Introduction

“How much do I need to retire?” It’s the million-dollar question that worries millions of people. With pensions disappearing and the future of Social Security uncertain, the responsibility of planning for retirement falls squarely on our shoulders. But navigating investments, 401(k)s, and IRAs can feel overwhelming. The good news is that you no longer need an expensive financial advisor to understand your future. Modern retirement planning tools can provide the clarity you need, while retirement planning tools help you organize your finances and stay on track. By using reliable retirement planning tools, you can make informed decisions with confidence. This guide will introduce you to the best apps and software, offering practical retirement planning tools to build a comfortable.

What Are Retirement Planning Tools?

Retirement planning tools are digital platforms, apps, and software that help you organize your finances and plan for your long-term goals. These retirement planning tools go beyond simple calculators, giving you a clearer picture of your financial situation. By connecting all your accounts—checking, savings, 401(k)s, IRAs, brokerage accounts, and even your mortgage—retirement planning tools provide a complete view of your finances. With these retirement planning tools, you can analyze your portfolio, track your progress, and run simulations to see how ready you are for retirement.

The rise of digital platforms is a major trend in personal finance, and retirement planning tools are leading the way. With the rapid growth of the FinTech market, retirement planning tools are helping individuals take control of their own wealth like never before. These retirement planning tools make financial planning accessible, offering features that were once only available to the wealthy. By using modern retirement planning tools, anyone can plan for the future with confidence and clarity.

Why Using These Tools is a Financial Game-Changer

Taking the time to set up and use a retirement planning tool is one of the most impactful steps you can take for your long-term financial health.

Gain Clarity and a Concrete “Retirement Number”

These tools take the guesswork out of planning. By analyzing your current savings, spending, and desired lifestyle, they can give you a concrete number to aim for and show you if you’re on track to reach it.

Uncover and Eliminate Hidden Investment Fees

High fees are a silent killer of investment returns. Many people don’t realize that the mutual funds in their 401(k) are charging fees that can eat up hundreds of thousands of dollars over a lifetime. These tools can analyze your portfolio and shine a bright light on these hidden costs.

Make Smarter, More Confident Decisions

A clear plan reduces financial anxiety and empowers you to make better decisions. When you can see how today’s saving and investment choices will impact your future, it’s easier to stay disciplined and focused on your goals. For more on managing your finances, check out this guide to smart financial choices.

How It Works: The Core Features of a Planning Tool

Modern retirement planning tools are built on a few key features that work together to give you a comprehensive view of your financial life.

Here’s a breakdown of the essential components:

| Feature | What It Does | Why It’s Important |

|---|---|---|

| Account Aggregation | Securely links all your financial accounts (banking, investments, loans) in one place. | Provides a single, accurate view of your total net worth. |

| Retirement Planner / Calculator | Uses your aggregated data to run simulations and forecast your retirement readiness. | Answers the question, “Am I on track to retire when I want?” |

| Portfolio Analysis | Analyzes your investment holdings for asset allocation, diversification, and, most importantly, fees. | Helps you optimize your investments and avoid costly fees. |

| Budgeting & Cash Flow Tools | Tracks your income and spending to help you identify opportunities to save more. | Your savings rate is the most important factor you can control in your retirement plan. |

