Introduction

Investing for retirement can feel overwhelming, but robo-advisors retirement make it simpler and more accessible. By using robo-advisors retirement, you get a data-driven investment manager working for you around the clock. Exploring robo-advisors retirement allows you to start investing without the high costs of a traditional financial advisor. Relying on robo-advisors retirement helps you put your retirement savings on autopilot, giving you confidence and control over your long-term financial future.

What Are Robo-Advisors Retirement?

Robo-advisors retirement are automated, algorithm-driven financial planning services that manage your investments without a human advisor. By using robo-advisors retirement, you provide information about your goals, age, and risk tolerance, and the software builds a diversified portfolio tailored to you. Exploring robo-advisors retirement allows you to enjoy low-cost, hands-off management of your investments. Relying on robo-advisors retirement ensures everything from setup to ongoing rebalancing is handled efficiently, giving you confidence in your long-term retirement plan.

The rise of robo-advisors retirement is one of the biggest changes in personal finance. Robo-advisors retirement are making sophisticated investment strategies accessible to anyone, not just the wealthy. By exploring robo-advisors retirement, investors can manage their long-term portfolios with confidence and low costs. Using robo-advisors retirement allows individuals to take control of their retirement planning while enjoying automated, data-driven guidance.

Why a Robo-Advisor is a Smart Choice for Most Investors

For most people saving for the future, robo-advisors retirement offer a smarter alternative to DIY investing or hiring a traditional advisor. By using robo-advisors retirement, you gain access to automated, algorithm-driven management of your portfolio. Exploring robo-advisors retirement allows you to benefit from low-cost, diversified investment strategies without the stress of constant monitoring. Relying on robo-advisors retirement ensures your retirement savings are guided efficiently and effectively toward your long-term goals.

Low Costs and Transparent Fees

This is a huge advantage. Traditional financial advisors often charge 1-2% of your assets per year. Most robo-advisors charge between 0.25% and 0.50%. This seemingly small difference can add up to hundreds of thousands of dollars more in your pocket by the time you retire.

Automated Discipline and Behavioral Coaching

The biggest enemy of the average investor is their own emotion. We tend to panic and sell when the market is down and get greedy and buy when it’s high. A robo-advisor is immune to these emotions.

- Automated Rebalancing: It automatically sells your winners and buys your losers to keep your portfolio aligned with your long-term goals.

- Tax-Loss Harvesting: Advanced services can automatically sell investments at a loss to offset taxes on your gains.

- Consistency: It invests your money consistently, removing the temptation to try and “time the market.”

Accessibility for Beginners

You don’t need to know the difference between a stock and a bond to get started. Robo-advisors have made sophisticated, diversified investing accessible to everyone, regardless of their financial knowledge. Most have very low or no account minimums, so you can start with as little as $100. For more on planning your future, check out this valuable resource.

How It Works: The Robo-Advisor Process

The process of getting started with a robo-advisor is designed to be simple and intuitive, typically taking less than 30 minutes.

Here’s a breakdown of the typical workflow:

| Step | Action | The “Why” |

|---|---|---|

| 1. The Questionnaire | You answer a series of questions about your age, income, financial goals (e.g., retirement in 30 years), and your comfort level with risk. | This allows the algorithm to understand your unique financial situation and build an appropriate portfolio. |

| 2. Portfolio Recommendation | The robo-advisor instantly recommends a diversified portfolio of low-cost Exchange-Traded Funds (ETFs). | This portfolio is tailored to your specific risk tolerance, from conservative (more bonds) to aggressive (more stocks). |

| 3. Fund Your Account & Automate | You link your bank account and set up a recurring deposit. The robo-advisor then handles all the buying, selling, and rebalancing for you. | This puts your long-term investment strategy on complete autopilot. |

