Introduction

What Are Budgeting Apps Retirement?

The rise of these integrated platforms is a major trend in the FinTech world. As reported by sources like Statista, consumers are demanding more holistic financial tools. They no longer want one app for budgeting and another for investing; they want a single command center for their entire financial life. These apps provide exactly that.

Why Connecting Your Budget to Your Future is a Game-Changer

It Makes Your Savings Goal Real and Actionable

A goal like “save $1.5 million for retirement” can feel abstract and impossible. A good app breaks it down. It shows you that to reach that goal, you need to save $800 a month. Then, it shows you that you’re currently spending $1,200 a month on dining out. Suddenly, the path to finding that $800 becomes crystal clear.

It Motivates You by Visualizing Your Progress

These apps provide powerful visualizations, like a net worth chart that shows your wealth growing month after month. Seeing this tangible progress is a huge psychological motivator that encourages you to stay disciplined and keep saving.

It Optimizes Your Entire Financial Life

By seeing everything in one place, you can make smarter, more holistic decisions.

- Identify high-interest debt that you should prioritize paying off.

- Uncover high fees in your investment accounts that are holding you back.

- Ensure you have an adequate emergency fund before taking on more investment risk.

For more on planning your future, check out this valuable resource.

How It Works: The Core Features of a Financial Planning App

Here’s a breakdown of the essential components:

| Feature | What It Does | The Key Benefit for Retirement |

|---|---|---|

| Holistic Account Aggregation | Securely links all your accounts: checking, savings, credit cards, loans, and investments. | Provides a single, accurate calculation of your total net worth. |

| Automated Spending Analysis | Tracks and categorizes all your spending to show you where your money is going. | Helps you identify areas where you can cut back to increase your savings rate. |

| Retirement Planner | Uses your real-time data to project your retirement readiness and run “what-if” scenarios. | Connects your daily habits to your long-term outcome. |

| Investment Checkup | Analyzes your portfolio for asset allocation, diversification, and hidden fees. | Ensures your savings are invested wisely and efficiently. |