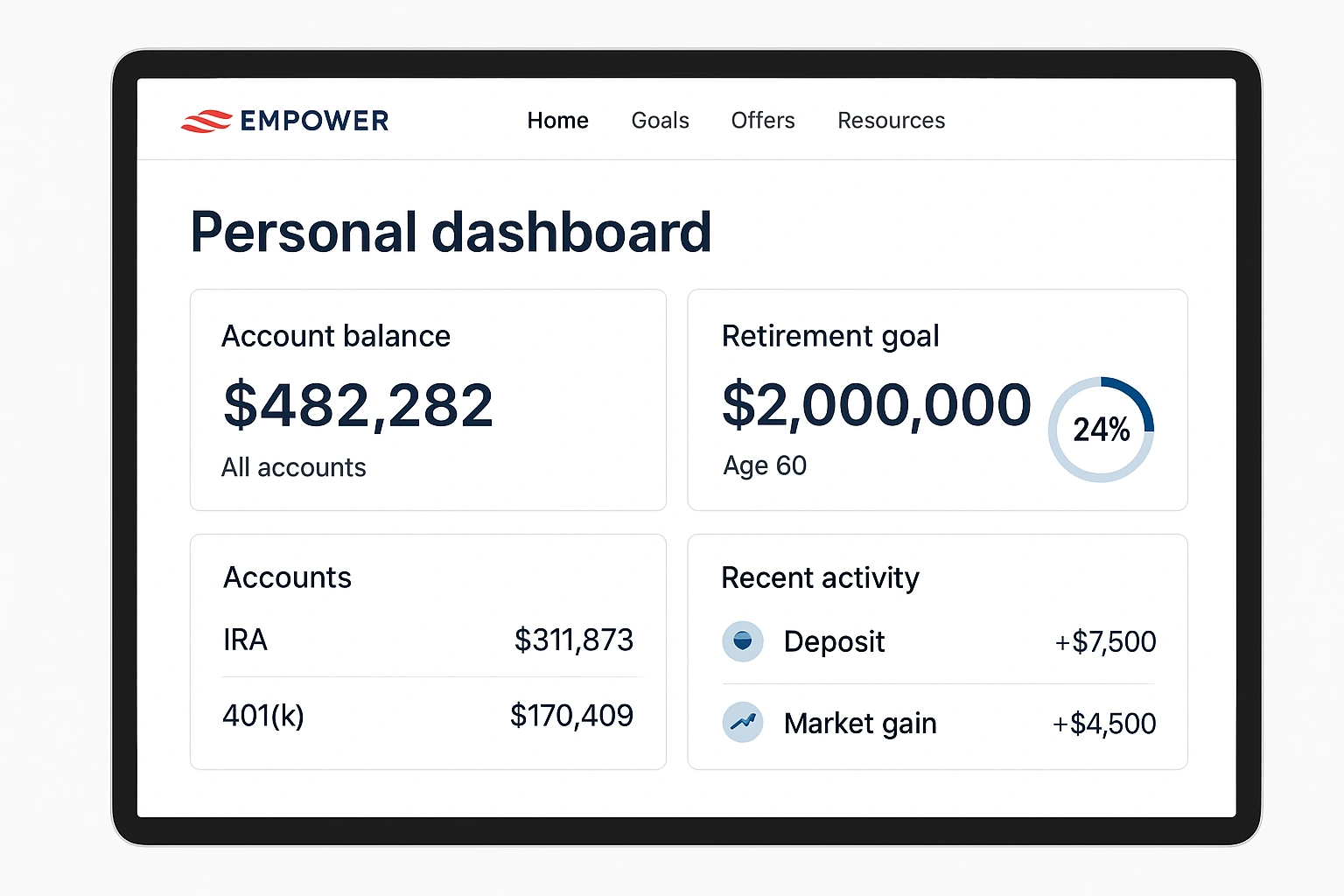

Real-Life Use Case: A Review of Empower Personal Dashboard

To evaluate a leading **retirement planning tool**, I used **Empower Personal Dashboard (formerly Personal Capital)**, which is widely regarded as one of the best free tools on the market.

The setup process involved securely linking my various financial accounts, including my 401(k), IRA, and checking account. The platform immediately provided a clean dashboard showing my real-time net worth. The most eye-opening feature was the “Retirement Fee Analyzer.” It analyzed the funds in my 401(k) and revealed that I was paying over 1% in annual fees, which the tool projected would cost me over $150,000 in lost growth by retirement. The “Retirement Planner” then allowed me to run different scenarios, showing me how increasing my savings rate by just 2% could allow me to retire two years earlier. This was incredibly motivating.

Here’s a breakdown of the experience:

| Pros | Cons |

|---|---|

| ✅ Powerful Free Tools: The net worth tracker, fee analyzer, and retirement planner are all free. | ❌ Upsell for Wealth Management: The company will likely contact you to offer their paid advisory services. |

| ✅ Excellent User Interface: The dashboard is clean, intuitive, and easy to understand. | ❌ Budgeting Tools are Basic: It’s more focused on investments than on detailed daily budgeting. |

| ✅ Holistic Financial View: Aggregating all your accounts in one place is incredibly powerful. | ❌ Occasional Account Sync Issues: Like all aggregators, it can sometimes have trouble connecting to certain financial institutions. |

Top Retirement Planning Tools for 2025 Compared

Empower is a fantastic all-in-one dashboard, but other tools offer different strengths. Here’s how some of the top **best retirement apps** and tools compare.