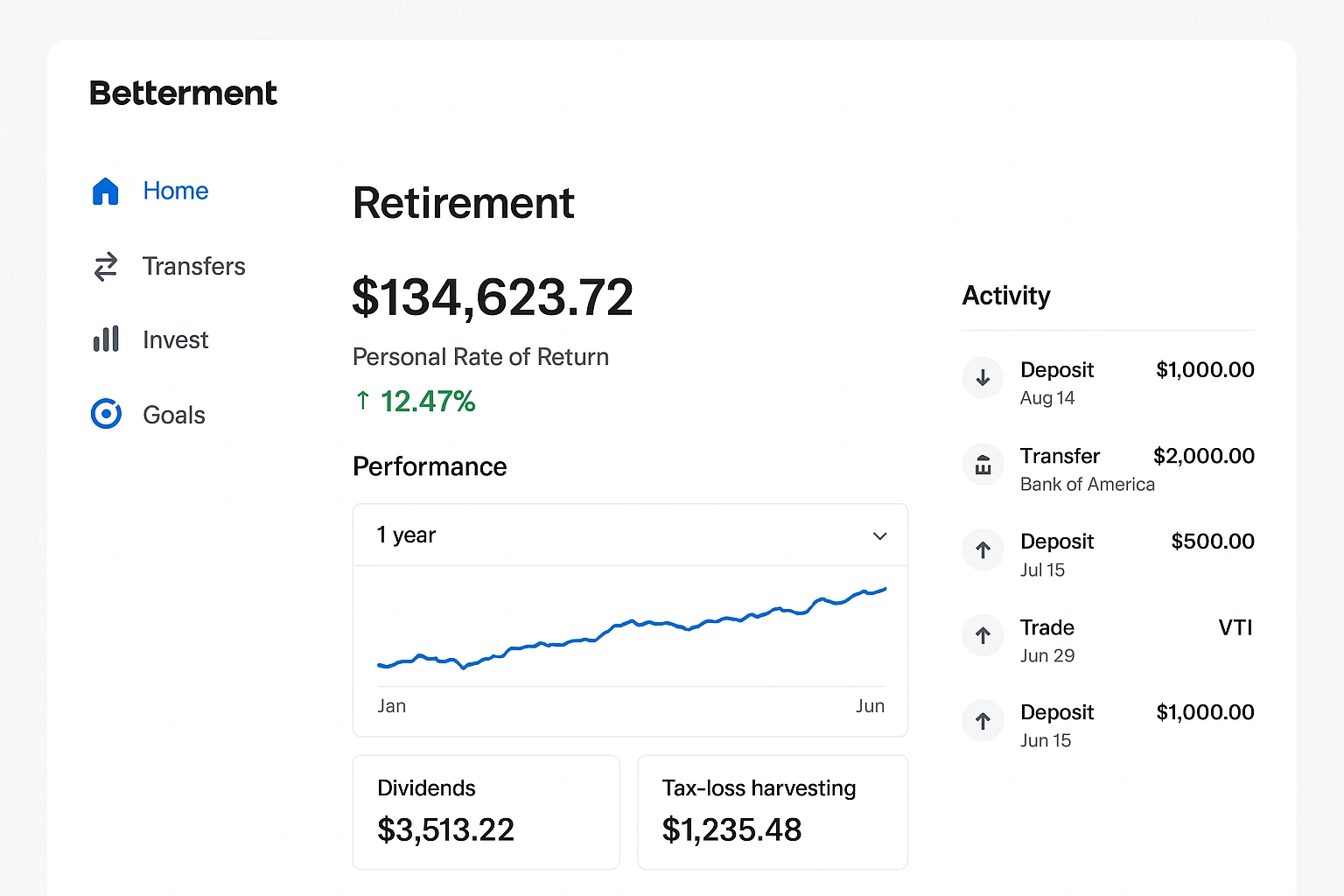

Real-Life Use Case: A Review of Betterment

To evaluate a leading **robo-advisor for retirement**, I opened an account with **Betterment**, one of the pioneers and largest players in the industry.

The onboarding process was incredibly smooth and educational. The questionnaire was easy to understand, and at the end, it recommended a portfolio of 90% stocks and 10% bonds, which was appropriate for my age and long-term goals. The interface clearly showed me the exact ETFs my money would be invested in and why. I set up a recurring monthly deposit, and from that point on, the process was completely hands-off. The dashboard provides a clean, simple view of my portfolio’s performance and projects its potential growth over time. It successfully turned a complex process into a simple, automated habit.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Excellent Goal-Planning Tools: Makes it easy to set and track multiple financial goals. | ❌ No Direct Stock/ETF Picking: You cannot buy individual stocks; you must use their pre-built portfolios. |

| ✅ Very User-Friendly: The interface is clean, modern, and easy for beginners to navigate. | ❌ Management Fee: The 0.25% annual fee is low, but it’s not zero. |

| ✅ Automated Tax-Loss Harvesting: This advanced feature is available to all clients, which is a major plus. | ❌ Less Control: The hands-off approach may not appeal to DIY investors who want to manage their own trades. |

