strength is in automatically tracking your spending, identifying recurring subscriptions, and providing a simple, clear overview of your financial life without requiring you to do a lot of manual setup.

Q: Are budgeting apps safe to use?

A: Yes, reputable budgeting apps use bank-level security, including 256-bit encryption and multi-factor authentication, to protect your data. They typically use trusted third-party services like Plaid to securely link to your bank accounts with read-only access, meaning the app cannot move your money.

Q: What is the difference between a budgeting app and a full financial planner?

A: A budgeting app is focused on tracking your day-to-day income and expenses to help you manage your cash flow. A full financial planning tool, like Empower’s dashboard, does that and also tracks your investments, analyzes your retirement plan, and gives you a holistic view of your entire net worth.

Q: Can a budgeting app really help me save more money?

A: Absolutely. The simple act of tracking your spending brings awareness to where your money is actually going, which is the first step to making changes. These apps also help by identifying forgotten subscriptions you can cancel and setting up achievable savings goals.

Q: What is the ‘zero-based budgeting’ method?

A: Zero-based budgeting is a method where you assign every single dollar of your income to a specific category (expenses, savings, debt repayment) until your income minus your outgoings equals zero. Apps like YNAB (You Need A Budget) are built around this proactive and highly effective budgeting philosophy.

Conclusion

Taking control of your finances is empowering, and the best budgeting apps make it easier than ever. By exploring the best budgeting apps, you can track your spending and plan for your financial goals with clarity. Using the best budgeting apps helps automate money management, turning a daunting task into a simple and enjoyable routine. Relying on the best budgeting apps ensures you have the tools to build a secure and prosperous financial future.