| Tool | Key Features | Pros | Cons | Best For |

|---|---|---|---|---|

| Empower Personal Dashboard | Account aggregation, retirement planner, fee analyzer. | Excellent free tools, holistic net worth view. | Upsell for paid advisory services. | Getting a complete, 360-degree view of your finances. |

| NewRetirement | Extremely detailed retirement calculator, scenario planning. | The most comprehensive and detailed retirement planner available. | The best features are on the paid plan; can be complex. | People who are close to retirement and need detailed planning. |

| Fidelity Retirement Score | Simple, easy-to-understand retirement readiness score. | Very easy to use, provides a quick snapshot of your progress. | Less detailed than other tools, works best if you have Fidelity accounts. | Getting a quick and simple checkup on your retirement progress. |

| Vanguard Retirement Nest Egg Calculator | Helps you understand how long your savings will last in retirement. | Simple tool for modeling different withdrawal strategies. | It’s a calculator, not a full planning platform. | Those who are already in or very near retirement. |

Common Mistakes to Avoid in Retirement Planning

These tools are powerful, but they can’t fix bad habits. Avoid these common financial mistakes.

- “Garbage In, Garbage Out”: A planning tool is only as good as the data you give it. If you don’t link all your accounts or you input unrealistic spending goals, your plan will be inaccurate.

- Ignoring Inflation: Don’t forget that $1 today will be worth much less in 30 years. Good planning tools will account for inflation, but you need to make sure you’re using a realistic rate.

- Being Too Conservative (or Too Aggressive): Your investment allocation should match your age and risk tolerance. A good tool can help you assess if your portfolio is appropriate for your situation.

- “Setting It and Forgetting It”: Your life and the market will change. You should review your retirement plan at least once a year to make sure you’re still on track.

- Thinking the Tool is a Substitute for a Human Advisor: As financial experts cited by Google often state, these tools are for planning, not for complex advice on things like estate planning or insurance.

Expert Tips for Success

Get the most out of your **retirement planning tools** with these pro tips.

- Focus on What You Can Control: You can’t control the stock market, but you can control your savings rate and your investment fees. These are the two most important levers for your success.

- Automate Your Savings: Set up automatic contributions to your 401(k) and IRA. Pay yourself first.

- Use the Scenario Planner: Stress-test your plan. What happens if the market drops? What if you have unexpected medical expenses? Running these scenarios can help you build a more resilient plan.

- Review Your Plan Annually: Sit down once a year to review your progress, adjust your contributions, and make sure your plan still aligns with your life goals.

“A good retirement plan is a living document, not a one-time event. The new digital tools make it easier than ever to monitor your progress and make adjustments along the way, turning a daunting task into an empowering journey.”

– A Certified Financial Planner (CFP)

Frequently Asked Questions (FAQ)

Q: What is the best free retirement planning tool?

A: Empower Personal Dashboard (formerly Personal Capital) is widely considered the best free retirement planning tool. Its free version offers powerful features, including a retirement planner, investment checkup, and a net worth tracker that aggregates all your financial accounts in one place.

Q: Do I still need a human financial advisor if I use these tools?

A: For many people, these tools are sufficient for planning and tracking. However, a human advisor is invaluable for complex situations, personalized advice on topics like estate planning or insurance, and providing emotional guidance during volatile market conditions. The tools are best used to make you a more informed client for your advisor.

Q: How do these apps make money if they’re free?

A: Many free tools, like Empower Personal Dashboard, make money by offering optional, paid wealth management services. They provide the powerful free tools in the hope that as your wealth grows, you will consider hiring their human financial advisors. Other tools may offer premium subscription tiers with more advanced features.

Q: Is it safe to link all my financial accounts to one app?

A: Reputable retirement planning tools use bank-level security, including 256-bit AES encryption and two-factor authentication, to protect your data. They typically have read-only access to your accounts, meaning no one can move money. It is generally considered very safe, but you should always use a strong, unique password for your account.

Q: At what age should I start using a retirement planning tool?

A: You should start as soon as you earn your first paycheck. The earlier you begin, the more powerful the effect of compound interest will be. These tools are valuable for someone in their 20s setting up their first IRA, as well as for someone in their 50s fine-tuning their plan for their final years of work.

Conclusion

Planning for retirement can feel overwhelming, but it doesn’t have to be. Modern retirement planning tools make it easier to understand your finances and take control of your future. With the right retirement planning tools, you can map out your goals, track your progress, and make smarter decisions along the way. By using reliable retirement planning tools, you can reduce unnecessary fees and stay focused on what truly matters for your long-term security. Having these retirement planning tools at your disposal ensures that, even in an uncertain future, your retirement can be planned with confidence and clarity.