Introduction

What Are Wealth Management Tools?

The rise of these platforms has democratized access to financial planning that was once reserved for high-net-worth individuals. As reported by sources like Wired, FinTech innovation is empowering consumers to take a more active and informed role in managing their own wealth, and these all-in-one tools are at the forefront of this movement.

Why a Holistic View is a Financial Game-Changer

Using an integrated wealth management tool is one of the most impactful steps you can take to build long-term wealth.

Track the Only Metric That Truly Matters: Net Worth

Your income doesn’t define your wealth; your net worth does. By aggregating all your assets and liabilities, these tools give you a clear, real-time calculation of your net worth. Watching this number grow over time is the single best way to know if you’re making financial progress.

Make Smarter, More Informed Decisions

When you can see your entire financial picture in one place, you can make more strategic decisions.

- See if your overall investment portfolio is properly diversified.

- Identify high-interest debt that you should prioritize paying off.

- Uncover high fees in your retirement accounts that are eroding your growth.

Gain Confidence and Reduce Financial Anxiety

Financial uncertainty is a major source of stress. A wealth management tool replaces that uncertainty with clarity. Knowing exactly where you stand and having a clear plan for the future provides an incredible sense of control and peace of mind. For more on planning your future, check out this valuable resource.

How It Works: The Core Features of a Wealth Management App

The best wealth management tools are built on a foundation of secure data aggregation and intelligent analysis.

Here’s a breakdown of the essential components:

| Feature | What It Does | The Key Benefit |

|---|---|---|

| Account Aggregation | Securely links all your financial accounts into a single dashboard. | Provides a complete and accurate view of your entire financial life. |

| Net Worth Tracker | Calculates your real-time net worth by subtracting your debts from your assets. | The single best metric for tracking your long-term financial progress. |

| Retirement Planner | Uses your real-time data to project your retirement readiness and run ‘what-if’ scenarios. | Connects your current financial situation to your long-term goals. |

| Investment Portfolio Analysis | Analyzes your combined holdings for asset allocation, diversification, and hidden fees. | Ensures your savings are invested wisely and efficiently. |

Real-Life Use Case: A Review of Empower Personal Dashboard

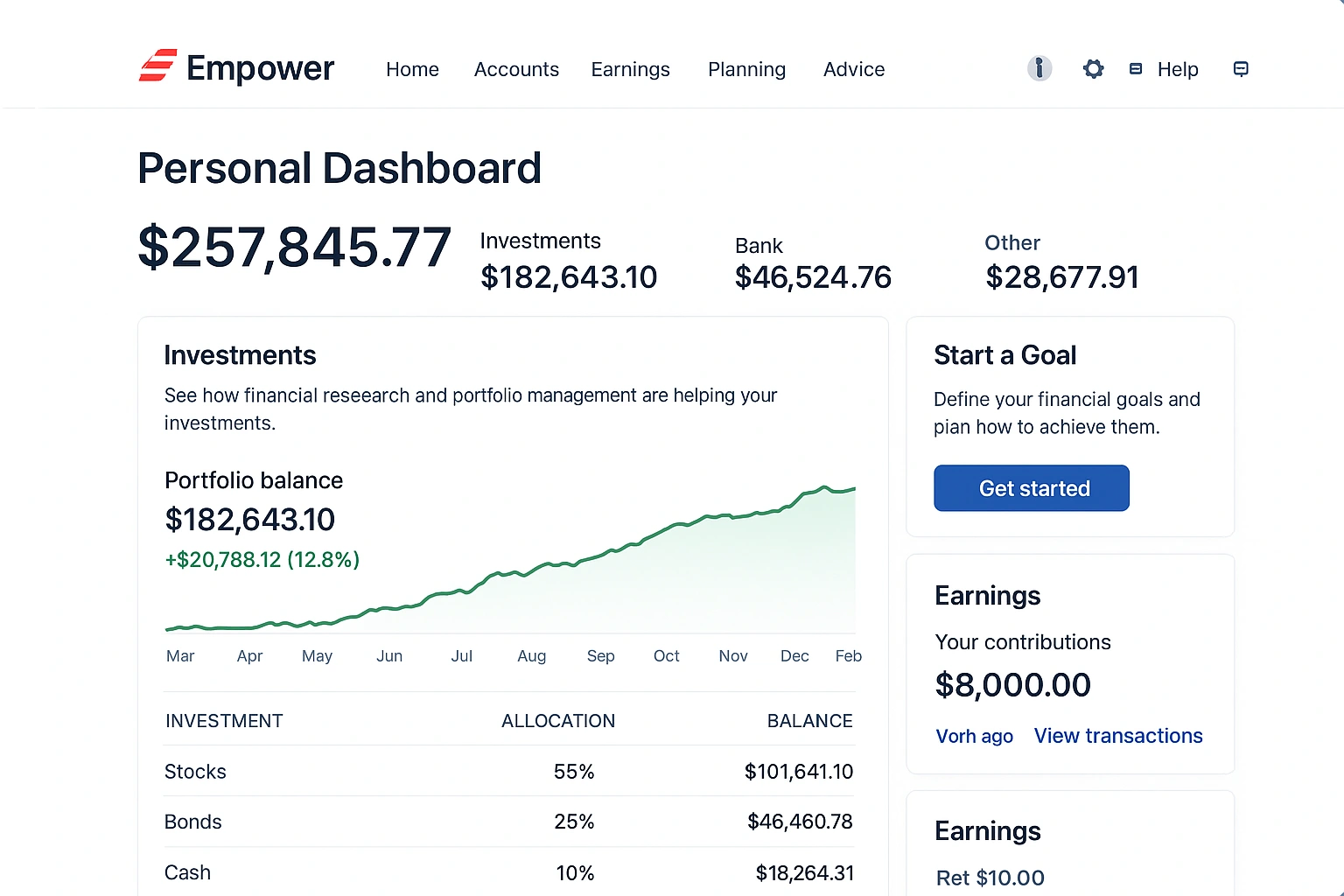

To evaluate a leading **wealth management tool**, I used **Empower Personal Dashboard (formerly Personal Capital)**. This platform is renowned for its powerful, free financial dashboard and is often considered the best starting point for anyone looking to get a holistic view of their finances.