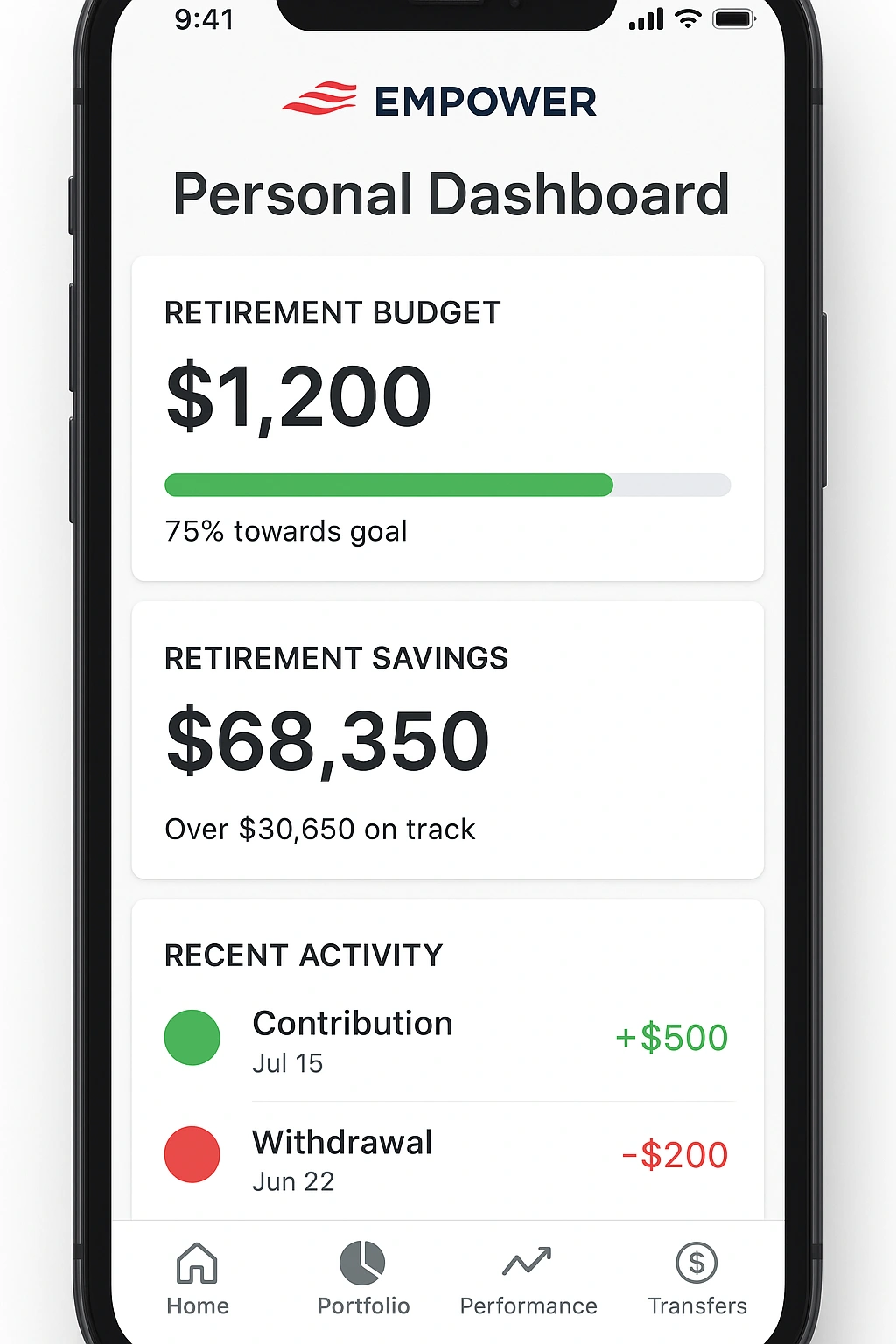

Real-Life Use Case: A Review of Empower Personal Dashboard

To evaluate a top-tier app that excels at both budgeting and retirement planning, I used **Empower Personal Dashboard (formerly Personal Capital)**. This platform is renowned for its powerful, free financial dashboard.

The experience was incredibly enlightening. After linking my accounts, the app gave me an instant, real-time view of my net worth. The budgeting tools automatically categorized my spending and showed me my cash flow for the month. But the real power came from the integration with the “Retirement Planner.” It took my actual savings and spending data and used it to run a projection, showing me I was slightly behind track for my desired retirement age. I was then able to use the “Recession Simulator” to see how my portfolio might perform in a downturn, which provided valuable context and peace of mind. The app clearly connected the dots: “If you can reduce your ‘Dining Out’ spending by $300 a month and invest it instead, you can retire two years earlier.”

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Excellent Free Tools: The dashboard, planners, and analyzers are all free to use. | ❌ Upsell for Advisory Services: The company uses the free tools as a lead generator for its paid wealth management. |

| ✅ Holistic Financial View: The best tool for seeing your entire financial picture in one place. | ❌ Budgeting is Less Proactive: It’s better at tracking past spending than a proactive system like YNAB. |

| ✅ Powerful Retirement Tools: The retirement planner and fee analyzer are best-in-class. | ❌ Occasional Account Sync Issues: Like all aggregators, it can sometimes have trouble connecting to certain institutions. |

Top Budgeting Apps for Retirement Compared

Empower is a fantastic all-in-one tool, but other apps offer different budgeting philosophies and features. Here’s how the top **financial planning apps** compare.