Top Robo-Advisors for Retirement Compared

Betterment is a top choice, but other platforms offer different features and investment philosophies. Here’s how the leading **automated investment tools** compare.

| Robo-Advisor | Key Features | Annual Fee | Best For |

|---|---|---|---|

| Betterment | Goal-based planning, tax-loss harvesting, high-yield cash account. | 0.25% | Beginners who want a user-friendly, all-around platform. |

| Wealthfront | Advanced planning tools, direct indexing for large accounts. | 0.25% | Tech-savvy investors who want powerful digital planning tools. |

| Vanguard Digital Advisor | Uses Vanguard’s own low-cost ETFs, simple and effective. | Approx. 0.15% | Investors who want a very low-cost, no-frills approach from a trusted name. |

| Fidelity Go | No advisory fees for balances under $25,000, professional management. | Free under $25k, 0.35% over $25k | Investors with smaller balances who want to start with zero fees. |

Common Mistakes to Avoid with Robo-Advisors

While robo-advisors simplify investing, it’s still possible to make mistakes. Avoid these common pitfalls.

- Being Dishonest on the Questionnaire: Don’t pretend you’re comfortable with high risk if you’re not. Your honest answers are crucial for the AI to build the right portfolio for you.

- Panicking During Market Downturns: The market will go down. A robo-advisor is designed to weather these storms. Don’t panic and pull your money out at the worst possible time.

- Not Automating Your Contributions: The “set it and forget it” approach is the key to success. Manually investing when you “feel like it” is a recipe for inconsistency.

- Ignoring the Underlying Fees: While the advisory fee is low, the ETFs in your portfolio also have their own small fees (expense ratios). Be sure you understand the all-in cost.

- Thinking It’s a Get-Rich-Quick Scheme: As financial experts cited by Google often emphasize, robo-advisors are tools for disciplined, long-term wealth building, not for short-term trading.

Expert Tips for Success

Get the most out of your **robo-advisor for retirement** with these pro tips.

- Start Early, Even if It’s Small: The power of compounding means that starting with $50 a month in your 20s is better than starting with $500 a month in your 40s.

- Choose a Roth IRA if You’re a Young Professional: Paying taxes now while you’re in a lower tax bracket is likely a smart move for the long run.

- Trust the Process: The core benefit of a robo-advisor is its discipline. Let it do its job of rebalancing and investing consistently, and don’t try to outsmart the algorithm.

- Increase Your Contributions Annually: Every year, try to increase your automatic deposit, even by a small amount.

“A robo-advisor is the ultimate tool for implementing a boring, and therefore, highly effective investment strategy. It automates the discipline that most human investors lack.”

– A leading financial blogger

Frequently Asked Questions (FAQ)

Q: What is the best robo-advisor for a beginner?

A: For beginners, Betterment and Wealthfront are excellent choices due to their user-friendly interfaces, low minimums, and robust goal-planning tools. Vanguard Digital Advisor is another top contender for those who want access to Vanguard’s low-cost funds with a simple, automated approach.

Q: Can a robo-advisor replace a human financial advisor?

A: A robo-advisor can replace the portfolio management function of a human advisor for many people. However, it cannot replace the personalized, holistic financial planning advice a human can provide on complex topics like estate planning, insurance, or unique tax situations.

Q: How much do robo-advisors cost?

A: Most robo-advisors charge an annual management fee that is a percentage of the assets you have with them. This typically ranges from 0.25% to 0.50%, which is significantly lower than the 1-2% often charged by traditional human financial advisors.

Q: Is my money safe with a robo-advisor?

A: Yes. Reputable robo-advisors are held to the same regulatory standards as traditional brokerage firms. Your accounts are typically SIPC insured up to $500,000, which protects you against the failure of the firm. This does not, however, protect you from normal market fluctuations and investment losses.

Q: What happens if the market crashes?

A: If the market crashes, the value of your robo-advisor portfolio will go down, just like any other investment in the market. A key feature of robo-advisors is automated rebalancing, which means they will systematically buy more of the assets that have fallen in value, adhering to a disciplined, long-term strategy and helping you avoid emotional decision-making.

Conclusion

The path to a secure retirement is built on smart, consistent investment choices. Robo-advisors retirement offer a simple and cost-effective way to manage your long-term portfolio. By using robo-advisors retirement, you can remove emotion and guesswork from investing while staying on track with your goals. Exploring robo-advisors retirement allows you to automate your wealth-building strategy and focus on enjoying life, confident that your financial future is secure.