The experience was a true eye-opener. The setup process involved securely linking my various accounts: checking, savings, 401(k), Roth IRA, and even my mortgage. Within minutes, the app presented me with a single, powerful number: my real-time net worth. The “Retirement Fee Analyzer” was the most impactful feature. It scanned the funds in my old 401(k) and revealed that I was paying over 1.2% in annual fees, which it projected would cost me over $150,000 in lost growth by retirement. This single insight prompted me to roll over the account into a low-cost IRA, a move that will have a massive impact on my future.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Powerful Free Tools: The dashboard, analyzers, and planners are all free to use. | ❌ Upsell for Advisory Services: The company uses the free tools as a lead generator for its paid wealth management. |

| ✅ Excellent for Investment Tracking: The retirement planner and fee analyzer are best-in-class. | ❌ Budgeting Tools are Basic: It’s more focused on tracking past spending than proactive, zero-based budgeting. |

| ✅ Holistic Financial View: Unmatched for seeing your entire net worth in one place. | ❌ Occasional Account Sync Issues: Like all aggregators, it can sometimes have trouble connecting to certain institutions. |

Top Wealth Management Tools for 2025 Compared

Empower is a fantastic free tool, but other platforms offer different features and experiences. Here’s how the top **financial advisor apps** compare.

| Tool | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Empower Personal Dashboard | Holistic net worth and retirement tracking. | Best free tool for a complete view of your finances. | Budgeting tools are more for tracking than planning. | Investors who want a free, powerful financial dashboard. |

| Monarch Money | Modern interface, collaborative tools for couples, goal setting. | Great for couples, strong investment tracking and goal features. | It is a premium, subscription-only tool. | Couples and families who want a premium all-in-one tool. |

| Copilot Money | AI-powered categorization and a beautiful, modern interface. | Sleek design, intelligent insights, great for Mac and iPhone users. | Subscription-only and currently only available on Apple devices. | Design-conscious Apple users who want a smart, automated experience. |

| Betterment | Robo-advisor with integrated goal planning and cash flow tools. | Excellent for hands-off investors who want their investing and planning in one place. | Charges an annual management fee for investing. | Investors who want a fully automated, managed approach. |

Common Mistakes to Avoid

An all-in-one app is powerful, but it’s only as good as the data and habits you bring to it. Avoid these common mistakes.

- Not Linking All Your Accounts: To get a true picture of your net worth, you need to link everything—including your debts like student loans and mortgages.

- Ignoring High Investment Fees: The app can show you that you’re paying high fees, but it can’t make you switch to a lower-cost fund. You need to take action on the insights it provides.

- “Set It and Forget It”: You need to actively engage with the app. A weekly check-in with your budget and a quarterly check-in with your investments is a good cadence.

- Using a Weak Password: You are linking all of your financial data to one place. It is absolutely critical that you use a long, strong, unique password and enable two-factor authentication. As security experts cited by Google often advise, account security is paramount.

Expert Tips for Success

Use your **wealth management tools** like a pro with these best practices.

- Schedule a Weekly “Net Worth Nudge”: Block 15 minutes on your calendar each week to review your dashboard.

- Focus on the Big Picture: Don’t get bogged down in categorizing every last transaction perfectly. Focus on the big trends in your spending and your net worth.

- Use the Tools to Inform, Not Dictate: Use the insights from the app to have a more productive conversation with your human financial advisor.

- Celebrate Your Milestones: When your net worth crosses a new threshold, take a moment to celebrate your progress!

“A wealth management tool is the ultimate tool for financial accountability. It forces you to confront the reality of your financial life in one place, which is the necessary first step to changing it for the better.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the best all-in-one wealth management tool?

A: For a free and incredibly powerful tool, Empower Personal Dashboard is the top choice. It offers a comprehensive net worth tracker and robust retirement planning tools at no cost. For those willing to pay for a premium experience with a more modern interface and better budgeting features, Monarch Money is an excellent alternative.

Q: Do these wealth management tools replace a human financial advisor?

A: They do not replace a human advisor, but they make your relationship with one much more effective. These tools are excellent for data aggregation and tracking, but a human advisor provides personalized, strategic advice for complex situations like estate planning, insurance, and navigating difficult life events. The app handles the ‘what,’ while the advisor helps with the ‘why’ and ‘how.’

Q: How do free wealth management tools like Empower make money?

A: Empower provides its powerful dashboard and tools for free as a way to attract clients for its primary business: paid wealth management services. They hope that as you use the free tools and your wealth grows, you will consider hiring their team of human financial advisors to manage your portfolio.

Q: Is it safe to link all my financial accounts to one app?

A: Yes, reputable platforms use bank-level security, including 256-bit encryption and two-factor authentication, to protect your data. They use trusted third-party services like Plaid to link to your accounts with ‘read-only’ access, meaning the app cannot initiate transactions. It is crucial to use a strong, unique password for your account.

Q: What is the difference between a wealth management tool and a simple budgeting app?

A: A budgeting app is primarily focused on your day-to-day cash flow—tracking income and expenses. A wealth management tool does that and much more. It provides a holistic, ‘big picture’ view by also tracking your investments, loans, and property to calculate your overall net worth and project your long-term financial trajectory.

Conclusion