| App | Key Feature | Pros | Cons | Best For |

|---|---|---|---|---|

| Empower Personal Dashboard | Holistic net worth and retirement tracking. | Best all-in-one view of your finances, powerful free tools. | Budgeting tools are more for tracking than proactive planning. | Investors who want to see the big picture. |

| YNAB (You Need A Budget) | Proactive, zero-based budgeting method. | Excellent for gaining intentional control over your spending. | Subscription-based, has a steep learning curve. | Hands-on budgeters who want to be very deliberate. |

| Monarch Money | Modern interface, collaborative tools for couples, goal setting. | Great for couples, strong investment tracking and goal features. | It is a premium, subscription-only tool. | Couples and individuals who want a modern all-in-one tool. |

| Rocket Money | Automated spending and subscription tracking. | Excellent at finding and canceling unwanted subscriptions. | Full budgeting features require a paid plan. | Beginners who want to quickly find savings. |

Common Mistakes to Avoid

An app is just a tool. To successfully use a budget to fuel your retirement, avoid these common mistakes.

- Focusing Only on Budgeting: Don’t just track your spending; track your net worth. Your retirement success depends on your assets growing, not just your expenses shrinking.

- Not Automating Your Savings: The most important step is to set up an automatic transfer from your checking account to your investment account every payday.

- Keeping Too Much Cash: An emergency fund is crucial, but keeping excess cash in a low-yield savings account means you’re losing purchasing power to inflation.

- “Setting It and Forgetting It”: You need to actively engage with your financial plan. A weekly check-in with your budget and a quarterly check-in with your investments is a good cadence.

- Letting a Bad Month Derail You: You will have months where you overspend. The key is to not get discouraged, learn from it, and get back on track. As financial experts cited by Google often advise, consistency over time is more important than perfection in any single month.

Expert Tips for Success

Use your **budgeting apps for retirement** like a pro with these best practices.

- Pay Yourself First: Automate your retirement savings to come out of your account the day you get paid.

- Give Every Dollar a Job: Use the zero-based budgeting method to be intentional about every dollar you earn.

- Track Your Net Worth: This is the ultimate measure of your financial progress. Aim to have it consistently trend upwards.

- Conduct a Subscription Audit: Use your app to identify all your recurring charges and be ruthless about canceling what you don’t need.

“Your daily budget is the steering wheel for your financial life. Your retirement plan is the destination. You need both to get where you want to go.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the best budgeting app to use for retirement planning?

A: The best apps for this purpose are those that combine daily budgeting with long-term investment tracking. Empower Personal Dashboard is a top choice because it excels at both, giving you a holistic view of your net worth and retirement trajectory. Monarch Money is another excellent option with strong goal-setting and investment tracking features.

Q: How can a budgeting app help me save more for retirement?

A: A budgeting app helps you save more by first showing you exactly where your money is going. This awareness allows you to identify areas of overspending. By cutting back on non-essential spending (like subscriptions or dining out), you can ‘find’ extra money in your budget to redirect towards your retirement savings goals.

Q: Is a budgeting app the same as a retirement calculator?

A: No, but the best ones include a retirement calculator. A budgeting app focuses on your current cash flow (income and expenses), while a retirement calculator projects your future wealth. The most powerful financial planning apps integrate both, using your real-time spending and saving data to power a more accurate retirement forecast.

Q: Are my financial details safe on these apps?

A: Yes, reputable apps use bank-level security measures, including 256-bit encryption and two-factor authentication, to protect your data. They use trusted services like Plaid to link to your accounts with ‘read-only’ access, meaning the app cannot move or transfer your money.

Q: Can I really manage my retirement planning with just an app?

A: For many people, yes. Modern financial planning apps are incredibly powerful and can handle everything from daily budgeting to long-term portfolio analysis. However, for complex situations involving estate planning or unique tax circumstances, a human financial advisor is still an invaluable resource. The app makes you a more informed and prepared client.

Conclusion

A secure retirement is built on consistent, disciplined financial habits, and budgeting apps retirement make it easier to stay on track. By exploring budgeting apps retirement, you can connect your daily spending to your long-term retirement goals. Using budgeting apps retirement provides clarity, motivation, and control over your finances. Relying on budgeting apps retirement ensures that your financial decisions today support a comfortable and secure retirement in the future.